HOME >> BUSINESS

Home prices in major cities still rising

By Li Qiaoyi Source:Global Times Published: 2014-1-19 23:43:01

Residential houses under construction in Lianyungang, East China's Jiangsu Province Photo: IC

Home prices in 70 major cities continued their upward spiral in December, official data showed over the weekend, but a moderation in the growth pace reinforced expectations of a possible cooling in the property sector.

Except for Wenzhou, an entrepreneurial hub in East China's Zhejiang Province, all of the 70 tracked cities saw a year-on-year rise in prices of new residential properties in December, excluding affordable housing, according to figures released Saturday by the National Bureau of Statistics (NBS).

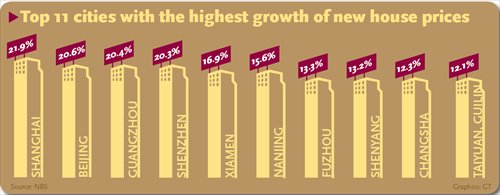

New home prices in Shanghai gained the most during the month, jumping by 21.9 percent from a year earlier, while Wenzhou saw a year-on-year fall of 2.8 percent.

Shanghai and Wenzhou were at the two opposite ends of the spectrum in November as well, but Wenzhou posted a less steep decline in the month of 1.2 percent.

The December figures showed that a raft of tightening measures taken recently by first-tier and some second-tier cities have been working to stabilize market expectations, Liu Jianwei, a senior statistician with the NBS, said in a statement posted on the bureau's website on Saturday.

There was further evidence of a slowdown in home price rises in the bureau's month-on-month statistics.

From November to December, 65 out of the 70 cities saw a rise in new home prices, with the monthly fluctuations for all the 70 cities ranging from a drop of 1.7 percent to a 1.1 percent increase, the NBS data showed.

This compares to the previous month's figures of price rises in 66 out of the 70 cities, and fluctuations ranging from a 0.5 percent fall to a 1.3 percent rise.

Reuters said in a report Saturday that calculations based on the NBS figures showed average new home prices in the 70 cities climbed by 0.4 percent in December from November, the fourth slowdown in a row since August.

Attributing the slower pace of gains in the property sector partly to the country's continued tight monetary policy, which has weighed down on mortgage lending, Yang Hongxu, vice president of the Shanghai-based E-house China R&D Institute, also noted that demand has been cooling.

Gains in new home prices in the country will slow down in 2014, Yang told the Global Times Sunday, forecasting an annual gain of roughly 5 percent this year, down from his estimate of around 7 percent for 2013.

However, the signs of moderation do not necessarily indicate that the nation's property sector is under control.

"It is too early to draw any conclusions," Zhang Dawei, research director at the Beijing office of Centaline China Real Estate, told the Global Times Sunday.

New home prices continued rising generally, Zhang said, noting that the year-end period is traditionally an off-season for the nation's property sector.

The real power of government curbs on the real estate market has yet to be seen, Zhang said.

In a new move to regulate the country's property market, the Ministry of Land and Resources, the country's top land regulator, said at an annual work conference on January 11 that a new bureau will be set up this year as part of the ministry's efforts to establish a nationwide property registry database, which is widely seen as laying the ground for an expansion of property taxes that are currently in place only in Shanghai and Chongqing.

Posted in: Industries