HOME >> BUSINESS

Partial agreements expected in China-US trade talks despite major differences

By Liao Qun Source:Global Times Published: 2019/7/29 21:32:46

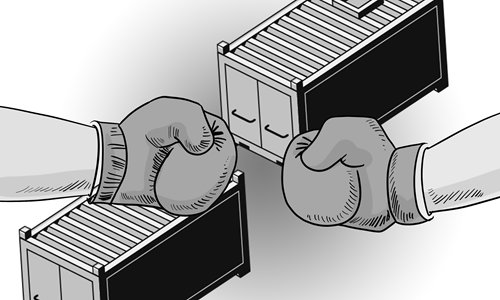

Illustration: Luo Xuan/GT

The China-US trade row has seen many ups and downs. It has allowed people to witness the capriciousness of the real world and the nature of economics and trade issues.

The most unexpected move was when the US upgraded the trade war in May by announcing it would raise tariffs on $200 billion in Chinese goods from 10 to 25 percent, and threatened to slap additional tariffs on another $325 billion in Chinese products.

The US has been unpredictable because its policy-making is based on evaluating how the trade war impacts their economy and is aimed at re-electing US President Donald Trump in 2020.

US economic growth reached a high of 2.9 percent in 2018 from significant tax cuts. This year, the GDP growth rate will inevitably decrease due to the dwindling effects of tax cuts, government debt and a peak in the stock market.

As the world's most developed country, the US economy appears to be stable. Nevertheless, as short-term cyclical forces remain irresistible and economic bubbles accumulated through years of quantitative easing emerge, great uncertainty still looms over US economic growth in 2020.

The trade war's short-term impact on the US economy might be less than on the Chinese side but must not be ignored.

An escalation of the trade war could drag the US economy's growth below 2 percent, lower than my previous estimates of 1.9-2.4 percent next year, assuming there won't be a trade war.

Trump may be hoping to reach a trade agreement with China by the end of the year to eliminate the threat of a low growth rate in the next year to concentrate on domestic issues.

As the victim and passive receiver of the China-US trade war, China hopes to reach a trade agreement with the US as soon as possible.

China has three bottom lines. First, the US-imposed tariffs on Chinese products must be abolished. Second, China's purchase of US products must correspond to reality. Third, the agreement must be fair on both sides.

This means the agreement should not compromise China's national dignity, specifically on issues affecting China's domestic economic mechanisms and policies.

The US has eight demands, including reducing a $100 billion trade surplus within one year and another 100 billion the following year, and halt subsidies to the advanced manufacturing industry included in "Made in China 2025," according to media reports.

It is not difficult to see that there are major conflicts between China and the US, which means it is impossible to reach a comprehensive and permanent trade agreement in the near future. However, we can expect a partial and temporary trade agreement.

Trump can brag about a partial and temporary trade agreement favorable to the US and a major diplomatic and economic victory, which provides him with added leverage in his re-election bid.

China could temporarily end trade war interference on the domestic economy and market and give more attention to fostering domestic reforms and solving economic issues.

China and the US are expected to reach a partial and temporary trade agreement in the last quarter of 2019, but major differences, such as eliminating the tariffs, state subsidies, and disputes on intellectual property protection will remain.

The author is chief economist with China CITIC Bank International. bizopinion@globaltimes.com.cn

Posted in: EXPERT ASSESSMENT