HOME >> BUSINESS

Richemont jewelry wealth dazzles Tiffany admirers despite drop in bling sales

Source:Global Times Published: 2019/11/10 22:23:39

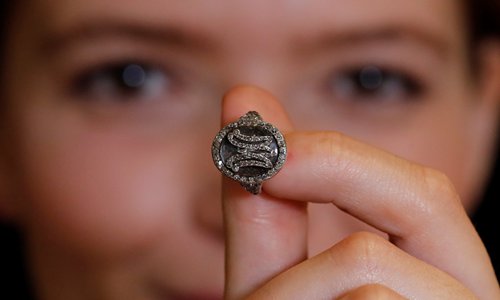

Photo: VCG

Richemont offers a sparkling vision to Tiffany & Co's suitors. Though the Swiss group on Friday reported disappointing results, the power of its Cartier and Van Cleef & Arpels brands shone through. The high-end jewelers convert an impressive third of their revenue into operating profit. That gives luxury rival LVMH a target as it pursues a possible takeover of the American group.Results for the six months to September fell short of expectations. The company chaired by Johann Rupert generated operating profit of 1.17 billion euros ($1.29 billion), below the 1.2 billion euros average of analyst's forecasts compiled by Refinitiv. Richemont's struggling watch business and an operating loss at its recently acquired online fashion retailers were partly to blame. So was a severe drop in Hong Kong bling sales. The Chinese special administrative region is a key hub for jewels and watches.

Despite the immediate challenges, though, Richemont remains one of the most powerful purveyors of expensive diamond rings and gold bracelets. Jewelry sales increased by 8 percent to 3.7 billion euros over the period, and earned an operating margin of 33 percent. Tiffany, by comparison, is expected to produce an operating margin of just 17.6 percent this year.

The US brand is perceived as less exclusive than Cartier or Van Cleef, partly the result of its push to attract younger affluent consumers. While the super-wealthy can spend hundreds thousand dollars for the most exclusive items, a Tiffany customer can pick up a simple silver bracelet for $500.

That gap represents an opportunity for LVMH should its $15 billion pursuit of Tiffany pay off. A successful deal would give Bernard Arnault's company a jewelry business to rival Richemont's. The 18 billion euro market grew 7 percent in 2018, says Bain, making it the fastest-growing segment in the bling universe along with shoes.

Sheltering under LVMH's larger umbrella would allow Tiffany to make long-term investments to boost future sales and profitability, just as the French group previously turned around Italian jeweler Bulgari.

The US company could also expand in China, building on LVMH's already strong presence and the appeal of its blue-boxed engagement and wedding rings.

Bridging the gap between Tiffany and Cartier would be a stretch for any owner, including LVMH. But Richemont's jewelry riches at least give it a shiny goal.

The author is Lisa Jucca, a Reuters Breakingviews columnist. The article was first published on Reuters Breakingviews. bizopinion@globaltimes.com.cn

Posted in: INSIDER'S EYE