China's six largest banks suspend opening new accounts in precious metal trading

Source: Global Times Published: 2020/11/28 12:40:12

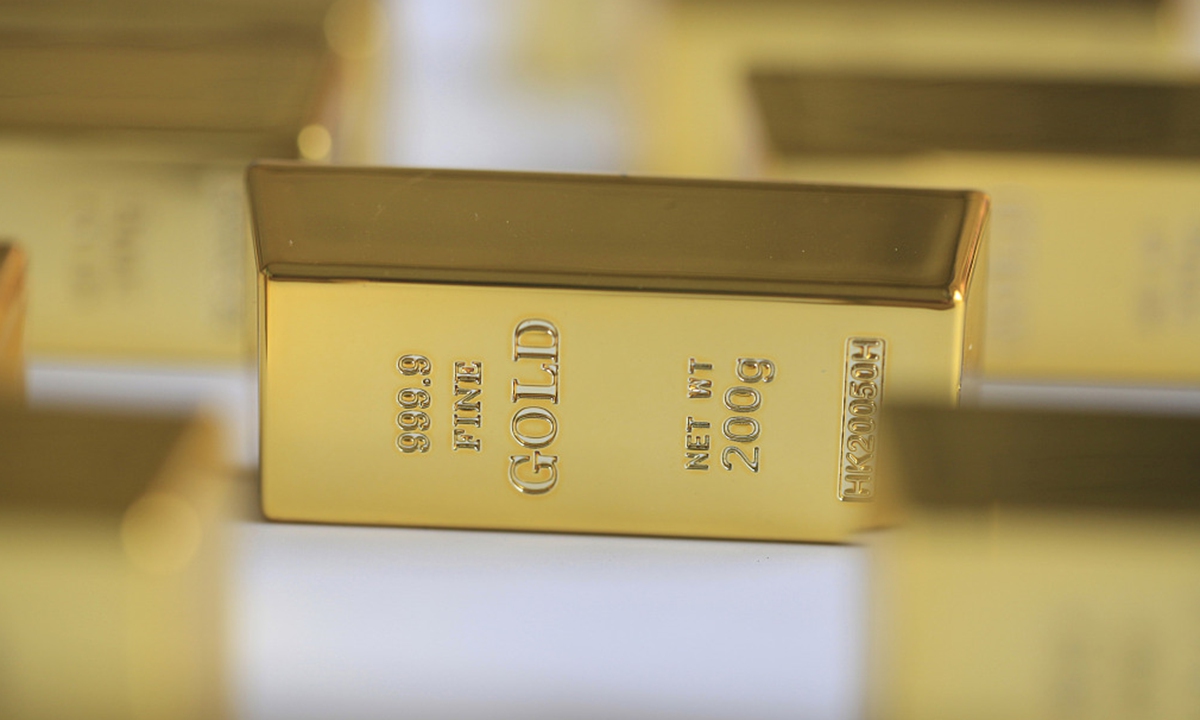

Photo:VCG

This move comes amid price and liquidity risks in the global precious metal market intensified due to changing global political and economic situation, which has led to a number of major state-owned banks and joint-stock banks worldwide taking action on Friday to suspend the opening of new trading accounts in the retail precious metal trading business.

In line with the global banks' moves, Chinese major banks also responded swiftly with new arrangements launched in a bid to protect investors' interests from growing risks of the precious metal market.

As of midnight Saturday, the banks will suspend the opening of new, individual trading accounts in gold and silver in all channels of the bank including counter, mobile banking, and online banking, according to the ICBC's public statement on Friday.

The normal trading of customers who have already opened an account will not be affected by the new arrangement, ICBC said.

Other major banks including Bank of Communications, China Construction Bank, China Merchants Bank, and Agricultural Bank of China also launched corresponding measures.

Gold futures in New York recent saw a brief dip below $1,800 an ounce. Meanwhile, with the increase in crude oil prices and other corresponding commodities, gold contracts on the domestic futures market in Shanghai fell from a peak of 454.08 yuan ($69) per gram on August 7 to a recent low of 378 yuan, a nearly 17 percent drop in just over three months, according to media reports.

Posted in: MARKETS