Cashing in

Graphics: GT

The tight liquidity in the country's interbank lending market was eased Tuesday after the central bank's fresh capital injection of 29 billion yuan ($4.78 billion) into the market via seven-day reverse repurchase agreements.

On Wednesday, the benchmark seven-day bond repurchase rate fell to 5.50 percent by close of trading, down from 6.35 percent on Tuesday.

The Shanghai interbank offered rate (Shibor) trended downward as well, with the one-week Shibor falling by 322.7 basis points during the two days to 5.616 percent on Wednesday.

The injection of funds Tuesday came shortly after the central bank's announcement on Friday that it had pumped more than 300 billion yuan into selected lenders through open market operations.

However, the moves to ease the liquidity situation had little impact on yields for wealth management products (WMPs), especially several high-profile fund products that are offered online.

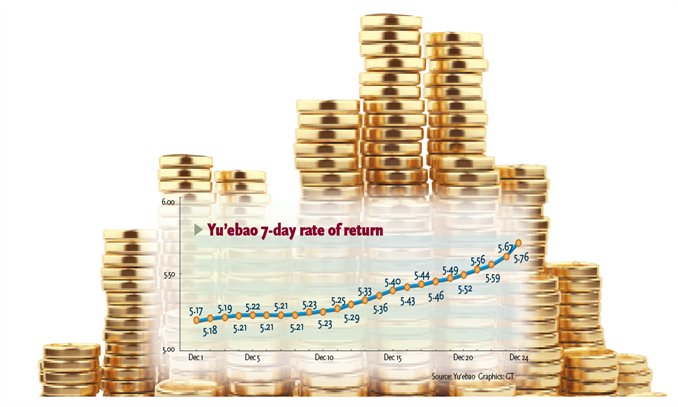

Yu'ebao, a high-profile WMP launched in June by third-party online payment platform Alipay in partnership with Tianhong Asset Management Co, continued its upward trend, with the average annual compound rate of its seven-day return rising to 5.757 percent on Tuesday.

The total investment in Yu'ebao had exceeded 100 billion yuan as of mid-November, Zhang Daosheng, a public relations manager at Alipay, told the Global Times Monday.

As for the estimated rate of yields for WMPs issued by banks, the country's major WMP providers, a slight moderation may be expected, as their demand for cash will fall after they meet the year-end regulatory requirements for reserves, Yin Yanmin, an analyst who specializes in wealth management products at industry website bankrate.com.cn, told the Global Times Tuesday.

"But it won't be a big retreat, and the average yield rates are likely to continue at a high level before the Spring Festival [which falls on January 31, 2014,]" Yin forecast.

WMP boom

Market watchers attribute the recent rise in WMP yield rates mainly to the tight liquidity in the interbank lending market, which increased banks' thirst for cash. But they also noted that it has helped to boost the cachet of WMPs among a growing number of depositors who are shifting away from banks toward higher-return investments.

As of Monday, the country's 148 commercial banks had issued 42,350 WMPs, according to Yin at bankrate.com.cn. This compares to 37,943 by the end of November.

The value of WMPs issued by banks is predicted to exceed 10 trillion yuan by the end of 2013, a considerable jump from 7.1 trillion yuan at the end of 2012, according to data from bankrate.com.cn.

Smaller banks in particular have been active in launching WMPs, partly because the wealth products can help them compete with bigger banks that have a larger network of branches and higher credit ratings, Jin Lin, a Shanghai-based senior banking analyst with Orient Securities, told the Global Times Monday.

The relatively low return offered by bank deposit rates has become a growing issue for the country's massive number of depositors.

According to data from the central bank, China's household deposits shrank by 896.7 billion yuan during October, the largest monthly decline this year.

"The WMP boom is expected to continue as long as market-based interest rate reform has not been completed," Orient Securities' Jin noted.

In a recent move to push toward the eventual goal of deposit rate liberalization, the central bank announced a new guideline for deposit certificates in the interbank market that took effect on December 9. However, a fully market-based deposit rate regime remains some way off.

When full liberalization of deposit rates is achieved, WMPs will lose their appeal for investors as a wholly market-based interest rate regime will replace the functions of WMPs, Jin said.

Internet challenge

In a year full of headlines about WMPs, one particularly noteworthy trend has been the rapidly rising popularity of Internet-based WMPs.

"2013 has marked the beginning of Internet finance [in the country]," said Yin of bankrate.com.cn, citing the success of Yu'ebao, which she believes has prompted other Internet giants to join the market.

Search engine giant Baidu Inc made inroads into the online WMP arena with the release of its Baifa product in late October, making it the closest rival to Yu'ebao.

In less than four hours after its debut, Baifa had drawn investment of 1 billion yuan, partly because it claimed to offer an annual yield of up to 8 percent. But Baifa's promotion of an 8 percent yield drew the attention of the authorities.

Shortly after the launch of Baifa, the China Securities Regulatory Commission said it would check the legitimacy of Baifa, and whether it violates rules banning unconditional guarantees of WMP return rates.

According to a rule released by the China Banking Regulatory Commission that took effect from January 1, 2012, commercial banks were banned from unconditionally promising a rate of return from WMPs that is higher than the deposit rate.

Qi Liumei from Central China's Hunan Province missed the opportunity to join the first wave of investors in Baifa, but she invested 12,000 yuan in it on Monday.

"The money was supposed to be added to my saving account," Qi told the Global Times Tuesday. "But I heard many friends of mine had made profits from investing in Baifa. Why should I still opt for the old-fashioned bank deposits?"

Qi, who is in her mid-20s, said she would continue buying into similar products if the investment proves safe, and if it offers yields of around 8 percent, the maximum return promoted by Baifa.

"The market for Internet-based WMPs with extremely low thresholds and easy operation has considerable growth potential," said Yin.

Meanwhile, banks have been actively developing similar WMPs based on online platforms in response to the challenge posed by Internet firms, she noted. Yin also downplayed the impact of the likes of Yu'ebao and Baifa on WMPs launched by banks.

In order to lure investor interest at an early stage, Internet firms are now offering subsidies in addition to high WMP yields, Yin noted, adding that this cannot be a long-term phenomenon.

Despite market skepticism over just how sustainable the appeal of such Internet-based WMPs will be, Internet firms appear to be eager to expand their activities in the field.

"We will release new products in partnership with other fund companies in the future," Alipay's Zhang told the Global Times, without offering further details.