HOME >> BUSINESS

BoCom sees 2014 growth at 7.8%

By Li Qiaoyi Source:Global Times Published: 2014-1-8 23:48:01

Local residents purchase food for the upcoming Spring Festival holidays in Qingdao, East China's Shandong Province on Tuesday. Photo: CFP

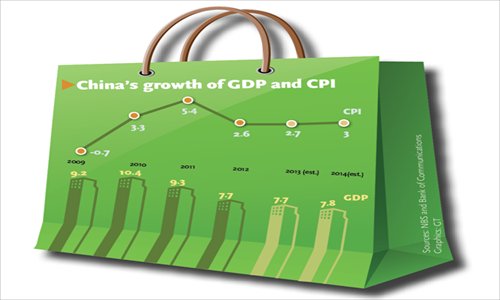

China's economy is expected to grow by around 7.8 percent in 2014, as both domestic and external demand will be sufficiently stable to maintain the overall economic growth momentum, Bank of Communications (BoCom) said Wednesday in its annual forecast for the country's economy.

But the economy still faces downward pressure, including challenges arising from the central government's pledge to de-leverage and rebalance the economy for longer-term sustainability, which might put short-term growth at risk, Lian Ping, chief economist with Shanghai-based BoCom, told reporters in Beijing Wednesday, while releasing the outlook report.

"It is wise for the central government to push forward with economic restructuring, but growth in fixed-assets investment will certainly slow as a result," Zhang Lei, a Beijing-based macroeconomic analyst with Minsheng Securities, told the Global Times Wednesday.

The primary driving force for the economy should be domestic demand, but it will take time for this to become the most important growth engine, Zhang noted.

He predicted that China's GDP growth rate will be around 7.5 percent this year.

However, some economists noted there are risks that might weigh down on economic growth.

Growth will slow in the first half of 2014, falling to just 7.1 percent in the second quarter before rebounding to 7.5 percent in the last quarter due to policy easing, Zhang Zhiwei, chief China economist at Nomura in Hong Kong, forecast in a research note sent to the Global Times Wednesday.

Zhang cited an oversupply of property in smaller cities and potential local government debt defaults as negative factors facing the economy.

There is even a risk that growth could fall below 7 percent in 2014, if the central government decides to implement harsh de-leveraging measures to rein in the country's shadow financing activities, Yao Wei, China economist at Societe Generale in Hong Kong, said in a note sent to the Global Times Wednesday.

Reuters reported Monday that the State Council has drawn up a set of guidelines aimed at reining in risky off-balance-sheet lending, calling for tougher measures to harness the rampant growth of such lending.

If such measures are implemented, credit growth will inevitably fall, putting a drag on overall economic growth, Yao noted.

But Zhang at Minsheng Securities said a sharp slide in GDP growth is unlikely, as the country still needs a certain growth rate to ensure sufficient employment levels.

As for this year's inflation outlook, BoCom said the headline consumer price index in 2014 will be slightly higher than 2013, moving up to 3 percent from the 2.7 percent estimated for 2013.

The bank also estimated that China's economy had grown by 7.7 percent in 2013, above the official target of 7.5 percent set in March.

The National Bureau of Statistics (NBS) announced Wednesday its final revision of the nation's GDP for 2012, noting a rise of 52.8 billion yuan ($8.72 billion) from the preliminary revised figure released in September.

But the overall GDP growth figure for the year was unchanged at 7.7 percent.

The NBS is scheduled to release major economic indicators for December on Thursday, and data for China's economic growth in 2013 is due to be released on January 20.

Posted in: Economy