Phone home

Wang Yun had hoped to find a good deal during Singles' Day online promotions on November 11 to upgrade to a new smartphone, but he wasn't able to find anything.

Since then, Wang, a software company employee in Beijing in his mid 20s, has been scouring the Internet for smartphone deals.

His current phone, a Samsung Galaxy S3, is hardly old-fashioned, but after using the phone for one and a half years, Wang feels it's time to move on to a new device.

"I bet few people nowadays, especially young guys, would wait for their phones to be completely broken before buying another one," Wang told the Global Times Thursday.

For Wang, online discounts increase the temptation to upgrade regularly, although the online marketplace has yet to become the main battlefield for smartphone sales.

Handsets sold online in the Chinese market are expected to account for 11 percent of the total this year, roughly the same as last year, according to sales monitoring data sent to the Global Times Thursday by market research firm GfK China.

But the overall smartphone market is still growing fast, and domestic brands are gradually gaining a larger slice of the pie.

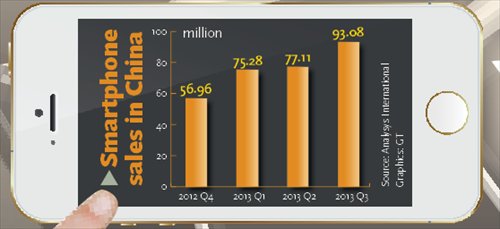

Fast growth

Smartphones used to be seen as luxury products but are now more everyday items, which has contributed to the fast growth in sales in the Chinese mainland market over the past year, Wang Jun, an industry analyst with Beijing-based market consultancy firm Analysys International, told the Global Times Thursday.

The lifespan for smartphones in the country's first-tier cities, where users are richer and more tech-savvy, is usually less than two years, Wang said.

Different research agencies have their own forecasts for the market's growth picture, but almost all of them point to a steep upward trajectory.

Driven by consumers' strong demand for buying the latest mobile phone models and tempting contracts provided by operators, China's shipments of smartphones are expected to reach 360 million for 2013, US-based research firm International Data Corporation (IDC) said in a research report released earlier this year.

This would represent a rise of nearly 70 percent from the shipment of 213 million units in 2012, according to IDC's statistics.

IHS iSuppli, another US research firm, forecast that shipments in China will reach 268 million units this year, up 44 percent from 2012.

Data from GfK pointed to even brisker growth, with their figures based on sales to end users, rather than shipments to retailers. Smartphone sales will hit 350 million for 2013, the firm said, a sharp rise of 84 percent compared to 2012.

Local brands popular

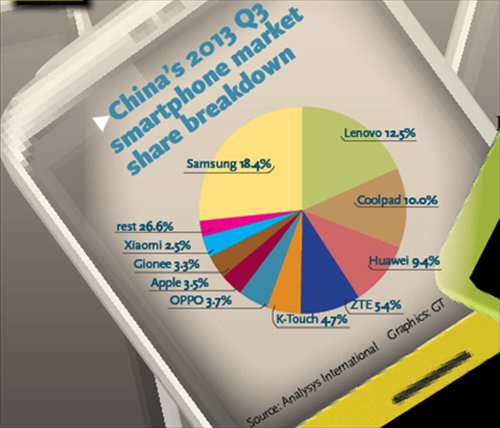

Domestic handset makers have become dominant in the country's smartphone sector in terms of market share this year.

In October, Chinese brands had a total share of 66 percent of the market in terms of sales, according to GfK's latest statistics.

Chinese handset makers used to dominate only the lower end of the market, but after having moved into the mid-range they are now also targeting the high-end segment, which has been dominated so far by foreign giants such as Apple and Samsung.

Chinese manufacturer ZTE unveiled an array of new devices in its higher-end Nubia lineup in late November. The priciest of the new devices sells for around 3,500 yuan ($577).

ZTE's rival Huawei, which is also based in Shenzhen in South China's Guangdong Province, has announced several mid- to high-end smartphones in its Ascend series over the past year, claiming that they have design and performance rivaling that of the global bestsellers.

Other local brands such as Lenovo and Coolpad have also made ambitious moves this year to gain a foothold in the high-end smartphone market.

In the price range of 2,000-3,000 yuan, Chinese brands have already caught up with their foreign rivals, Patrick Wu, an analyst at GfK China, told the Global Times on Thursday.

In October, Chinese vendors held a 42 percent share of the market for this price range, according to Wu.

"Consumers' fondness for local firms seems to be on the rise [this year], although the enthusiasm for domestic brands is still much lower when choosing upscale devices selling for above 3,000 yuan," Analysys International's Wang said.

In addition to their rising clout in the domestic market, local brands have also been reaching out to overseas markets.

Following overseas expansion moves by major Chinese manufacturers like Huawei, ZTE and Lenovo, relative newcomer Xiaomi also plans to expand into Southeast Asian markets according to media reports earlier this month, with Singapore being eyed as the first stop.

Xiaomi only started three years ago, but it has already risen to prominence in the Chinese smartphone market.

Chinese manufacturers are expected to achieve strong growth in their smartphone exports this year, with shipments set to rise to over 170 million units, according to a forecast by IHS iSuppli.

Foreign competition

But while the market may be growing, local brands are also facing some uncertainties, such as renewed competition from foreign rivals.

US tech giant Apple saw its share of the Chinese market fall earlier this year, but recent figures show this might be about to change.

A report released Wednesday by research agency Counterpoint said that Apple's share of the domestic smartphone market climbed rapidly to 12 percent in October, up from a 3 percent share in September, catapulting the firm into the No.3 position in terms of largest smartphone players in the market.

Apple is expected to announce a deal shortly with China Mobile, which would mean that its iconic iPhone model would be available from all three of the country's telecom carriers. This will "ignite a 'price war' boosting the overall iPhone sales in China," said the Counterpoint report, forecasting that Apple may even grab the No.1 spot in China in December or January 2014.

China Mobile's Beijing branch has already started pre-orders for a 4G-enabled smartphone on its website, which is widely expected to be the iPhone 5S and iPhone 5C.

Preorders for the gadgets had totaled nearly 55,000 by 6 pm on Sunday.