HOME >> BUSINESS

Govt support for rail sector makes sense

By Ivan Chung and Amanda Du Source:Global Times Published: 2015-6-22 22:28:02

Industry can support economy, but needs financing

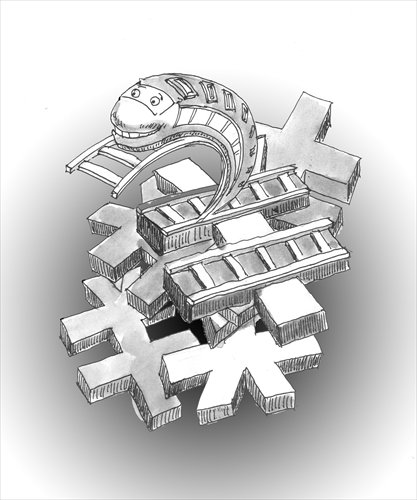

Illustrations: Luo Xuan/GT

The Chinese government has a strong incentive to support massive railway capital expenditure to stimulate slowing economic growth.

As for rail companies, given their large funding needs, they have an incentive to explore new funding channels - including offshore bond markets - to diversify their sources and reduce the costs of financing.

As China's economy rebalances, infrastructure spending - especially rail investment - is becoming increasingly important for growth, as property and manufacturing fixed-assets investment levels ease further.

Rail is also an integral part of China's "One Belt, One Road" initiative, which aims to link China to Europe through central and western Asia. Electric railway trains are of particular importance, as they use less energy to operate, helping to promote environmental sustainability.

Given the advantages of rail for the Chinese economy and the environment, the authorities are likely to play an active role in supporting rail-related companies in executing their expansion plans. China's rail spending totaled 808.8 billion yuan ($130.3 billion) in 2014, the highest level since 2011. Rail spending is likely to be sustained at a high rate of around 800 billion yuan per annum until 2020, covering the country's next Five-Year Plan period (2016-20).

However, the issue now is how the rail projects can be financed.

State-owned railway giant China Railway Corporation (CRC) and regional rail companies rely mainly on debt financing and government grants to fund capital expenditure, because the majority of national rail operations - particularly for passenger transport - are unprofitable and cannot generate the large cash flows needed to support rail investment plans.

Over the past two years, the country's leaders have promoted China's high-speed railway expertise during overseas trips. The central government also plans to accelerate its "One Belt, One Road" initiative and "going global strategy."

However, revenue from overseas operations remains small for Chinese rail-related companies. In addition, because China's overseas railway markets are mainly located in developing countries or economically underdeveloped regions - especially in Africa and Asia - rail-related companies could face operational, financial, legal, environmental, regional and geopolitical risks.

These risks may affect their ability to deliver projects on time. For example, China's railway construction companies have faced setbacks recently in their rail projects in Saudi Arabia and Mexico.

At present, the CRC, local rail companies and local governments are already highly leveraged. Support from the central government is therefore crucial in maintaining their creditworthiness.

A key reason why the CRC and some regional State-owned rail companies can access credit markets at low cost is investor perception that the CRC and the companies will continue to enjoy explicit and implicit government support. Such support is evidenced in the adequacy and predictability of government support through grants and subsidies.

The onshore market, for instance, considers the CRC's rail bonds as quasi-government bonds. Such a situation is reflected in the CRC's bond coupon rates, which are 30-170 basis points higher than comparable 10-year China government bonds.

On March 31, 2015, a total of 1.07 trillion yuan of rail bonds were outstanding, accounting for 3.9 percent of total non-government bonds or 8.9 percent of onshore corporate debentures.

Any weakening of government support for the rail companies will likely result in higher funding costs or barriers to credit markets.

Given the large funding needs in the railway sector, the central and local governments have a strong incentive to provide support to help rail issuers tap into bond markets at low cost, thereby alleviating financial pressure on local governments in particular.

As for the rail companies themselves, tapping into the offshore bond markets will diversify funding channels and lower funding costs.

The authors are Ivan Chung, a senior vice president at Moody's Investors Service, and Amanda Du, a vice president at the company. bizopinion@globaltimes.com.cn

Posted in: Expert assessment