HOME >> BUSINESS

US trade flip-flop sets a confrontational trajectory

By Wen Sheng Source:Global Times Published: 2019/8/6 18:33:40

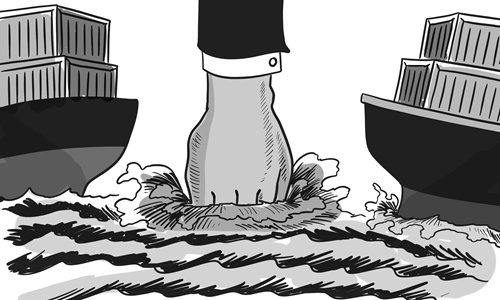

Illustration: Luo Xuan/GT

Since US President Donald Trump debated with, and overruled, his major economic advisors on Thursday, and threatened via Twitter that he will impose 10 percent tariffs on a further $300 billion of Chinese imports from September 1, the erratic nature of the current US government is ever-clearer.

Just one month ago in Osaka, Japan, the leaders of China and the US consented to refrain from escalating the trade war, and to resolve their trade differences at the table.

Few in China could have anticipated the White House's rapid turnabout. Now, prospects for the continuation and fruitfulness of bilateral trade talks are darkening.

By whatever metrics, the atmosphere for genuine trade talks is being poisoned by the White House as the Trump administration is committed to bullying tactics and intransigence, setting a confrontational course for the world's two largest economies.

As the past 13 months of intermittent talks have shown, the Chinese government will not be moved by the great pressure imposed by Washington, because China aims to set a standard for other countries to follow: Never cave in the face of a bully wielding a club of tariffs.

"China's position is very clear that if the US wishes to talk, then we will talk. If they want to fight, then we will fight," said Zhang Jun, China's permanent representative to the United Nations.

Time and again, China has warned that if the US government stubbornly ratchets up belligerence and exacerbates the trade war, it will meet with China's harsh countermeasures, and the White House will have to take accountability for the escalation of aversions.

Trump's latest move, if put into effect, will impose levies on all of China's exports to America, which totaled $539 billion in 2018. The magnitude of the trade war is unprecedented in history, demonstrating the current US administration's malicious intention to cripple and crash a fledgling Chinese economy.

To soften the US' high tariffs assault, China has to find a mattress. On Monday, the People's Bank of China, the central bank, lowered the yuan by 229 basis points against the US dollar, and onshore and offshore yuan weakened beyond 7 against the greenback - a benchmark not breached since 2008.

According to economic theory, a weaker exchange rate for a country's currency will help propel that country's exports while inhibiting imports.

In a statement, the central bank said the depreciation was attributed to US trade protectionism and the imposition of increased trade tariffs on China. The bank reaffirmed that China's foreign exchange management will pivot to back up the economy and prevent it from any harm premeditated by others.

It is broadly believed that, in the coming months, the central bank will attempt to keep the currency's exchange rate relatively stable, likely within a reasonable range of 6.5-7.5 versus the US dollar, Chinese economists predict.

However, if the Trump administration gives up their latest tariff threat and comes back to the negotiating table, China will certainly reciprocate, and may intervene in the foreign exchange market, selling out more US dollars to defend the value of the yuan.

Therefore, the conception that Beijing has abandoned its last hope for a trade deal with the US government is misguided. For the benefit of both economies, and the global economy as a whole, China has always wanted to prevent the trade war from expanding and inflicting immense pain on many people.

The two economic powers shall not let a trade deal drift further away.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn

Posted in: INSIDER'S EYE