HOME >> BUSINESS

China approves new insurance firm to replace defunct Anbang

Source:Global Times Published: 2019/7/11 20:23:41

Dajia a comprehensive solution for troubled insurance group

A view of the newly established Dajia Insurance Group in Beijing on Thursday Photo: VCG

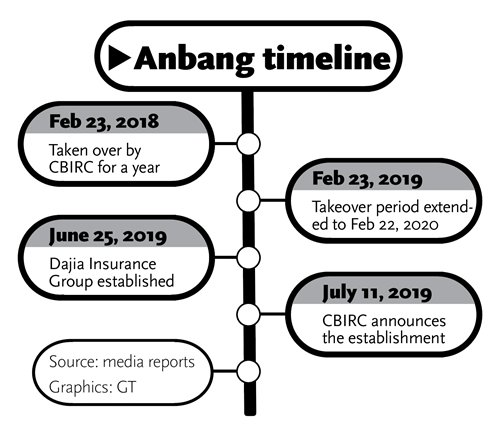

Graphics: GT

China's insurance regulator on Thursday approved the establishment of a new company called Dajia Insurance Group, which will take over the assets of Anbang, a giant conglomerate that has been under state control for over a year.

Experts said it's a reasonable choice to start a new enterprise that can comprehensively resolve Anbang's financial woes, which were brought about by its complicated asset structure and risky investments. The new entity can protect policyholders' legitimate rights and interests.

Anbang was one of China's most aggressive buyers of global assets before authorities launched a campaign to regulate risky outbound mergers and acquisitions. According to a statement released on April 16, Anbang decided to reduce its registered capital from 61.9 billion yuan ($9.02 billion) to 41.539 billion yuan.

"Given the short development history of China's insurance sector, and long-term features of endowment insurance contracts, a timely takeover is needed to defuse financial risks for the company after illegal practices threatened its solvency," Li Daxiao, chief economist at Shenzhen-based Yingda Securities, told the Global Times on Thursday.

Setting up a new entity that will formulate customized solutions could be a more efficient means to achieve continuity of Anbang's insurance services and get the company back to a focus in the insurance sector, Li said.

Zhong Ming, professor with the Shanghai University of Finance and Economics, said that starting a new company is appropriate in cases where partial adjustments don't resolve the problems. Zhong added that policyholders' interests have legal protection in China if any further problems emerge in the process of the state's takeover or the new company's operation.

The new company, Beijing-based Dajia Insurance Group, is similar to an asset management company. It has 20.36 billion yuan in registered capital, contributed by the China Insurance Security Fund Co, Sinopec Group and SAIC Motor, read a statement released by the China Banking and Insurance Regulatory Commission (CBIRC).

The China Insurance Security Fund controls 98.2 percent of Dajia, while Sinopec Group owns 0.55 percent and SAIC holds 1.2 percent of the Dajia, according to media reports.

Dajia, which means "everyone" in Chinese, will accept the transfer of equity rights from Anbang subsidiaries such as Anbang Life Insurance, Anbang Pension and Anbang Asset Management, the statement said.

A Dajia Property Insurance unit will also be established, which will take part of the insurance business, assets and debts from the Anbang Property Insurance unit.

After the completion of its restructuring, Anbang won't launch any new insurance operations, the CBIRC said, noting that the plan that Dajia showed the insurance regulator had achieved gradual progress to dispose of Anbang's risks.

The regulator took control of Anbang in February 2018. It then extended the one-year takeover period to February 2020.

Newspaper headline: New firm to resolve Anbang's woes

Posted in: INDUSTRIES,MARKETS,BIZ FOCUS