HOME >> BUSINESS

Corporations must break dangerous debt habits

By Yang Zhirong Source:Global Times Published: 2014-6-22 17:18:01

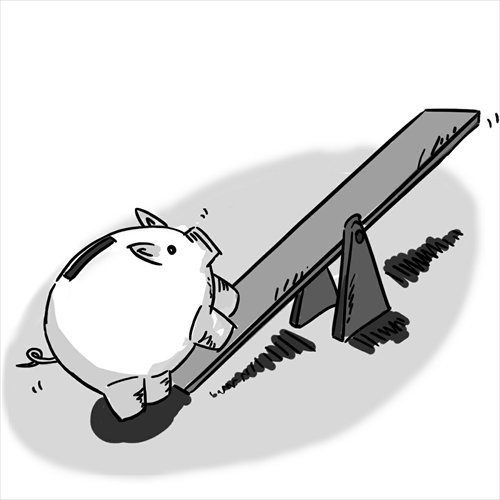

Illustration: Chen Xia/GT

Although China still lags well behind the developed West in terms of its government debt-to-GDP ratio, the country's nonfinancial corporate entities lead the world in terms of leverage. Economic planners and market regulators must discourage this relentless quest for debt and carve out more diverse funding channels for businesses.

According to data from the Chinese Academy of Social Sciences (CASS), Chinese nonfinancial corporations owed 58.67 trillion yuan ($9.41 trillion) to their creditors by the end of 2012, representing 113 percent of GDP that year. Later, the People's Bank of China revealed that the nonfinancial corporate sector's leverage ratio had climbed to an average of 109.6 percent by the end of 2013, well ahead of the 49 percent and 72 percent rates recorded in Germany and the US respectively. And just last week, ratings agency Standard & Poor's announced that debt accumulation within China's nonfinancial corporations had hit $14.2 trillion by the end of last year, more than any other country in the world. By 2018, this obligation is expected to exceed $20 trillion, accounting for a third of world funding demand at that time.

Since the collapse of the Bretton Woods system, high leverage growth models have become the norm in many parts of the world. But as corporations dig themselves deeper into debt to pay for growth, they are discouraged from spearheading the sorts of long-term economic transformations and industrial upgrades China desperately needs.

Li Yang, vice president of the CASS, warned recently that the mini stimulus measures which many local governments are now hoping to fund with social capital are not attractive enough for corporate investors due to concerns about commercial sustainability.

The homogeneity of China's capital structure is looking increasingly worrisome owing to a lack of long-term equity. Chinese planners should encourage innovations that make it easier for companies to satiate their funding demands with equity instead of debt. Moreover, commercial banks should be encouraged to seek a greater share of their profits through investments in promising businesses, thereby paring down their own reliance on lending.

Anbound pointed out in 2012 that the biggest risk to China's economy over the coming decade would be its debt-laden growth model. Actually, the consultancy went one step further to say that this dangerous propensity to borrow should be abandoned immediately. If the country did not change its profligate ways, it could find itself in a debt bubble similar to the one that clobbered Japan back in the 1990s.

A full fledged campaign to make equity fundraising a viable alternative to debt is desperately needed to defuse alarmingly high leverage ratios within China's corporate groups.

Firstly, Chinese authorities should accelerate steps to develop a diverse multi-layer capital market. China's A-share markets and its share transfer system for small- and medium-sized companies need to be freed up from administrative controls and become fully market-oriented. In a similar vein, bond markets need to be revamped to effectively track and control the risks of various debt instruments.

Secondly, Chinese groups should explore their options with debt restructuring. China has entered a new stage of its economic development, one that will be marked by a slower growth pace and a reconstituted industrial structure. With the effects of previous stimulus packages now more or less digested, creditors should at least be open to reconsidering earlier repayment terms in the light of current economic conditions. Such compromises might, for instance, make it easier to monitor corporate banking accounts to safeguard the interests of creditors and debtors.

Finally, commercial banks should actively build equity investment mechanisms of their own. Such tools are sorely needed in China, where indirect financing methods are still decidedly the mainstream. With China's yuan-denominated loan balance hitting 76 trillion yuan at the end of May, this suggests that commercial banks can play critical roles in the debt-to-equity transition.

China's tenuous path toward excessive leverage must be reversed and greater access to equity financing represents a viable long-term solution to this pressing problem. But given current market factors and constraints, leverage rates will not ease to reasonable levels unless the government champions the development of the capital market, promotes debt restructuring and encourages banks to play a part in fundraising reforms.

The author is a research fellow with Beijing-based private strategic think tank Anbound. bizopinion@globaltimes.com.cn

Newspaper headline: Greater access to equity funding can unwind risks of over-leveraging

Posted in: Comments