HOME >> SOURCE

China’s industrial activity, consumption beat expectations in November

By Shen Weiduo and Song Lin Source:Global Times Published: 2019/12/16 19:13:41

Better-than-expected outcome a sign of recovery amid global uncertainties

Large crowds of customers line up outside the IKEA store in Zhengzhou, Central China's Henan Province on Sunday, which was the first weekend since the Swedish furniture giant landed its first store in Henan. Similar scenes took place when US warehouse club retailer Costco opened its store in Shanghai on August 27. Photo: VCG

Graphics: GT

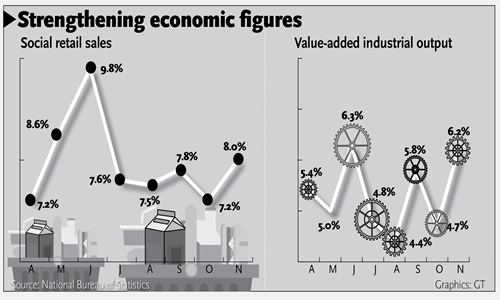

Led by strong industry activity and rising domestic consumption, China posted better-than-expected economic figures in November, a sign of recovery despite mounting downward pressure from domestic structural reforms and a slowdown in global economy.In November, China's value-added industrial output expanded 6.2 percent year-on-year, an increase from 4.7 percent in October. It also beat the market forecast of 5 percent, according to data released by the National Bureau of Statistics (NBS) on Monday.

As industrial activity is recovering, analysts expect growth to further stabilize next year, with the government likely to set an economic growth target at around 6 percent, strengthen investment in large-scale infrastructure projects and further stimulate domestic consumption.

"With a series of policies gradually kicking in, as well as the concerted efforts of the whole country, we see positive trends in the economy," Fu Linghui, spokesperson of the NBS told a press conference in Beijing on Monday.

Retail sales rose 8 percent year-on-year to 37.28 trillion yuan ($5.34 trillion) from January to November, NBS data showed.

Online sales were 9.5 trillion yuan from January to November, a year-on-year increase of 16.6 percent, playing a significant role in boosting market sales and driving November retail sales, said Fu.

The better-than-expected industry figures indicated that the economy is showing signs of recovery, and the economic slowdown has eased to some extent, Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, told the Global Times on Monday.

"In particular, a surge of added-value in high-tech manufacturing (8.9 percent) also showed that structural adjustment efforts are gradually taking effect," Liu Xuezhi, a senior economist at the Bank of Communications, told the Global Times on Monday, adding that recovering industry activities also showed the central government's measures such as fee and tax cuts are working.

Moreover, employment also showed stable growth, with a total of 12.79 million people being newly employed in urban areas from January to November, surpassing the annual target of 11 million well in advance of the deadline. The unemployment rate remained stable at 5.1 percent.

Fixed-asset investment grew by 5.2 percent year-on-year to 53.37 trillion yuan from January to November. In particular, investment in basic infrastructure rose 4 percent, while investment in the manufacturing sector was up 2.5 percent and up 10.2 percent in the property sector, according to the NBS.

Stressing that the country still faces downward pressure amid global uncertainties and domestic structural adjustment, Liu forecast that China is expected to strengthen investment in large-scale infrastructure projects to stabilize growth, but it will also prevent debt risks at the same time.

It's likely that China will set the GDP growth target at around 6 percent for next year, Liu said.

"As long as the economic growth rate fits in with our development stage, either a higher or lower economic growth rate is acceptable," Fu said.

Experts also noted that positive outcomes from the China-US trade talks will ease the bilateral trade conflict temporarily and offer a buffer for domestic economic growth, and the economic figures in December would remain relatively stable.

Fu said that agreement on the text of the phase one China-US deal will further reduce market uncertainty and bolster market confidence, which is beneficial to China, the US and the world.

Given the strong industrial output figures and the cooling China-US trade war, global investment banks also raised their forecasts for China's economic growth next year.

"We have raised our GDP growth forecast for 2020 to 6 percent from the previous 5.7 percent," Wang Tao, a UBS economist, said in a note sent to the Global Times on Monday.

Posted in: INDUSTRIES,ECONOMY,BIZ FOCUS