China’s Economy: 2014 review

| Editor's Note |

China's economy has experienced a bumpy year in 2014, with growth having slipped to 7.3 percent in the third quarter year-on-year, the slowest pace since the first quarter of 2009 during the global financial crisis, when growth measured 6.6 percent.

One explanation of the economic slowdown that has been mentioned in the country's key economic policy papers this year is that China is in a period of changing gear in its economic growth, a period of short-term pain from structural adjustment as well as a period for dissolving the side-effects of previous stimulus measures.

| Economic Growth |

According to the National Bureau of Statistics in October, China's GDP reached 41.99 trillion yuan ($ 6.76 trillion) in the first three quarters, with year-on-year growth of 7.4 percent.

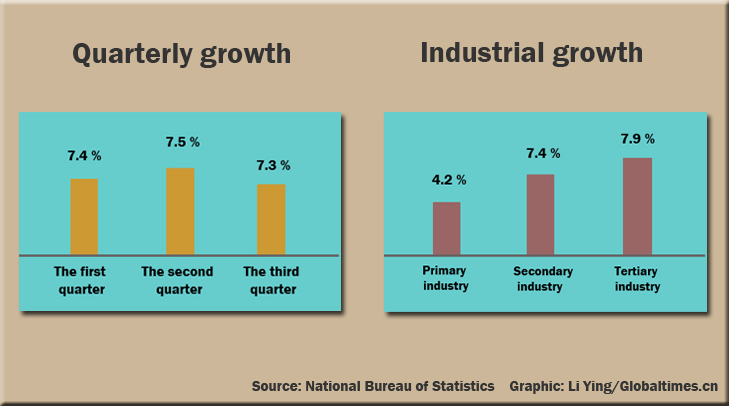

In terms of quarterly growth, GDP witnessed a year-on-year growth of 7.4, 7.5 and 7.3 percent respectively in the first, second and third quarters of 2014.

As for industrial growth, primary industry grew by 4.2 percent year on year, while secondary industry and tertiary industry grew 7.4 and 7.9 percent respectively.

Source: National Bureau of Statistics

China's economy will see slight improvement in the fourth quarter, with GDP expected to grow by around 7.3-7.4 percent year-on-year, according to Liu Xuezhi, an analyst at the Bank of Communications.

| Economic Changes |

Breakthroughs in industry

Tertiary industry continued to increase its role in the entire economic structure as industry sped up its internal structural adjustment.

Positive changes in demand

Consumption continued to drive economic growth, accounting for 48.5 percent of growth over the first three quarters of 2014, 7 percentage points higher compared to gross capital formation. The economy showed signs of rebalancing.

Income distribution

During the first quarters of 2014, incomes of urban and rural residents continued to increase. The actual growth rate of the per capita disposable income was 8.2 percent, 0.8 percentage points higher than the GDP growth rate. Meanwhile, the income gap between urban and rural residents narrowed.

Improvements in regional structure

The economy experienced more balanced development in the eastern, central and western regions. The eastern region took a leading role in economic structural adjustment, while the central and western regions displayed their advantages with the advancement of a series of regional development strategies.

Resource conservation and environmental costs

Economic development showed signs of shifting from extensive development to intensive development. During the first three quarters of 2014, GDP energy consumption per unit reduced by 4.6 percent year on year.

Source: National Bureau of Statistics

| Major Reforms in 2014 |

-Financial sector

Jan 17 China restarted IPO approvals after a 14-month hiatus.

Feb 26 The People's Bank of China (PBC), the central bank, said it would remove a cap on foreign-currency deposit rates in Shanghai's free trade zone from March 1.

Mar 15 The daily trading band for the yuan's exchange rate against the US dollar was widened to 2 percent above or below a daily reference exchange rate.

Apr 10 The Shanghai-Hong Kong Stock Connect program was approved by the China Securities Regulatory Commission and the Securities and Futures Commission of Hong Kong, to allow mutual trading on the two cities' bourses.

