HOME >> BUSINESS

Strong growth needed in nuclear, renewable sources in China: BP

By Chu Daye Source:Global Times Published: 2016-4-26 21:58:01

Policy shifts, price reforms offer long-term support for gas

A section of an oil platform of the BP Eastern Trough Area Project in the North Sea File photo: CFP

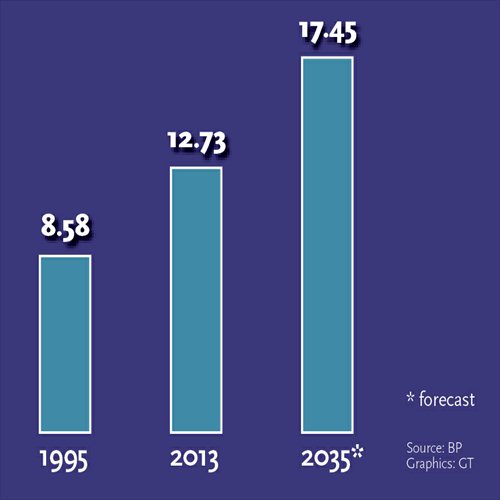

World energy demand (billion tons of oil equivalent)

To reduce the proportion of coal in China's fuel mix, extraordinarily strong growth will be needed in the nuclear energy, renewables and natural gas segments, Spencer Dale, British oil giant BP's group chief economist, said in Beijing on Tuesday.

Dale made the remark at a press event to introduce the 2016 edition of the BP Energy Outlook 2035, which sets out BP's view of the most likely developments in global energy markets based on its analysis.

Slowing economic growth and the pursuit of the quality of growth will cause China's energy consumption growth to slow. Growth in the nation's energy demand is expected to average 2 percent a year over the next 20 years, compared with around 8 percent over the past 15 years, according to the BP energy outlook.

By 2035, China, the world's largest energy consumer, will account for 26 percent of total global energy consumption.

Globally, natural gas will see the fastest growth among fossil fuels, in part due to its ample supply and in part helped by governments encouraging the shift from coal to cleaner energy sources. Growth in natural gas will come from conventional gas and shale gas, the outlook said.

BP's energy outlook forecasts that by 2035, shale gas will account for one-quarter of the total global gas output. It also said China will be the world's largest contributor to growth in shale gas production.

It is expected that half of China's increased demand for natural gas will be met by an increase in domestic supply, which will be unconventional gas, predominantly shale gas, according to Dale.

China has set a target of increasing the share of natural gas in its energy mix to 10 percent by 2020 from less than 6 percent in 2014.

China's natural gas market is still growing slowly, partly due to the slow pace of market-oriented reforms, the Beijing-based Economic Information Daily newspaper reported in February.

Domestic natural gas consumption in 2015 stood at 193.2 billion cubic meters, increasing 5.7 percent year-on-year.

But consumption was still more than 30 billion cubic meters below what the government planned for the year, the newspaper reported, citing data from the National Development and Reform Commission, the national economic planner.

"Breaking down the numbers, the situation in China last year was caused by slowing industrial usage and the failure of gas to gain share from coal in both the power sector and the business sector," Dale told the Global Times on Tuesday.

However, the combination of pricing reforms that have been announced and other general government legislation encouraging a shift from coal to other fuels should underpin the long-term growth of China's gas consumption, Dale noted, stating that he's optimistic about the situation.

BP continued to make selective long-term investments in 2015, even as it greatly slashed expenditure to weather the ongoing crude price slump.

On March 31, BP and oil giant China National Petroleum Corp (CNPC) signed a production-sharing contract (PSC) for shale gas exploration, development and production in the Neijiang-Dazu block in Southwest China's Sichuan Province.

The contract is BP's first shale gas PSC in China, and it covers about 1,500 square kilometers. CNPC will be the operator for this project.

The PSC is also the first outcome of a framework agreement on strategic cooperation between BP and CNPC that was signed in October 2015 during President Xi Jinping's visit to the UK.

CNPC said on Tuesday that its oil and gas output will reach 300 million tons of oil equivalent a year by 2020.

Posted in: Companies