Indian businesses’ plight also deserves govt attention

Source: Global Times Published: 2020/11/18 20:12:58

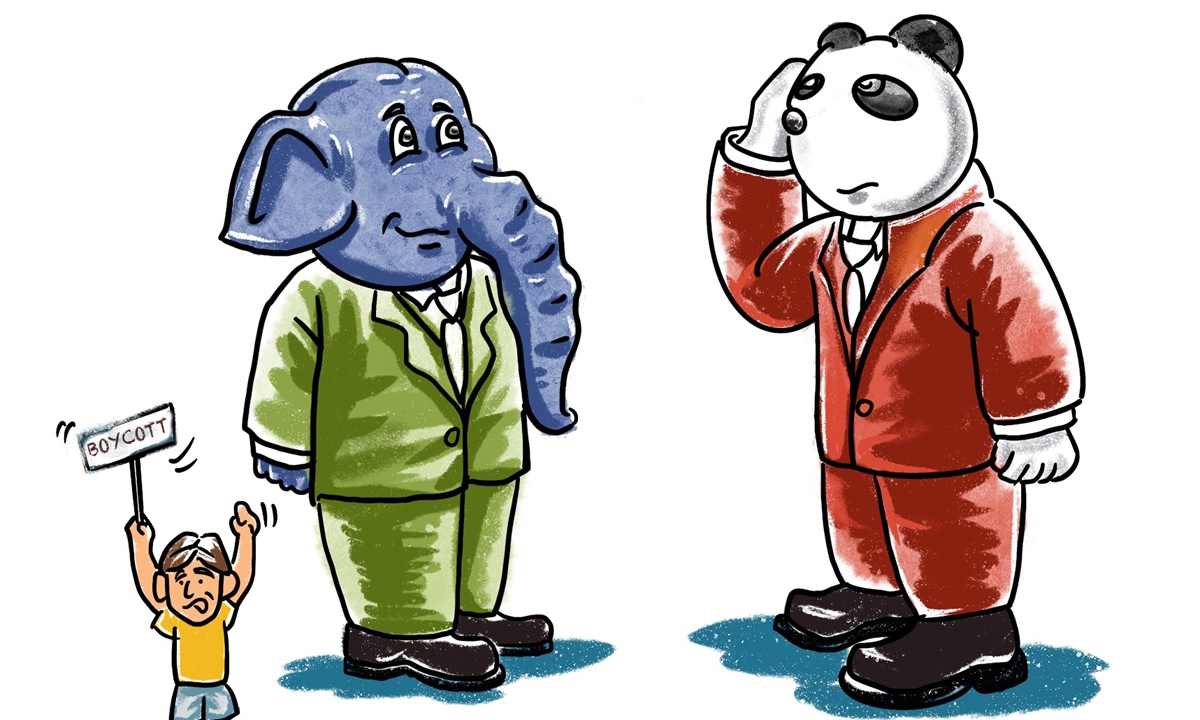

Illustration: Tang Tengfei/GT

India's resistance to Chinese investment seems to show signs of easing as the Indian government is reportedly mulling a plan of loosening previous restrictions on foreign direct investment from countries sharing a boundary with India, including China.Given the fact that India's other neighbors have very limited investment in the South Asian nation, if there will be any easing of the investment restriction, the change may mostly work for the Chinese investment.

While India's relevant authorities haven't offered any comment on this issue yet, judging by the market reaction, there is cautious optimism over the possibility that a certain part of foreign direct investment from countries including China may not need to be subject to government scrutiny for some sectors. The news has also sparked some speculation as to whether the implementation of some rules have encountered difficulties.

Under the rules issued by the Department for Promotion of Industry and Internal Trade in April, all Chinese investments are required to get approval from the Indian government, tighter scrutiny that used to be applied to only Pakistan or Bangladesh previously. By March 2020, China's total current and planned investment in India had exceeded $26 billion, a significant rise from the level of around $1.6 billion in 2014, according to a Brookings report. Apparently, it is very challenging to carry out reviews on China's large scale investment volume, so the feasibility of the rule is questionable.

Various market justifications for the news is evidence enough to indicate that whether it turns out to be true or not, loosening restrictions on Chinese investment is not something out of market expectation. It may also serve as a reminder that "boycotting China" is not the only voice in India. At a time when the entire Indian economy is suffering its deepest contraction on record, it is essential for its government to heed those voices that reflect real economic difficulties and hope to get outside aid to relieve their pressure.

Although there has been a strong push-back against Chinese products and investment in India, the latter's crackdown on imports and capital from China has also hurt its own business interests. Even though the Modi government has been trying hard to attract foreign investment to lift its economy, foreign direct investment inflows into the country may still go into a freefall this year due to factors like the coronavirus epidemic, lockdown measures, supply chain disruption and boycott of China-related investment.

Against such a backdrop, it is conceivable that measures introduced to reject Chinese investment may only generate more pressure and hardship for its domestic economy. While these business difficulties may be hard to be heard amid rising nationalist sentiment, they should by no means be overlooked.

Last but not least, even if the easing of investment rules is true, there is still much to be done to repair the damage to the trade and economic cooperation between China and India. Market confidence has been undermined on both sides, and we sincerely hope to see more expressions of goodwill, no matter what the reason.

Posted in: GT VOICE