UK can be ‘bridgehead’ to US, EU for China

Mutual opportunities available in finance, investment

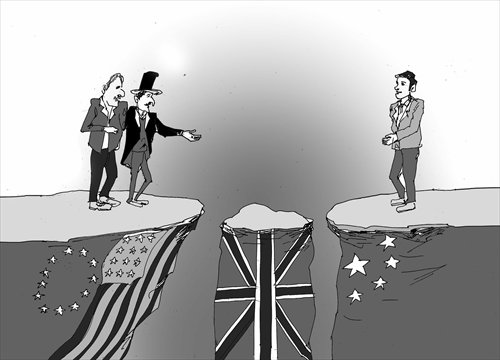

Illustration: Luo Xuan/GT

Following his visit to the US, Chinese President Xi Jinping will pay a state Visit to the UK. As the time lag between these two visits is just one month, we can not help thinking about the status of the UK among different forces in the world today. I believe the UK can be a pragmatic bridgehead to the US and EU for China, if China knows how to manage these complex relationships.

The UK is a specific case not only because of its position as an island to the northwest of the European Continent and its social patterns that have been cast over time, but also because of its previous historical position of dominance in the world, and its relationship of "mother country to former colony" with North America. It is the UK's specific relationship with the US and the EU that will make it possible for the country to provide a link with China.

The meeting between the UK and China is actually a rendezvous between the past "overlord" and the future leader in the world. Hence, the UK, China and the US will form a triangular relationship, and China can learn a lot from the UK about competing with the US.

Personally, I do not think that the British have forgotten how they lost their dominance to the Americans, and the British will probably make use of all possible opportunities for their historical "revenge." This may have prompted the UK's decision to go against US advice and join the China-initiated Asian Infrastructure Investment Bank (AIIB).

As for the EU, the UK has successfully maintained its independence. It is a member state of the EU, but the UK is not part of the eurozone, or the Schengen Agreement. In other words, the UK represents another vision inside the EU that is different from the so-called continental culture of Europe.

There are specific characteristics of the relationships between the UK and the US and EU. But the relationship between the UK and China can be more pragmatic.

The two countries can have more collaboration in the fields of trade, finance and investment, which are also areas in which the UK has competitive advantages.

The UK was the very first country to advocate "free trade" around the world. In my opinion, the situation in China today is similar to that in the UK after its industrialization. That is to say, the effect of overcapacity dominates industrial production in the "world's factory" - which was previously the UK, and is now China. We urgently need to explore more markets to release our excess production. Faced with more and more serious protectionism in North America and the EU, China will take over the UK's "free trade" mantra, backed by the UK itself, so as to tackle the thorny problem of overproduction.

Other than trade, the UK is also a good "supervisor" in finance, with London being the world's first global financial center. Even today, the UK ranks fifth globally in terms of GDP, so it is still strong in terms of finance. We have to admit that US is the leading financial country in the world and Wall Street is the top global center for finance. Nevertheless, China has already exceeded the US in some areas and is challenging in more and more fields, such as high-technology. Cooperation with the UK can help China become the world's leading financial country one day. For example, the internationalization of the yuan will proceed more quickly if we have support from the UK.

In return, China can also provide the UK with more investment, which is what the country urgently needs. The investment priorities will be in infrastructure such as high-speed rail, construction, real estate and other heavy investment projects. This will also help China to discover appropriate outlets for its overcapacity in terms of capital.

President Xi's state visit will be vital for both China and the UK. The two countries can help each other realize their respective positions in today's and tomorrow's complicated changing world.

The author is Zhao Yongsheng, a Paris-based economist and professor, and vice-president of the Paris-based China-France Association of Lawyers and Economists. bizopinion@globaltimes.com.cn

Read more in Special Coverage: