New rules set to boost commodities trading

Shanghai FTZ regulations also aim to close loopholes

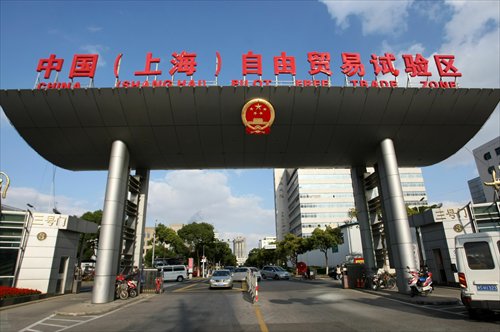

Cars drive through an entrance at the China (Shanghai) Pilot Free Trade Zone in the Waigaoqiao area of Pudong, Shanghai. Photo: IC

The Shanghai government on Thursday released a set of regulations to guide the spot trading of commodities in the China (Shanghai) Pilot Free Trade Zone (FTZ), in a move to facilitate the establishment of international commodities trading platforms in the zone.

The regulations, which were posted on the municipality's official website, set the requirements for entities hoping to initiate a spot trading platform in the FTZ. They also spell out technical details for spot transactions in order to close possible loopholes.

The regulations stipulate that entities who want to start a commodity spot trading platform in the FTZ should have industry experience and at the same time have no record of illegal activities in the past three years.

Shanghai plans to set up eight international platforms to trade oil, gas, iron ore, cotton, liquid chemicals, silver, bulk commodities and nonferrous metals in the FTZ by 2015, the local government said in August.

Experts noted that the regulations released Thursday are designed to speed up the process of building the city into an international trading hub.

The Thursday regulations said that commodity market operators should employ third-party institutions for custody and settlement of funds as well as for commodity warehousing, in order to reduce risks in commodities trading.

The requirement for third-party institutions "is to make sure buyers who have paid can get their goods delivered and also to avoid irregularities such as faking warehousing certificates," an industry insider close to the matter who declined to be named told the Global Times on Thursday.

Fund settlement and warehousing are badly managed in some ports in China, leaving loopholes that people sometimes use to gain illegal benefits.

In June, Shandong-based private metals trading firm Dezheng Resources Group was exposed by the media for faking duplicate warehouse certificates for one metal cargo in order to get multiple bank loans.

The scam happened in Qingdao Port in East China's Shandong Province, the world's seventh-largest port in terms of throughput capacity. The case, which is still under investigation, involves a number of major banks, including Standard Bank, Standard Chartered Bank and Industrial and Commercial Bank of China.

Potential losses from the alleged fraud are estimated at more than $1.2 billion, Reuters said on November 21.

"The new regulations in Shanghai can help to avoid such fraud, as it will be much more difficult to fool the new system," Lu Hongjun, president of the Shanghai Institute of International Finance, told the Global Times on Thursday.

The FTZ benefits from preferential polices that could give it an upper hand in building commodities trade platforms. One perk is that it allows transactions of bonded commodities.

China is currently the world's largest importer of crude oil and iron ore. Establishment of influential international spot trading platforms in Shanghai could gain Chinese firms a bigger say in pricing, experts said.

The source told the Global Times that trading of nonferrous metals, such as copper, is expected to see fast development in the FTZ, as Shanghai is already a leading port for trading of the metal.

Also, Shanghai is home to China's largest listed steel maker, Baosteel, offering a further advantage for iron ore spot trading in the area.

"But in the long run, the municipality's commodities trading depends on the convenience and safety of the trading platforms, as there are still competitors, such as the iron ore trading platform in Beijing," Wang Guoqing, a senior analyst at industry information provider Beijing Lange Steel Information Research Center, told the Global Times on Thursday.