Shopping habits overhauled amid COVID-19 pandemic

Source: Reuters Published: 2020/9/2 19:18:40

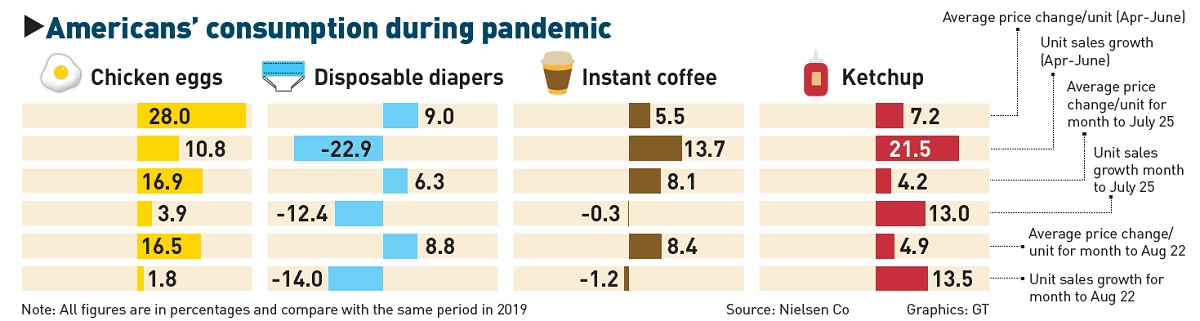

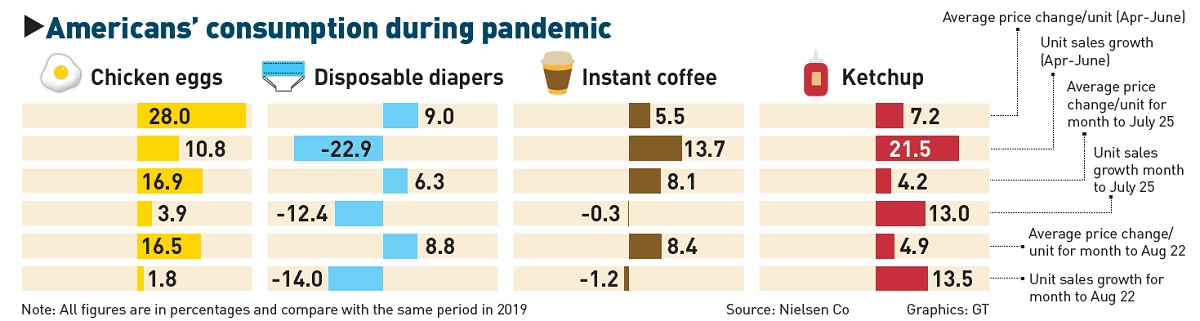

Instant coffee, ketchup, Lululemon yoga pants and Nike Air Max sneakers are all in. Bottled water, pricey diapers and Burberry luxury trench coats are out.

Many of the new trends can be attributed to one factor, according to retail specialists: working from home.

Almost overnight, a consumer-driven economy with clearly delineated work and home spending, changed profoundly. Rising demand for certain items, as well as global supply-chain disruptions, has driven up prices.

Americans are now shelling out significantly more than a year before for coffee, eggs, sliced ham, ketchup and cheese, for example, according to the Reuters analysis of the latest pricing data from Nielsen Co, the Brewers Association and StyleSage Co.

Yet it's a complex picture. Some changes in behavior seem counter-intuitive during a time of deep economic uncertainty.

Demand and prices have also increased for more expensive or "splurge" items like $106 men's Nike Air Max sneakers, $105 Lululemon yoga pants and even a $1,500 Louis Vuitton handbag.

Economists put this apparent discrepancy in behavior down to the fact that many people, unable to spend outside, have more cash in hand. Even many workers on furlough are receiving jobless benefits that match their wages under a federal stimulus plan.

"If I were to consider the consumer situation right now, in a strange way, they may have more disposable income, if they kept their job," said Nirupama Rao, an assistant professor of business economics and public policy at the University of Michigan. "Of course we're facing mass layoffs, but the bulk of people have maintained their wages and earnings."

'Unprecedented pressure'

Shoppers paid roughly 8 percent more on average for JM Smucker's instant coffee, including Folger's and Dunkin', at bricks-and-mortar stores in the four weeks to August 8 versus a year before, according to Nielsen data analyzed by Bernstein.

They shelled out nearly 10 percent more for Kraft Heinz sauces and about 5 percent extra for Tyson Foods' sliced hams. Such inflation might make commercial sense, given the bump in demand for home staples. But some consumer experts complain retailers and big brands are cutting back on promotions and using their power to shore up profits during a health crisis that has led to millions losing their livelihoods.

"Brand manufacturers have been fattening their pockets with profits while putting unprecedented pressure on the consumer who has to pay those higher prices," said Burt Flickinger, retail consultant at Strategic Resource Group.

JM Smucker said it did not raise prices of its instant coffees in the four weeks to August 8, but did cut back on some promotions for in-demand products. Kraft Heinz declined to comment, but said second-quarter prices went up during earnings in July as it pulled some offers and discounts for scarce products. Tyson did not respond to a request for comment.

Other industry experts point out that companies have had to grapple with costly production shifts to adapt to the new landscape. They note that before the pandemic, when costs were lower and there were more promotions and discounts, prices of Heinz sauces were declining.

Pre-COVID-19, tens of millions of commuters grabbed a coffee to-go en route to work. Suddenly, instead of 9.1 kilograms bags of coffee for restaurants, or large containers of ketchup, producers have had to switch to smaller, home-use packaging.

