HOME >> BUSINESS

Stagflation possibility from skyrocketing pork prices calls for vigilance, not panic

By Wang Jiamei Source:Global Times Published: 2019/10/30 21:12:02

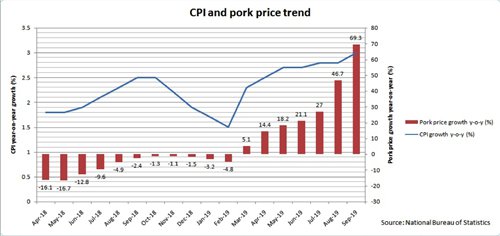

The importance of pork, the primary protein source on the Chinese table, has become especially noteworthy this year. Pork prices soared 27 percent, 46.7 percent, and 69.3 percent year-on-year in July, August, and September, respectively, pushing China's consumer price index (CPI) to relatively high levels of 2.8 percent, 2.8 percent, and 3 percent in the corresponding months, according to data from the National Bureau of Statistics.

The higher inflation, which comes at a time when China's GDP has continued to slow down, is causing concern over possible stagflation, namely a situation in which consumer prices are climbing while the economic growth rate is slowing. Once stagflation occurs, it is difficult for policymakers to deal with. On the one hand, expansionary policies may lift the economy but exacerbate inflation, which could get out of control. On the other hand, tightening policies may see inflation go down, but could curb economic growth as well.

Of course, jumping to the conclusion that China will enter a stagflation period because of the skyrocketing pork prices may seem too hasty. But in view of the deteriorating economic environment both at home and abroad, it is still necessary to be vigilant toward this possibility. The authorities should attach more attention to curbing inflation, or restraining the high pork prices. The Chinese government has already taken a number of measures to increase pork supply and rein in prices. So far, the policy effect has been uncertain. Even according to optimistic forecasts, the supply of pork won't recover until 2020, and the prices won't fall back before then.

Finally, against the background of the current economic restructuring, the more crucial and complicated problem for the Chinese economy may still be how to deal with the downward pressure, which carries more profound importance compared with the pork issue.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn

Posted in: INSIDER'S EYE