China-Australia trade stalemate far from hitting bottom

Source: Global Times Published: 2020/12/2 20:08:40 Last Updated: 2020/12/2 21:13:40

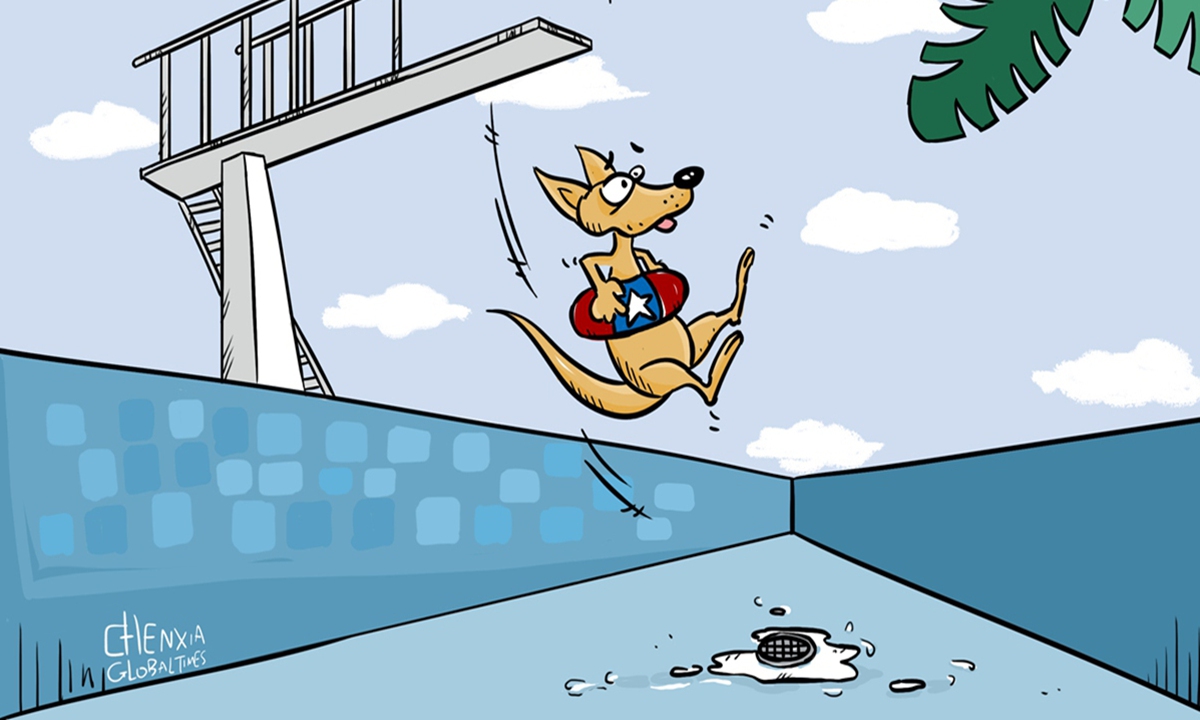

Illustration: Chen Xia/GT

The Australian Bureau of Statistics is scheduled to release trade data for October on Thursday, which may not show a free-fall drop yet as many have concerned amid cascading trade tensions with China.

Data released on Wednesday showed that the Australian economy rebounded by a bigger-than-expected 3.3 percent quarter-on-quarter in the third quarter, which the market generally believes points to a relatively optimistic picture.

Considering the changes in Australia's trade data over recent months, there is little chance of a "surprise" in Thursday's release of trade figures. Even if the mostly watched China-Australia trade data may reflect some volatility, it is unlikely to deviate too much from an expected general range.

Yet, figures for individual months may not reveal the true extent of the damage caused by China-Australia trade tensions, with investors and exporters still nervous over future trade relations.

Given the deteriorating China-Australia relations over the past months, there is no denying that bilateral trade has endured short-term fluctuations. However, what really matters may be the story not captured by the official figures - the trade diversification push by both sides.

According to some media reports, China just secured 28.72 million tons of coal from Indonesia in a deal worth $1.467 billion, and has also been increasing coal imports from Russia and Mongolia in recent months. In May, China gave a green light to US barley imports which met import requirements at home. These moves clearly reflect China's intention to diversify trade of certain commodities away from Australia.

In the meantime, Australian barley growers are reportedly viewing India as a potential market for selling their crop.

Trade diversification efforts on both sides are evident and have been accelerated by the rapid deterioration of bilateral ties, which may be heading toward a substantial economic decoupling at a faster-than-expected pace. With so many discouraging signs for bilateral trade, it is no longer news that front-line traders are actively seeking alternative supplies.

Should the economic vibrancy of China-Australia relations recede, bilateral trade will be more vulnerable to political maneuvering. That means once the economic dependence between the two sides reaches a tipping point, even trade of some specific commodities that are deemed immune to political tensions could face a growing risk of interruption.

There is no denying that China would also suffer economically if further escalation in tensions with Australia led to the blockage of certain crucial commodities. Yet, through diversification and the possibility of broadening China's trade options, economic loss can be minimized.

We do not want to see China and Australia sink to new lows when it comes to two-way trade, but bilateral relations have deteriorated so quickly that it is clear the unwanted "surprises" are not over yet.

It is now reaching the stage that it would appear insufficient to merely call for restoring 'stability' between China and Australia. Perhaps a truly alarming reminder that window of opportunity is closing for an Australian economy burdened by the recklessness and arrogance of its elected officials.

Newspaper headline: Canberra still under pressure in trade impasse

Posted in: GT VOICE,OTHER REGIONS