China’s UnionPay set to benefit from West’s sanctions on Russia

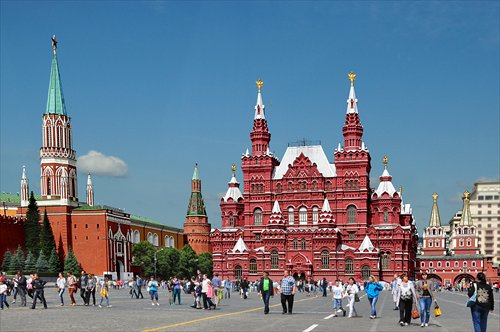

Red Square in Moscow, Russia on June 13 Photo: CFP

Photo: CFP

An ancient saying states that when two dogs fight for a bone, a third will run away with it. As such, the escalating conflict between Russia and Western countries is expected to result in closer economic ties between Russia and other countries, especially China.

There are opportunities in a wide range of sectors, such as energy, telecommunication and aviation. But growing trade volume relies on a well-developed payment system. Therefore, as traditional credit card giants Visa and MasterCard may lose ground amid the conflicts, China's UnionPay payment system is expected to gain ground.

The US and EU have imposed several rounds of sanctions on Russia so far over Russia's stance on the Ukraine crisis. But it seems that Russia is not likely to budge - on Wednesday it announced economic retaliation measures against Western nations, such as a ban on the import of agricultural goods from Western countries, which may also present an opportunity for Chinese companies.

As a result of earlier US sanctions, Visa and MasterCard blocked cards issued by Russia's SMP Bank and InvestCapitalBank in April.

This is not the first time that the two US payment systems had stopped offering services for Russian banks this year. Visa and MasterCard halted services for SMP Bank, InvestCapitalBank and several other Russian banks on March 21, but services for SMP Bank and InvestCapitalBank were resumed several days later.

The halt caused great inconvenience to Russia as it still does not have its own nationwide payment system.

A group of Russian tycoons who are close to Russian President Vladimir Putin were also sanctioned and have been banned from using Visa and MasterCard services. Gennady Timchenko, a Russian billionaire and an ally of Putin, switched to UnionPay after he was sanctioned by the US, Reuters reported on Tuesday.

Other major payment companies are now ready to take market share away from Visa and MasterCard in Russia. China UnionPay and Japanese payment system JCB are now in talks with leading Russian banks, media reported on Wednesday.

Seize the opportunity

China UnionPay has stepped up efforts to further tap into the Russian market recently. UnionPay International, a UnionPay unit focusing on international business, signed agreements in June with Russia's MTS Bank and a local travel association to facilitate the issuance of UnionPay cards in the country and further promote the brand.

On July 1, UnionPay International signed an agreement with Russia's Orient Express Bank to issue the first UnionPay premium credit card in the country.

The move aims to further move into the high-end credit card market in Russia. Orient Express Bank is one of the leading banks in the Russian Far East region, with its credit card market share ranking in the top 10, according to information on UnionPay International's website.

The company is expected to issue 2 million UnionPay cards in Russia in the next three years, media reported on July 23, citing the company's Russia representative Fan Jiguang.

Chinese businessmen and travelers abroad have been the major driving force for UnionPay internationalization before. But "to issue cards in a foreign country means an increasing number of foreigners are now using cards under the UnionPay system," Luo Yuding, a professor at Shanghai University of Finance and Economics, told the Global Times Wednesday.

"It is quite convenient to withdraw money with UnionPay cards in Russia, but in major shopping malls, UnionPay cards are still not widely accepted," Yu Xiaoguang, a 28-year-old Chinese who has been working in Moscow for over two years, told the Global Times on Wednesday.

UnionPay cards are now accepted by over 100,000 POS terminals and more than 30,000 ATMs in Russia and a total of 45,000 UnionPay cards have been issued in Russia, according to information on the company's website.

However, Visa and MasterCard together make up around 80 percent of the country's total payment cards, local news portal RIA Novosti reported on June 23.

'Technology support'

After Visa and MasterCard stopped processing some Russian transactions in response to US sanctions, Putin announced in March that Russia should build its own national payment system in a bid to limit its exposure to political risks in the financial system.

On July 29, the Russian central bank announced it would create a national payment card system, without using existing structures. The new system is expected to start in 2015 and the first cards will be issued in a year and a half.

"This also presents an opportunity for UnionPay, as it could seek to provide technology support to Russia," said Luo from Shanghai University of Finance and Economics.

As the US and EU have imposed sanctions on Russia, some companies in the country have been moving cash holdings to Asian banks, recent media reports said.

Megafon, Russia's second-largest mobile phone operator, said on July 31 that it had converted its foreign currency deposits into rubles and Hong Kong dollars to protect the firm against any further sanctions, Reuters reported.

"UnionPay's international development should be accompanied by the overseas expansion of Chinese banks," said Xu Hongcai, director of the Department of Information under the China Center for International Economic Exchanges.

Xu also said that such changes in Russia could also speed up internationalization of the yuan, the Chinese currency.

Despite the opportunities, Luo noted that UnionPay should pay attention to potential risks.

"Both Russian laws and laws from the US and the EU should be followed when it makes asset transfers denominated in US dollars or euros," he said.

Overseas aspiration

Founded in 2002, China UnionPay has grown into a sizable payment system that has established a presence in over 140 countries and regions around the world and has issued UnionPay cards in over 30 countries and regions, according to information posted on its website.

In 2012, UnionPay International was founded to facilitate the company's overseas business.

Data from China UnionPay in June showed that total global transactions made via UnionPay in 2013 topped 32.3 trillion yuan ($5.25 trillion), ranking second among all payment systems. Visa still led the market with transactions worth 41.7 trillion yuan in 2013, while MasterCard ranks third with 25.1 trillion yuan in transactions.

But UnionPay's business still mainly relies on the China market. In overseas markets, Visa and MasterCard still account for a much bigger share.

"It will take time for UnionPay to catch up, but it has great potential," Luo said.

Newspaper headline: Growing closer in crisis