China's CPI growth slows to 1.8 pct in July

| Editor's Note |

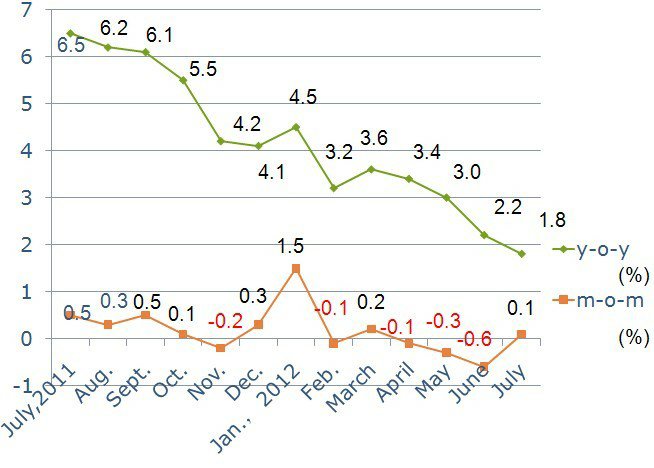

China's consumer price index (CPI), a key gauge of inflation, grew to 1.8 percent year on year in July, the slowest pace since February 2010, the National Bureau of Statistics (NBS) announced Thursday.

The rate was 0.4 percentage points lower than the figure in June.

The easing inflation is explained as a result of the base effect. The CPI growth rate hit a 37-month high of 6.5 percent in July last year before gradually retreating as China's economy slowed for eight quarters in a row.

| Latest News |

China's CPI eases to 1.8 pct in July

China's consumer price index (CPI), a key gauge of inflation, grew to 1.8 percent year on year in July, the slowest pace since February 2010, the National Bureau of Statistics (NBS) announced Thursday.

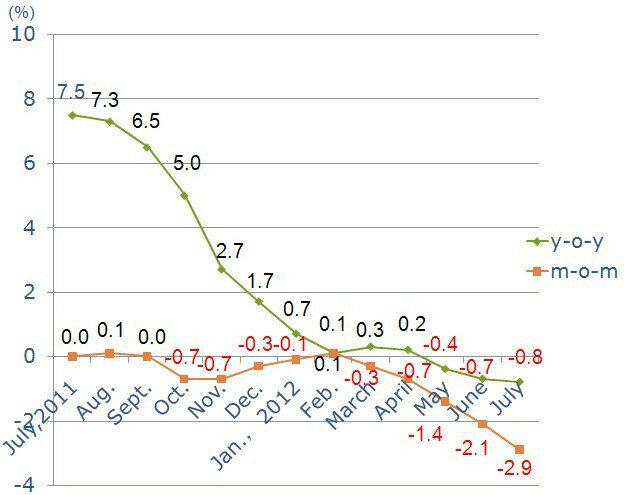

China's PPI down 2.9 pct in July

China's producer price index (PPI), a main gauge of inflation at the wholesale level, fell 2.9 percent in July from a year earlier, the National Bureau of Statistics said Thursday.

China PPI drop highlights plight of real economy

China's producer price index (PPI), a main gauge of inflation at the wholesale level, fell 2.9 percent in July from a year earlier, the National Bureau of Statistics (NBS) announced on Thursday.

|

CPI and PPI Data |

1. The change of the national consumer price index (CPI) from July, 2011 to July, 2012

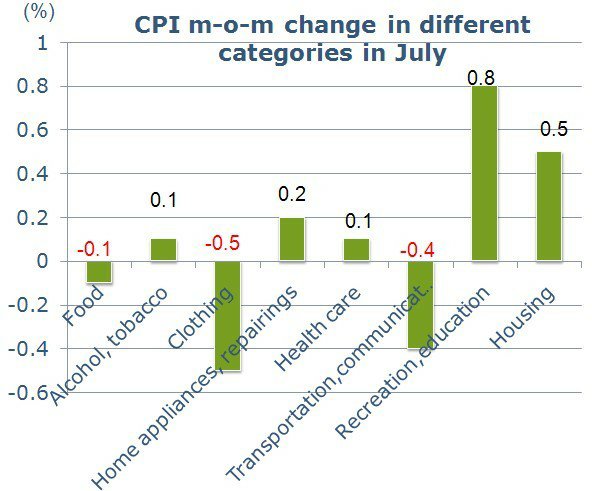

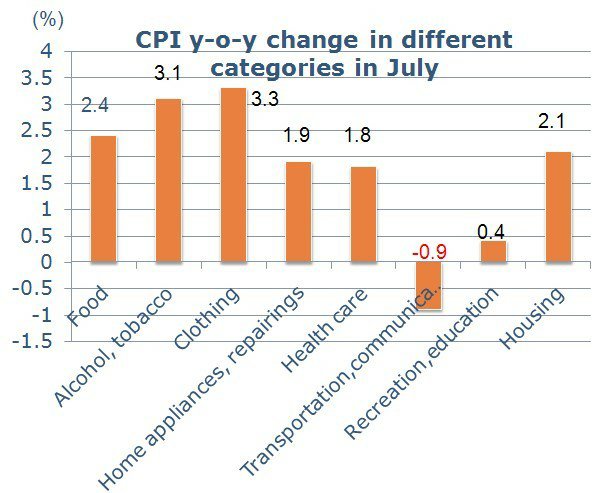

4. China's y-o-y CPI change in different categories in July, 2012

4. Related data: The change of China's producer price index (PPI) from July, 2011 to July, 2012

Illustration: Globaltimes.cn

| Comments |

On CPI

Agaist

@智小智爱咪咪: They say the main reason the CPI grew to was the decrease in price of pork and eggs. But I didn’t feel the price fell at all. Why is data that NBS announces always different from real life?

@腾讯来的何某人: This is just a little way to stimulate investment, but the final purpose is to fuel domestic demand. All this time, the problem of weak economic development has not changed while the government tries their best to take money from everyday citizens’ pockets. The government does not provide everyday people with enough reassurance, so they don’t see the bright future of policies issued by the government. This is the crucial problem. Just releasing some data doesn’t change anything.

Neutral:

@郑宗盛: Many people believe that the CPI decreasing is a good thing. But do those who can see a recession coming hide behind the CPI?

For:

@贺东亮Shine: The CPI grew to 1.8 percent year on year in July, which is the lowest rate in the last 30 months. This is the result of efforts made by the Central Bank to control prices. The economy is running steadily and smoothly, and NBS data is increasingly reliable.

@杨百万软件俱乐部: The data is much like we expected; macro-economic regulation and control is proving increasingly effective. With a low inflation rate, I expect the government now has an opportunity to fine tune their policy.

On PPI

Qu Hongbin, chief economist at HSBC China and co-head of Asian Economic Research at HSBC

Qu said the data suggests that China's real economy, especially industrial enterprises, are facing increasing deflationary pressure.

"The decline of the PPI has highlighted the grim facts of sluggish market demand, shrinking business orders and continuing destocking," he said.

"Policymakers should place more attention on downward pressure in the real economy," Qu said, adding that easing inflation will offer more room for policy fine-tuning.

Liu Yuhui, a researcher with the Chinese Academy of Social Sciences

Liu said weak demand will be followed by narrower profits, which will in turn affect investment and employment.

Source: Xinhua

| Related Biz Reports |

|

|

|

|

|

|