Challenges seen in attracting foreign capital

Nation drawing higher-quality investment: experts

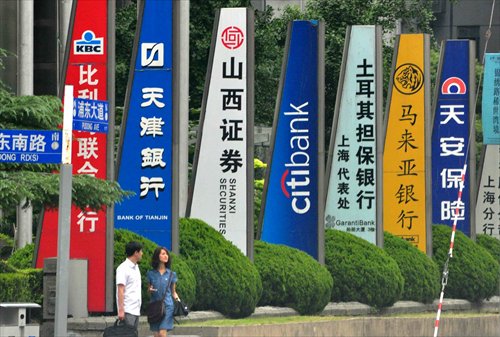

Branches of foreign and domestic financial institutions in Shanghai Photo: IC

The gloomy prospects for multinational direct investment in 2016 will inevitably affect China, an official familiar with the situation noted Thursday, citing information from the UN Conference on Trade and Development.

As the costs of factors of production such as labor have risen in China, the country's traditional advantages in attracting foreign capital have gradually declined, Shen Danyang, spokesperson for the Ministry of Commerce (MOFCOM), told a briefing in Beijing.

"Developed countries have made efforts to carry out 're-industrialization strategies' and some developing countries have tried to increase preferential measures to attract foreign capital. All of these situations pose new challenges for advancing the level of China's use of foreign capital," Shen said.

Apart from the rising costs of domestic production factors, the reordering of the global value chain is also affecting China's ability to attract foreign capital, as multinational companies have been seeking investment in countries where they feel they could make more profits, experts noted.

The sluggish global economy has also hampered the growth rate of investment from foreign companies, Sang Baichuan, director of the Institute of International Business at the Beijing-based University of International Business and Economics, told the Global Times on Thursday.

Structural change

Although it is facing new challenges, China will remain attractive for foreign investors thanks to existing factors and new moves to attract foreign capital, according to Shen.

Foreign direct investment (FDI) into China's non-financial sectors reached a record high of $135.6 billion in 2015, up 5.5 percent year-on-year and ranking first among developing countries worldwide for the 24th consecutive year, data from MOFCOM showed Thursday.

And in the first two months of 2016, the country's FDI increased 2.7 percent year-on-year to $22.52 billion, Shen said.

"The structure of foreign investment in China is undergoing changes and being optimized: More investment from advanced manufacturing industries and modern services sectors will flood into China in the future while cost-driven foreign capital will be transferred to countries and regions where the labor and production costs are lower, such as Vietnam and Mexico," Sang said.

Chen Fengying, a research fellow with the China Institutes of Contemporary International Relations, echoed Sang's view, saying that the quantity of foreign investment will not rise sharply in the future but the quality of foreign capital should be highlighted.

"What matters more is improving the country's ability to attract high-quality investment," Chen told the Global Times on Thursday.

However, foreign investors will find it hard to enter some sectors that are linked to national security, such as information and communications technology, Chen noted.

According to data from the UN, China continues to be viewed as the top country in the world in terms of investment prospects in 2016-17, Shen noted.

Moreover, the majority of foreign companies that have been interviewed by the American Chamber of Commerce, the EU Chamber of Commerce and the Japan-China Investment Promotion Organization have expressed optimism toward the Chinese market.

Further efforts

MOFCOM will step up efforts to create a more equal, transparent and predictable investment environment for foreign capital, Shen said, and access will be increased to services sectors such as finance, education and culture.

"As the financial sector is also included in the services industry, relevant security checks should be strengthened during the process of opening services sectors to foreign investors," noted Chen, the research fellow.

Also, "a unified negative list for investment management is expected to be released," she said.

The country will strengthen the protection of intellectual property rights and improve the complaint mechanism in order to secure the rights of foreign investors, according to MOFCOM.

"China's efforts to guarantee the legal rights of foreign investors show the country's commitment to complying with international economic and trade rules," Sang said.