HOME >> BUSINESS

CPI hits 3.0% in Sept, fired by pork prices

By Zhang Hongpei Source:Global Times Published: 2019/10/15 21:08:01

Structural adjustment needed to maintain steady economy

Local residents shop for vegetables at a market in Lianyungang, East China's Jiangsu Province on Tuesday. Photo: IC

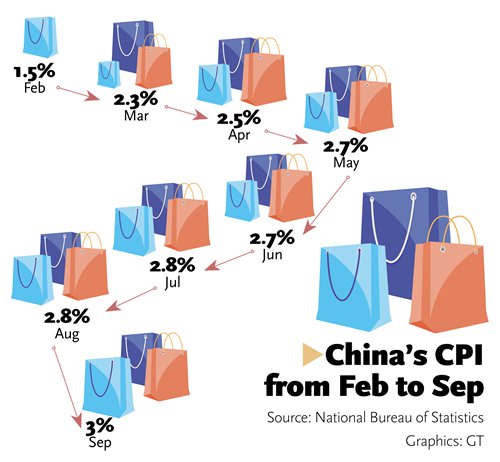

The consumer price index (CPI) in China, a main gauge of inflation, rose 3 percent year-on-year in September - the fastest rate in nearly six years - and that pace is likely to continue, industry observers said.

However, the nation is unlikely to experience an inflationary spiral, they said.

The figure, announced on Tuesday by the National Bureau of Statistics (NBS), reached 3 percent for the first time since November 2013 mainly due to rising food prices - in particular pork prices, which soared 69.3 percent on a yearly basis.

The CPI was up 0.9 percent month-on-month, which was 0.2 percentage points higher than in August.

China doesn't have the basis of one-way inflation or deflation, but will follow market changes, said Sun Guofeng, head of the monetary policy department of the People's Bank of China (PBC), China's central bank, on Tuesday.

The CPI is likely to rise about 3 percent in the fourth quarter, based on the hefty increase in pork prices, which is forecast to last until next year, analysts said. However, the trend does not signal an inflationary spiral, they added.

Wang Jun, the Beijing-based chief economist at Zhongyuan Bank, told the Global Times on Tuesday that surging pork prices have resulted in a structural price hike instead of a general rise in inflation.

China's CPI from Feburary to September

"Prices of consumer goods except for pork and oil haven't risen much. Besides, higher pork prices mainly reflect tighter supplies due to African swine fever (ASF) rather than higher demand, so it is structural," Wang said.

Data from the NBS showed that non-food prices went up 1.0 percent year-on-year in September.

"Non-food prices have been subdued, so there is limited space for the CPI to rise further simply because of soaring pork prices," said Liu Xuezhi, an analyst at the Bank of Communications.

He estimated that the CPI will rise no more than 3 percent for the full year of 2019.

The average level of CPI growth in the first nine months was 2.5 percent, according to the NBS.

"For the moment, it is urgent to tackle the imbalance of pork supply and demand by encouraging hog feeding, increasing frozen pork reserves and expanding imports," Liu told the Global Times on Tuesday.

China imported about 1.33 million tons of pork from January to September, up 43.6 percent year-on-year, data from the General Administration of Customs showed on Monday.

Policies have been implemented in China to combat the impact of ASF. A total of 30,000 tons of pork reserves had been released into the market by the end of September.

Wang also said that "one key factor is that money supply is steady."

Growth in M2, a broad measure of money supply, was 8.2 percent in August, kept at a "mild and controllable" level, according to Wang.

The NBS also announced the Producer Price Index (PPI), which measures costs for manufacturing goods at the factory gate. The September PPI dropped 1.2 percent year-on-year, marking the third straight month of contraction.

"What we should also notice is that last month's PPI rebounded slightly by 0.1 percentage points on a monthly basis, ending the contractions that were seen from June to August and showing the gradual, positive effect of increasing domestic demand," Liu noted.

Both the CPI and PPI figures fell within expectations. Monetary policy will not be affected, while it is key to holding economic growth steady, said Li Daxiao, chief economist at Shenzhen-based Yingda Securities.

China is scheduled to release the GDP growth rate for the first three quarters on Friday. Analysts forecast the figure will come in at about 6.1 percent.

Premier Li Keqiang said in a meeting with local officials on Monday that China will persist in its efforts to stabilize employment and prices to weather economic downward pressure, making sure the full-year's main targets are achieved, including yearly GDP growth of 6-6.5 percent.

Posted in: ECONOMY