HOME >>

China orders sweeping audit amid looming debt

Source:Globaltimes.cn Published: 2013-8-13 19:24:00

| Editor's Note |

While China’s local governments construct highways, railroads and other expensive infrastructure projects to bolster their contribution to GDP, they are accumulating tens of billions of yuan in debt along the way, a trend which many observers say could spark a crisis to the world’s second largest economy. The National Audit Office (NAO), the country’s highest accounting authority, announced on July 28 that it would launch a sweeping inspection of local debt levels and borrowing habits.

| Latest News |

Drowning in debt?

By conducting a large-scale, authoritative and effective audit, the central government wants to find out how much debt has been accumulated and then make decisions on how to control local borrowing.

Reining in culture of debt

While the full extent of local government debt remains unknown, many have started looking for the factors that led to the worrying levels of debt now encountered. Several experts reached by the Global Times said the fundamental reason was local officials' eagerness to invest generously in infrastructures to lift GDP growth.

Revamping local financing system

China's central government is expected to bail out local governments on the verge of default, preventing Detroit-like bankruptcies from taking place in the country, experts said.

| Background |

China’s ongoing construction boom promises to raise living standards for millions of citizens. But the nationwide spending spree which has funded countless infrastructure projects has also swallowed billions of yuan from local government budgets.

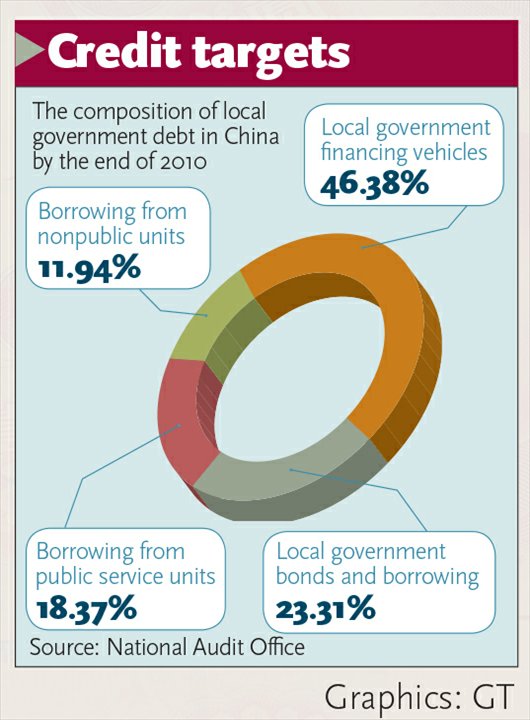

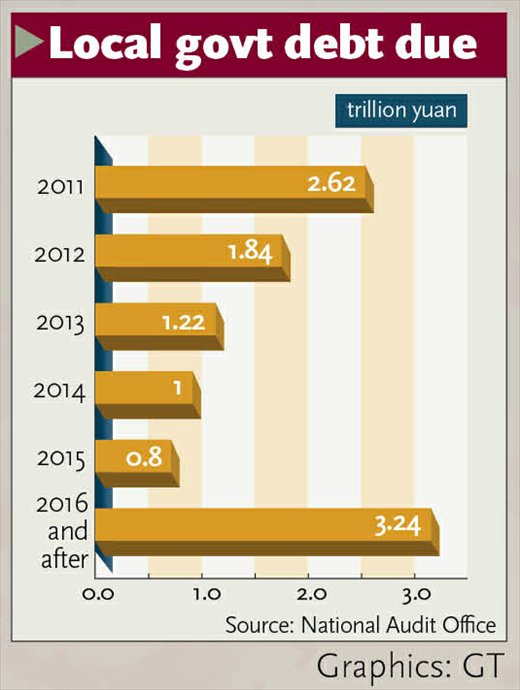

The central government initiated a similar review of local accounts in 2010 which saw the NAO audit provincial, city and county governments. It later published a report revealing that local government debt reached 10.7 trillion yuan ($1.75 trillion) by the end of 2010, an amount equal to 27 percent of China’s GDP during that year.

The NAO’s latest audit will extend to township-level governments and the central government, while also looking again at the governments it reviewed in 2010, according to recent reports in the 21st Century Business Herald.

| Local Govt Debt |

The National Audit Office reviewed the debt levels and borrowing habits in 36 provincial, city and county governments between November 2012 to February 2013 --National Audit Office

Nine cities’ debt ratio exceeds 100%

Data from financial information portal laohucaijing.com shows that the top 10 heavily indebted provincial capital cities are Nanjing, Chengdu, Guangzhou, Hefei, Kunming, Changsha, Wuhan, Harbin, Xi'an and Lanzhou.

Cities in debt crisis

Reasons for amassed debt

◆Lack of tax income

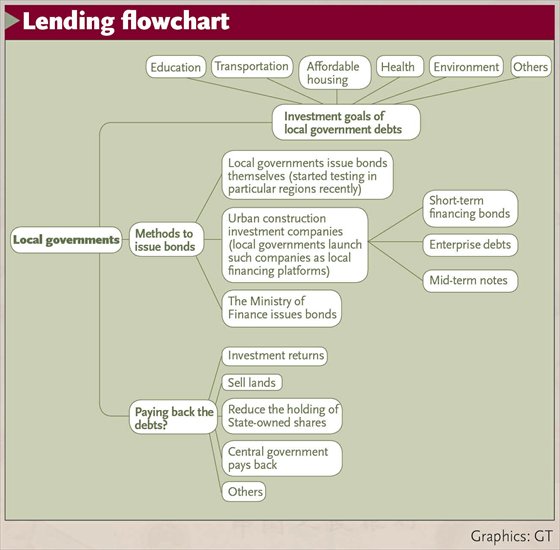

Local governments are hungry for construction projects, which require large sums of money. However, they can only take 25 percent of value-added tax, handing in 75 percent to the central government. Lack of tax income forces local governments to set up financing companies to seek funding.

◆Financing companies ‘operate inappropriately’

Local governments establish financing companies, seeking funds from commercial banks. In return, governments pay back the debt directly or offer up collateral such as land and bonds. But sometimes those companies “operate inappropriately,” the local authorities “violate policies or manipulate the collaterals,” and the banks “lack the credit management of the financing firms,” causing local debt to soar.

◆Insufficient planning

Local officials are obsessed with lifting GDP by investing in real estate and unnecessary infrastructure projects. However, they usually fail to make thorough plans to avoid defaulting before they borrow.

◆Political ambitions

Economic development is the key barometer to evaluate local officials’ political achievements, which leads many to aim at raising GDP even at the cost of leaving the government in a quagmire of debt.

Source: Global Times

Potential influences

Zuo Xiaolei, chief economist at China Galaxy Securities

One day local governments will run out of land to sell and home prices will keep surging. Then the consumers' money will continue flooding into the real estate market making the housing bubble even bigger.

Zhu Lixu, an analyst with Xiangcai Securities

Mounting debt may prevent local governments from investing more in improvements such as rail transport and other important public projects. And if the consumer price index (CPI) increases, the interest rate will be raised and local governments will face more pressure to pay the debt back.

Terry Gao, associate director of international public finance at Fitch Ratings

Our concern is that the increase of the debt is coming faster than economic development. If the problem continues, the lower level governments may suffer from a weak cash chain.

Source: Global Times

Possible solutions

▲New performance barometer

The performance of officials must not be linked with other economic barometers such as GDP growth, otherwise local governments will continue to ¬intervene in the economy as much as possible. The assessment of officials’ performances should be based on residents’ income, environmental protection and public security, rather than solely on economic growth.

--- Zhang Guangtong, vice dean of the School of Taxation with Beijing-based Central University of Finance and Economics

▲Adequate revenue allocation

One solution is to ensure that the local governments have adequate resources to deliver the necessary social and infrastructure spending by aligning ¬revenue responsibilities with expenditure mandates and adjusting revenue sharing arrangements.

--- IMF

▲Private capital participation

Allowing private capital to participate in the establishment of local government financing and diversification of shareholders will check and restrain borrowing decisions currently made by local governments.

--- Kang Tao, chief consultant of Nanjing Boda Investment & Management Consulting and consultant to government investment projects

▲To ensure China's fiscal soundness, a top priority is to strengthen the management, transparency, and overall governance framework of local government finances.

--- IMF

Source: Global Times

| Comments |

● From experts

|

|

Tang Min, a member of the Counselors’ Office of the State Council Financial reform is certainly important, but we should first reassess our bottom line and risk management. With China already facing widespread local debt amounting to more than 10 trillion yuan ($1.63 trillion), property bubbles and looming shadow banks, the government must be vigilant and prepared for any potential financial shock. | |

|

|

Zhou Li, a professor from the School of Economics and Management, Tsinghua University There is no need for local governments to worry as long as their capital and financial resources grow faster than their debt. However, the government should set up budgetary funds that address debt and leave local governments with an effective repayment plan. | |

|

|

Shang Fulin, president of the China Banking Regulatory Commission Local debt, real estate woes and overall slowdown are after-effects of China's economic transformation and systemic transition; all of which are controllable if the government conducts proper risk management. | |

|

Hong Hao, managing director and chief strategist at BOCOM International Solvency is more important than the level of debt when assessing the country's debt sustainability. China’s debt levels are high, but not at the point of shattering. Meanwhile, the private sector looks strong. The balance sheet of households has remained healthy, more so as household incomes are on the rise. In other words, the private business sector is unlikely to have any big problem repaying its debt. |

● From foreign media

|

|

The audit could indicate increased official concern over the systemic risk from rising debt levels in China, especially debt of local governments, as top leaders slow economic growth in order to promote reform. | |

|

|

An audit of the regions two years ago found that liabilities had mushroomed to $1.7 trillion (10.4 trillion yuan), but the full figure is already higher and rising fast as officials turn to the shadow banking system. Ma Xiaofang, a senior audit officer, said the chief worry is reliance on land sales to pay off half of all past debts. | |

|

|

Mr Kowalczyk said that the concerns about the bad loans in China were serious because “the size of the debt is large and unknown”. However, he added that the audit was a step in the right direction and would be good for the country in the long run as it should help bring out the details on the size of the problem. | |

|

|

China has made periodic efforts over the years to assess the scope of local government debt, and the statement by the National Audit Office on July 28 was too terse to tell how comprehensive the latest effort would be. Bankruptcy proceedings started this month by Detroit surprised and alarmed many in China, however, prompting renewed concern about the financial health of Chinese cities and towns. |

| Related reports |

Govt orders nationwide audit for local debt records

Chinese local govts unlikely to see Detroit-like bankruptcy: think-tank

Check on local govt debt is necessary

| News Vocab |

地方政府性债务 dìfāng zhèngfǔ xìng zhàiwù

“地方政府” n. local government(Source: 《新世纪汉英大词典》)

“性” suffix; used to form nouns and adjectives (Source: 《新世纪汉英大词典》)

“债务” n. debt(Source: 《新世纪汉英大词典》)

“地方政府性债务” n. local government debt

Web editor: duliya@globaltimes.com.cn

Posted in: Frontpage