Nov 17 The Shanghai-Hong Kong Stock Connect program was officially launched.

Nov 21 The PBC gave banks more freedom to set their interest rates, allowing them to offer deposit rates of 1.2 times the benchmark rate, up from 1.1 times the rate.

Nov 30 China issued draft rules for a bank deposit insurance system, directly covering deposits of up to 500,000 yuan.

-Fiscal and tax policy

May 21 Ten local governments including those in Beijing, Shanghai and Guangdong were allowed to raise money by selling municipal bonds directly.

Aug 31 China passed an amendment to the Budget Law to allow more local governments to sell bonds directly to raise funds for projects of public interest.

Oct 2 The State Council imposed caps on the amount of debt local governments can build up and banned them from raising funds through local government financing vehicles. It also said China would not bail out local governments if they fail to repay their debts.

Nov 28 China announced an increase in its fuel consumption tax for the first time in five years as part of the effort to fight pollution.

Dec 24 The Ministry of Finance said it had prohibited local governments from rolling out new preferential tax policies for enterprises.

-SOEs

Feb 19 Sinopec said it would allow private capital to be invested in its oil product marketing business, to develop a mixed-ownership structure.

May 6 The ratio of profits handed over to the central government by centrally administered SOEs was raised by 5 percentage points.

May 21 The NDRC invited private companies to participate in 80 major national projects, in sectors including energy and infrastructure.

Jul 15 The State-owned Assets Supervision and Administration Commission singled out six large SOEs for a pilot program to attract private investment and improve corporate governance.

Aug 29 The Political Bureau of the CPC Central Committee approved plans to reform the payment system for executives of large SOEs.

-Foreign investor market access

Jan 6 China lifted a 14-year-old ban on selling video game consoles, allowing foreign-backed enterprises to enter the world's largest video game market by revenue.

Jul 25 China allowed foreign investors to wholly own hospitals in seven cities and provinces across the country.

Nov 4 The National Development and Reform Commission (NDRC) released a revised draft of the foreign investment catalogue, which cut the number of sectors that limit foreign investment to 35 from 79, opening up sectors such as steel, oil refining, paper making and premium spirits.

-Property market

Dec 22 China unveiled rules requiring real estate owners to register their property holdings with the government. The rules will take effect on March 1, 2015.

-Rural sector

Jan 19 The "No.1 Central Document" was released, which for the first time allowed farmers to transfer or mortgage land use rights to help with financing.

| Key Phrases of 2014 |

New normal

The Chinese economy is in a process of transition from the previous high-speed growth to a phase of medium-to-high growth. This phase will also see the necessary restructuring of the economy, with a shift toward innovation as a driver of growth rather than investment, according to Chinese President Xi Jinping's explanation.

One belt and one road

The "One Belt and One Road" strategy, which refers to the Silk Road Economic Belt and the 21st Century Maritime Silk Road, was proposed by President Xi during his visits to Kazakhstan and Indonesia in September and October 2013. This year has seen some tangible progress in bringing the strategy forward.

Shanghai-HK Stock Connect

The establishment of the stock connect scheme linking bourses in Shanghai and Hong Kong went through a number of twists and turns before finally being launched on November 17.

Beijing-Tianjin-Hebei plan

The regional block covering the municipalities of Beijing and Tianjin and North China's Hebei Province has been thrust into the limelight since President Xi called for integrated and coordinated development of the region at a seminar in Beijing in late February of 2014.

Alibaba's record IPO

While numerous firms have been successful in the past year, few can match the progress made by e-commerce giant Alibaba Group Holding. The Hangzhou-based firm set a record as the world's largest-ever flotation by raising $25 billion on the New York Stock Exchange in September of 2014, and it has become a symbol of China's new wave of entrepreneurship.

| Key Figures of 2014 |

Jack Ma Yun, Chairman and founder of Alibaba Group Holding Ltd Photo: Chinanews.com

Ma's company floated in the US on September 19, setting the record for the world's largest-ever IPO, with its shares rising more than 40 percent on their market debut.

Wang has become well known for his Wanda Plaza complexes, which include residences, shopping malls, five-star hotels and entertainment facilities such as cinemas. This year, his business has expanded quickly into overseas markets, both in the property sector and more diversified areas such as e-commerce.

Li Yining, Economist at Peking University Photo: njdaily.cn

Li is well-known for several major economic theories, including his proposal in 1980 that a joint-stock system should be set up for Chinese enterprises. He has also stressed the importance of employment in a country's economy, and called for greater development of private business. He also suggested to push forward the country's urbanization.

Lei Jun, CEO and founder of Xiaomi Technology Co Photo: sina.com.cn

Lei Jun's ranking on the Hurun Rich list rose to 10th in 2014 from 63rd in 2013, mainly due to Xiaomi's rapid expansion.

Dong Mingzhu, Chairwoman of Gree Electric Appliances Inc Photo: ce.cn

Dong can be considered one of the Chinese businesspeople of the year, partly because she represents one of the traditional business sectors, the home appliance sector.

Jia Yueting, CEO of LeTV Information Technology Co Photo: China.com.cn

Jia has been one of the most controversial businessmen in the Internet sector this year. He was reported to have left China in June, amid rumors that he was being investigated by the authorities.

| Future Outlook |

China set to lower GDP growth target

China is expected to lower its economic growth target in the country's next five-year plan period, analysts said on December 21, 2014, but pro-growth measures will probably be rolled out during the period as well.

China to boost growth quality in 2015

China will focus on boosting economic growth quality and efficiency in 2015 and stick to the theme of seeking progress while maintaining stability, according to a high-level meeting of the Communist Party of China (CPC) on December 5, 2014.

China will adapt to the economic "new normal," keep economic growth within a reasonable range and emphasize growth mode transformation and economic restructuring, said a statement issued after the meeting of the Political Bureau of the CPC Central Committee.

Growth prospects still strong : CASS

China is likely to continue to make the biggest contribution to the world's economic growth in 2015, although it is still facing the challenges of slowdown and financial fragility, a report by a top government think tank showed on December 26, 2014.

| Commentary |

Jin Baisong, deputy director of the department of Chinese Trade and Studies at the Chinese Academy of International Trade and Economic Cooperation

It is great to see China's economy and investment abroad have made new breakthroughs. However, there is still a large gap between China and developed countries in terms of per capita GDP as well as the quality, efficiency and structure of investment. From this perspective, China still needs to improve its efficiency and quality economic growth, as well as adjust its economic structure.

Source: Chinanews.com

Fan Jianping, chief economist at the State Information Center

Compared with other BRICS countries and developed countries, China has managed to maintain relatively stable financial and property markets. The recent surge in the capital market shows investors are quite confident in China's economy.

There are always two sides of the same coin. Firms in traditional industries such as steel mills have gone bankrupt due to industrial overcapacity, but high-tech companies such as robotic automation manufacturers have so many orders they can't finish them in the next three years. There will be huge opportunities in the country's high technology sectors.

China's rapid growth potential not yet exhausted

Per capita GDP, which represents a country's labor productivity and technological prowess, can be used to measure the extent of its latercomer advantage. The per capita GDP gap between China and developed countries reflects, among other things, a gap in technological achievement. According to data from the late British economist Angus Maddison, in 2008, China's per capita GDP reached $6,725 in 1990 Geary-Khamis dollars, about 21 percent of per capita GDP in the US, which was roughly the gap between the US and Japan in 1951, Singapore in 1967, and South Korea in 1977. Given the same gap, Japan, Singapore and South Korea saw economic growth soar to 9.2 percent, 8.6 percent and 7.6 percent over the following 20 years by harnessing their latercomer advantage. In this sense, China should also have the potential for 8 percent annual growth from 2008 to 2028.

Web Editor: liyingxa@globaltimes.com.cn