Alibaba announces plans for US IPO

A trader works on the floor of the New York Stock Exchange (NYSE) in New York, US, on March 4, 2014. Photo: CFP

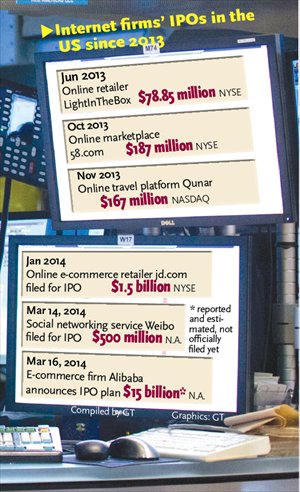

Internet firm's IPOs in the US since 2013

China's e-commerce company Alibaba Group Holding Ltd announced Sunday plans for a US IPO, as Chinese companies flock to the US stock market to take advantage of soaring valuations.

An IPO in the US is expected to enhance Alibaba's "transparency" and allow the company to "pursue long-term vision and deals," read a statement e-mailed to the Global Times Sunday. But a spokesperson with Alibaba refused to indicate which bourse the IPO would be launched or the amount of money that they would aim to receive from the flotation.

Unnamed sources were quoted by Reuters Saturday as saying that the deal is expected to be worth more than $15 billion, making it one of the global Internet industry's largest IPOs since Facebook Inc's $16 billion in 2012.

Alibaba, owner of the country's leading business to consumer e-commerce platform tmall.com by sales volumes, becomes the latest major Chinese Internet company to tap US markets, just after its rival JD filed for a US IPO to raise $1.5 billion in late January. On Friday, Twitter-like social networking service Sina Weibo also filed for an IPO in the US market.

China will see more Internet enterprises issue stock offerings on the US market in 2014, as they, including Alibaba, need large amounts of financial support to help further expand operation and the US market usually gives a higher valuation than the stock market in China, said Liu Boyu, an IPO analyst with Beijing-based ChinaVenture Investment Consulting Group.

In addition, the threshold of an IPO in the US is lower for some aspects such as the revenue amount, Liu told the Global Times Sunday.

Analysts expect Alibaba's average valuation to reach $153 billion in a report by Bloomberg on February 5.

Zhang Yi, CEO of Shenzhen-based market research firm iiMedia Research, noted that the company needs to get listed as soon as possible otherwise it may suffer lower valuation, given that the company faces increasingly strong challenges from Tencent, operator of the country's popular instant messaging mobile app WeChat.

The two companies have engaged in a tight competition for the top position in mobile Internet. While Alibaba acquired an 18 percent stake in China's Twitter-like Sina Weibo last April to complement its shortcomings in social networking, Tencent announced it would buy a 15 percent stake in JD in early March this year to strengthen its capacity in e-commerce operation.

Liu also has an optimistic attitude toward the prospect of Alibaba's US IPO due to Alibaba's active deployment in mobile Internet as well as Internet financing products.

Besides, US investors have started regaining an appetite for Chinese dotcoms since last year after a series of auditing scandals and short-selling in 2011 damaged the reputation of Chinese firms, Zhang told the Global Times on Sunday.

For instance, Qunar doubled the initial value in its US debut in November 2013. It raised $167 million at $15 each, higher than the expected range of $12 to $14 for the IPO in the NASDAQ.

Analysts believes that the IPOs of online marketplace 58.com Inc and travel-booking site Qunar in the second half of 2013 opened the door for another round of US stock offerings by Chinese Internet companies.

According to media reports, in 2013 China's IPOs raised nearly $1 billion on the Wall Street, five times higher than the figure in 2012 but still lower than 2010's over $4 billion.

Sina Weibo files for $500 million listing

Twitter-like messaging service Weibo Corp filed Friday to raise $500 million from a US IPO.

Weibo, owned by Sina Corp, becomes one of the latest Chinese Internet giants to tap US markets, following on the heels of search service Baidu and its own corporate parent. Alibaba, which owns a stake in Weibo, is also expected to raise about $15 billion in the US this year.

But underscoring challenges facing Internet firms operating in a controlled media environment, Weibo warned investors in its IPO filing about uncertainty arising from Chinese government regulation.

Still, US investors have long shown an appetite for Chinese companies' stock, hoping to share in some of the spoils of the world's fastest-growing major economy.

US markets may see more IPOs from Chinese corporations in 2014 than in any year since 2010. That's despite long-simmering concerns among investors about Chinese accounting standards, the result of several high-profile auditing scandals in past years.

Weibo, one of several Chinese Twitter-like services, increased ad revenue by 163 percent to $56 million in the final three months of 2013. Overall revenues leapt almost three-fold to $188.3 million in 2013, from $65.9 million in 2012. And its net loss shrank to $38.1 million in 2013 from $102.5 million the previous year.

But its user growth is at risk of tailing off after three years of explosive expansion, as newer messaging apps such as Tencent Holdings Ltd's WeChat draw users away.

In January, an official government-backed Internet organization reported that user numbers for Chinese microblogs, including Sina Weibo, had fallen 9 percent in 2013.

However, Weibo said the number of its daily users had risen 36 percent to 61.4 million as of the end of December, from the same time a year before.

Weibo hired Goldman Sachs and Credit Suisse to manage its US debut, which it said would boost brand recognition and help retain talent.

Its proposed $500 million target is an estimate worked out solely for the purposes of calculating registration fees.

Reuters - Global Times