As ketchup, mayonnaise and vinegar sales surged, Kraft Heinz diverted resources to running these production lines around the clock, while suspending others. It added extra shifts for factory workers to make grocery-sized bottles.

Egg suppliers, like market leader Cal-Maine Foods Inc, have had to overcome a shortage of cartons.

"If you look at eggs, before they'd be powdered to send to restaurants and now they have to be put in cardboard containers to go to supermarkets," said Daniel Bachman, senior US economist at Deloitte. "It took a high price to induce the change."

Yet consumer companies cannot take demand for granted and can be burnt by raising prices.

Prices for bottled water and disposable diapers have gone up, while demand has fallen for most of the pandemic. People are unwilling to pay out extra when they can drink their own water at home, and can opt for reusable or cheaper generic diapers at a time when there's a lack of child day care, some economists say.

"You're at home anyway so you're not sending your child off somewhere in a diaper that fails," said Rao.

Much remains uncertain.

The US epidemic and its economic consequences are moving targets, and it is unclear when - or even if - American life and consumer behavior will revert to "normal."

Rao said food producers had been reluctant to invest in permanent changes to retool factories. "They're hindered by the fact there's so much uncertainty as to how long this will last."

Newspaper headline: Spending trends

People wearing face masks carry shopping bags as they walk near Herald Square in New York City, the US on June 25. Photo: AFP

"Everything we knew about supply and demand, we can essentially throw out the window because consumer behavior has changed completely," said Piotr Dworczak, assistant professor of economics at Northwestern University.Many of the new trends can be attributed to one factor, according to retail specialists: working from home.

Almost overnight, a consumer-driven economy with clearly delineated work and home spending, changed profoundly. Rising demand for certain items, as well as global supply-chain disruptions, has driven up prices.

Americans are now shelling out significantly more than a year before for coffee, eggs, sliced ham, ketchup and cheese, for example, according to the Reuters analysis of the latest pricing data from Nielsen Co, the Brewers Association and StyleSage Co.

Yet it's a complex picture. Some changes in behavior seem counter-intuitive during a time of deep economic uncertainty.

Demand and prices have also increased for more expensive or "splurge" items like $106 men's Nike Air Max sneakers, $105 Lululemon yoga pants and even a $1,500 Louis Vuitton handbag.

Economists put this apparent discrepancy in behavior down to the fact that many people, unable to spend outside, have more cash in hand. Even many workers on furlough are receiving jobless benefits that match their wages under a federal stimulus plan.

"If I were to consider the consumer situation right now, in a strange way, they may have more disposable income, if they kept their job," said Nirupama Rao, an assistant professor of business economics and public policy at the University of Michigan. "Of course we're facing mass layoffs, but the bulk of people have maintained their wages and earnings."

'Unprecedented pressure'

Shoppers paid roughly 8 percent more on average for JM Smucker's instant coffee, including Folger's and Dunkin', at bricks-and-mortar stores in the four weeks to August 8 versus a year before, according to Nielsen data analyzed by Bernstein.

They shelled out nearly 10 percent more for Kraft Heinz sauces and about 5 percent extra for Tyson Foods' sliced hams. Such inflation might make commercial sense, given the bump in demand for home staples. But some consumer experts complain retailers and big brands are cutting back on promotions and using their power to shore up profits during a health crisis that has led to millions losing their livelihoods.

"Brand manufacturers have been fattening their pockets with profits while putting unprecedented pressure on the consumer who has to pay those higher prices," said Burt Flickinger, retail consultant at Strategic Resource Group.

JM Smucker said it did not raise prices of its instant coffees in the four weeks to August 8, but did cut back on some promotions for in-demand products. Kraft Heinz declined to comment, but said second-quarter prices went up during earnings in July as it pulled some offers and discounts for scarce products. Tyson did not respond to a request for comment.

Other industry experts point out that companies have had to grapple with costly production shifts to adapt to the new landscape. They note that before the pandemic, when costs were lower and there were more promotions and discounts, prices of Heinz sauces were declining.

Pre-COVID-19, tens of millions of commuters grabbed a coffee to-go en route to work. Suddenly, instead of 9.1 kilograms bags of coffee for restaurants, or large containers of ketchup, producers have had to switch to smaller, home-use packaging.

As ketchup, mayonnaise and vinegar sales surged, Kraft Heinz diverted resources to running these production lines around the clock, while suspending others. It added extra shifts for factory workers to make grocery-sized bottles.

Egg suppliers, like market leader Cal-Maine Foods Inc, have had to overcome a shortage of cartons.

"If you look at eggs, before they'd be powdered to send to restaurants and now they have to be put in cardboard containers to go to supermarkets," said Daniel Bachman, senior US economist at Deloitte. "It took a high price to induce the change."

Yet consumer companies cannot take demand for granted and can be burnt by raising prices.

Prices for bottled water and disposable diapers have gone up, while demand has fallen for most of the pandemic. People are unwilling to pay out extra when they can drink their own water at home, and can opt for reusable or cheaper generic diapers at a time when there's a lack of child day care, some economists say.

"You're at home anyway so you're not sending your child off somewhere in a diaper that fails," said Rao.

How long will it last?

Much remains uncertain.

The US epidemic and its economic consequences are moving targets, and it is unclear when - or even if - American life and consumer behavior will revert to "normal."

Rao said food producers had been reluctant to invest in permanent changes to retool factories. "They're hindered by the fact there's so much uncertainty as to how long this will last."

Newspaper headline: Spending trends

Posted in: AMERICAS