Likonomics: China's economic reboot

| Editor's Note |

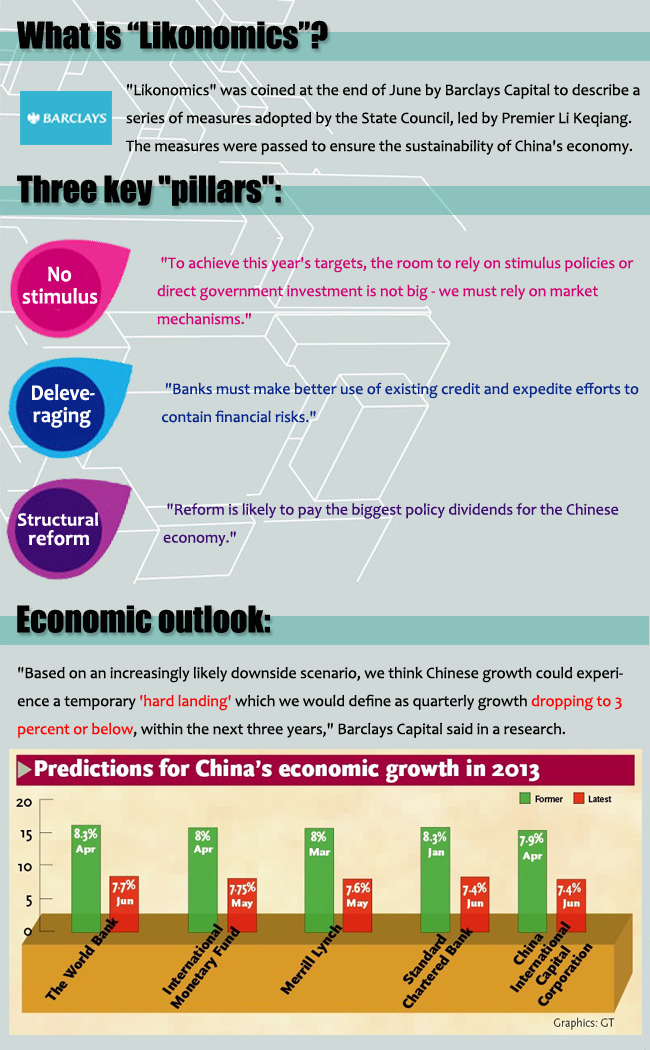

'Likonomics', the term to describe Chinese Premier Li Keqiang's economic policy. Was coined on June 27 by three economists at Barclays Capital. Like "Thatcherism", "Reaganomics", and more recently “Abenomics”, "Likonomics" has become the buzzword to describe the implications of China's new economic program.

| About Likonomics |

| About Keqiang Index |

| Comments |

Chinese media comments:

cntv.cn: Likonomics to revitalize Chinese economy

At the end of June, China’s banks went through a short but severe monetary liquidity crisis. While the crisis exposed several existing problems with China’s financial system, it also revealed the determination of the new leadership to stabilize currencies and make structural adjustments to the economy.

As we enter the advanced stages of reform, will and determination is more important than ever before.

In March Premier Li mentioned how governments should take the initiative in spending cuts, something that coincides with the recent ideas for stock stimulus. We have a reason to believe that Li’s policy will be carried out faithfully and further drive China’s economy.

Investment Express: Likonomics not economic policy cure-all

While economic policy requires continuity and stability, it must also adjust to changes in the economic and social environments. As the premier of China, Li Keqiang shoulders the responsibility of improving the country’s economic health. All policy decisions must hold up to real future implementation. Likonomics are largely based on the findings of a small number of scholars. His economic policy and principles are not the same thing.

Caxin.com: What Are Policy-Makers Up To? Likonomics, Expert Says

Li and his cabinet realize that the government-led investment of the past is unsustainable and have withstood calls for new stimulus plans over the past three months. Meanwhile, the central government has been working to control financial risk, especially excessive credit that will cause asset bubbles.

Xinhua News Agency: Barclays CEO says Likonomics supports China's sustained growth

Jenkins said that under Likonomics, China may witness relatively slower economic growth over the coming years, likely in the range of 6 percent to 8 percent.

Foreign media comments:

Economist on July 1 explained Likonomics as a policy of no stimuli, deleveraging and structural reform. Li has argued that "China had little scope for stimulus or government-directed investment," mostly because Beijing's post-crisis stimulus – a four trillion-yuan package – was discredited for being too big and causing subsequent inflation. Likewise, leveraging has been denied for the same reasons, while structural reform, as Li has said, has always been "the biggest dividend" for China.

In the online version of Market Watch, the Wall Street Journal said China's economy would suffer slowed quarterly growth as low as 3 percent as part of what's known as a "temporary hard-landing." In the long-run, however, Likonomics will produce "for short-term pain leading to long-term gain."

Reuters quoted China Central Television (CCTV)'s report that the Chinese government would "will keep policy stable and make macro-controls more targeted and forward-looking to stabilize economic growth." In a July 18 report, Reuters also reported that analysts said the temporary slowdown in China would push the Chinese government "to quicken reforms to take up the economic slack, rather than slow them down."

| Background |

| Li's previous reforms | ||

| Time | Reform | Report |

| 2013 | Institutional reform | Li insisted on cutting down the cabinet departments down to 25 to bring more efficiency. |

| 2009 | Healthcare reform | When serving as the vice premier of the State Council, Li was tasked to oversee the country's healthcare system reform. The reform has been progressing with the goal of providing a basic medical system as a public service to all. |

| 2008 | Fuel tax reform | Li was credited with seizing the opportunity presented by the 2008 financial crisis to propel complex fuel tax reforms involving multiple stakeholders. The initiative has helped eliminate redundant fuel fees, inspired energy conservation and emission reduction, improved the refined oil pricing system and accumulated experience for future reforms. |

| 2005 | Shantytown renovation | Within three years, 1.2 million residents had moved into new apartments and the shantytowns had been relegated to history. |

| 2004 | Urbanization reform | When Li served as the governor of Henan Province, he tried to seek a coordinated development of industrialization, urbanization and agricultural modernization. |

| Related Reports |

Special reports:

Keep it steady

With a doctorate degree in economics from Peking University, Premier Li Keqiang has already had a strong impact on thinking about the progress of China's economy.

The right Balance

On June 24, the 100th day of the new government led by President Xi Jinping and Premier Li Keqiang, China's stock markets suffered their heaviest daily loss in nearly four years.

Biz reports:

Growth slows for 2nd straight quarter

Economists warn against credit tightening

China’s banks weigh options amid cash squeeze

| Editor's Note |

经济增长 jīngjì zēngzhǎng economic growth

Example:

现在需要由家庭消费、私营部门和新经济来带动经济增长。(Source: 每经网)

Domestic consumption, the private sector and new economies are all needed to boost economic growth.

Web editor: yangruoyu@globaltimes.com.cn