US expat tax law proves unfair intrusion

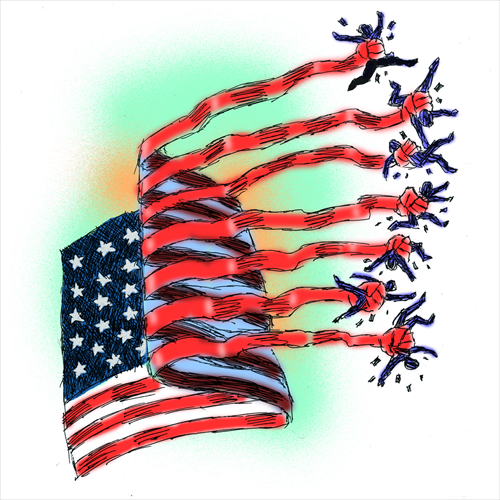

Illustration: Peter C.Espina/GT

The US is the only industrialized nation that taxes its expatriates for income that is earned outside of its own borders. Although the US argues that this is a tool to prevent wealthy Americans from disguising their assets by hiding them in foreign tax havens, it has harmed a wide range of US expatriates, many of whom are now choosing to renounce their US citizenship in order to avoid ruinous penalties imposed by the Internal Revenue Service (IRS).

Two issues have led to a rise in this number. The first is that the current US tax system forces individuals who are already paying taxes in their nation of residence to also pay US taxes for services they will never take advantage of. For middle-class expatriates, such "double taxation" may very well be impossible to endure.

This is especially onerous for individuals who are "accidental citizens" such as children born in the US who have nonetheless spent most or all of their lives outside the US. Yet according to the IRS, they have the same reporting and taxation requirements as any other US citizen.

However, what has brought this situation to a head for many US expatriates is the Foreign Account Tax Compliance Act (FATCA), described by The Economist as legislation that involves a degree of "extraterritoriality stunning even by Washington's standards."

FATCA demands that foreign banks comply with its record-keeping provisions or face a ruinous 30 percent withholding tax. These provisions demand that foreign financial institutions report all assets and income from US citizens, even if those citizens hold dual citizenship and permanently reside in another nation.

The consequences have been nothing short of devastating for many US expatriates. In addition to facing onerous taxes, many banks have decided to cease providing services to US expatriates rather than risk the penalties that FATCA can impose on non-compliant financial institutions. This can leave a long-term resident isolated from his or her home's financial institutions, destroying the expatriate's ability to take out loans, run small businesses or build up a retirement account.

It can even harm familial relationships as the expatriate's spouse and family may find themselves caught up in the law of a nation that they are neither citizens nor residents of.

While many nations have agreed to cooperate with the US in carrying out FATCA, these agreements are reluctant and mainly spurred by US threats of economic retaliation against domestic banks. The hostility this has given rise to should not be underestimated.

Most disturbingly, FATCA is unlikely to be effective against the tax-dodgers it was supposedly targeted against. Wealthy individuals and corporations have a vast array of tools that they can use to protect their income from taxation. The individuals harmed by FATCA are most commonly middle-class expatriates, far from the hysterical images of magnates sipping wine on some Caribbean tax haven promoted by the US media.

Expatriates provide a vital service to their home nation, one that cannot be easily translated into a monetary value. An expatriate is an unofficial ambassador from the US to those he or she encounters. Equally, an expatriate who has been forced to renounce his or her citizenship due to the actions of a rapacious government will still be an ambassador, but one presenting a far different message to his or her neighbors.

By harming expatriates' ability to establish small businesses or to put down roots in a foreign nation, FATCA harms both individual Americans and the larger interests of the US. In fact, FATCA is likely to cost the US more than it will ever gain, in both implementation costs and the permanent loss of the good will and assistance of the US expatriate community.

Citizenship-based taxation is an unjust and counterproductive policy. One merely has to ask what the US government's reaction would be if the UK or China demanded such unlimited access to US banking institutions in order to try to tax their citizens living in the US to understand just how obnoxious this policy is. Expatriates should only be liable for any income they have generated in the US, rather than income or assets in their current nation of residence.

In part, US anger at perceived British tax abuses sparked the Revolutionary War. It is ironic that similar anger at the unjust nature of FATCA is driving expatriate Americans away from the US.

The author is a freelance writer based in Corona, California. charlesgray109@gmail.com