HOME >> BUSINESS

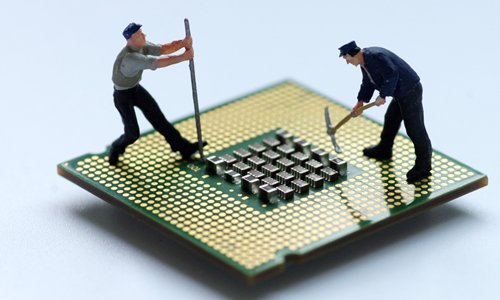

China faces talent gap in chips

By Wang Cong Source:Global Times Published: 2019/5/20 21:48:40

File Photo: IC

As China ratchets up efforts to cut reliance on foreign semiconductors amid renewed tensions with the US over trade and technology, a reckoning has begun over a serious challenge for the strategically important industry in the country: a shortage of talented people.

Chinese analysts on Monday called for more targeted efforts in building a talent pool for the country's semiconductor industry, as US officials continue to tighten their grip on chip exports to China in an apparent bid to contain the nation's technological rise.

In the latest move, the US government banned US companies from supplying key components, including chipsets, to Chinese telecom company Huawei, prompting renewed calls for speeding up the development of the domestic semiconductor industry.

"A talent shortage is one of the most pressing issues for the development of the semiconductor industry in China, and it's a problem that cannot be solved overnight," said Liu Kun, a veteran analyst in the semiconductor industry in Beijing, told the Global Times on Monday. "If we don't take long-term measures to solve the issue, then we will never be self-sufficient."

There are only 400,000 semiconductor professionals in China, which needs more than 720,000 by 2020, leading to a gap of 320,000 in the talent pool, according to an industry white paper released last year by research firm CCIDC Consulting.

The massive talent shortage is the result of a combination of factors such as China's weak industry chain, high costs and relatively low rewards, according to industry insiders and analysts.

For example, the average monthly salary for professionals in the chip sector was about 9,120 yuan ($1,319), ranking as the sixth highest-paid job in China, according to the CCIDC white paper.

Liu, who studied semiconductors, said many students choose to work for internet companies and other technology-related companies because the pay is much higher.

"When you consider how much work and investment you need to put in to get a degree in semiconductors and what you get paid for at the end, it's not very promising," according to Liu.

But the root problem is that China's chip sector is still less advanced and a complete industry chain has not been formed, despite fast growth in recent years, according to an industry insider who spoke on condition of anonymity.

"This is not a problem that we can solve overnight. It requires a process because we didn't even have this industry before, and the industry is relatively weak. We cannot produce talent out of nothing," the insider told the Global Times on Monday.

The insider said that addressing the issue would need a whole-society effort from governments to private investors to universities to push forward the industry.

Backed largely by government policies and incentives, China's chip sector has been growing very fast over the past few years, with the number of companies reaching 2,000 and the output of semiconductors growing 9.7 percent year-on-year to 173.95 billion pieces.

Posted in: INDUSTRIES,BIZ FOCUS