HOME >> SOURCE

China’s NEV industry booms despite relative slump in sales

Source:Global Times Published: 2019/12/29 20:46:08

A NIO ET sedan makes its debut at Shanghai Auto Show in April. Photo: Zhang Hongpei/GT

The market slump is within expectation as China's new-energy vehicle (NEV) industry transforms from the subsidy-driven phase to a market-driven one, industrial analysts said on Friday.

This came after heavier subsidy reduction this year that led to five consecutive months of decline in NEV production and sales since July, casting shadow and doubt over this booming industry.

In 2019, the subsidy standard has been lowered by an average of 50 percent on the basis of 2018, and local subsides are required to be eliminated, according to a statement from the Ministry of Finance in March.

The NEV subsidy was launched since 2009 as part of the government plan to cultivate the industry.

Since then, the fiscal policy has greatly contributed to the industrial development and encouraged auto companies to produce NEVs.

NEV subsidies exceeded 22 billion yuan ($3.1 billion) in 2017 and dropped to 13.7 billion yuan in 2018, according to the Ministry of Industry and Information and Technology (MIIT).

The subsidy standard is reduced in accordance with the scale efficiency and cost reduction of NEVs to promote the market-driven industry, a government report said in March.

Xu Haidong, assistant secretary-general of the China Association of Automobile Manufacturers (CAAM) told the Global Times on Friday that China has reduced fiscal subsidies for NEVs because they are not sustainable.

Graphics: GT

Industrial growth

In the past, China's NEV sector was generally in a situation where the government played the leading role while enterprises were not very active. But the phenomenon has changed over recent years.

In 2009, China launched an encouraging policy to support the promotion and application of the NEV in cities, marking the start of the industrial upgrade.

However, by the end of 2012, only 27,432 NEVs had been sold in 25 cities, accounting for less than 0.1 percent of the total, a report by CAAM said.

According to an industry development plan released in 2012 by the State Council, China's cabinet, subsidies will be provided for new energy vehicles in public services and in private purchases.

Under the policy stimulus, China's NEVs showed an explosive growth.

In 2015, the output of NEVs stood at 379,000 vehicles, up 3.5 times year-on-year, according to a report by CAAM. China has also become the world's largest incremental market for NEVs.

In 2018, a total of 769,000 electric cars were sold in China, far surpassing the 209,000 sold in the US, according to London-based industry research agency JATO.

However, some major NEV producers still relied on subsidies to be able to make profits, Su Hui, an analyst with the China Automobile Dealers Association, told the Global Times on Thursday.

BYD's annual profit of 2.78 billion yuan in 2018, with 3.6 billion yuan in subsidies, has surpassed its profit for the whole year, according to the company's report.

The core handicap for non-profitability is high costs from areas like battery production which, according to Xu, can soon be reduced with the development of scale and technological improvements.

"Around 2023, the cost of NEVs will be similar to that of fuel vehicles, so now we are at a critical moment," Xu from CAAM said.

A favored market

In addition to government support, the Chinese NEV market is the largest in the world with the biggest opportunity to tap into consumer demand, according to Su.

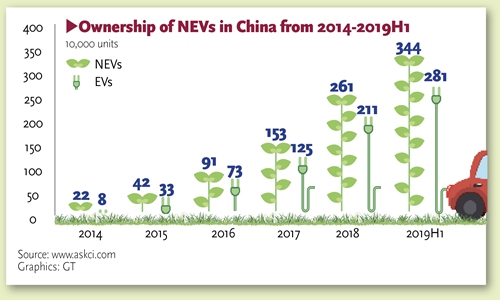

Statistics showed that the domestic ownerships of electric vehicles, the major part of the NEVs, have increased from a few thousand in 2009 to 2.6 million in 2018.

By June this year, China had 3.44 million vehicles, or 1.37 percent of the total, according to the Traffic Management Bureau with China's Ministry of Public Security.

"Compared with the growing market size, there is still a huge space for the increase in ownership, making China the most potential market in the field," Su said.

To promote the high-quality and sustainable development of the NEV industry, the sales volume of NEVs will account for about 25 percent by 2025, according to MIIT.

The MIIT released on Friday a list of NEVs exempted from vehicle purchase tax, including Tesla's Model 3, a model made in its Shanghai factory, sending a strong message for further support for NEVs.

The new insurance policy for NEV is expected to be released soon, in which return and exchange conditions and punishment standards will be adjusted, He Xing, an official from the State Administration for Market Regulation, said earlier this month.

International auto companies are accelerating their business layout toward the world's largest NEV market under China's favorable policies to go green.

German automaker Audi's first electric car, the e-tron, announced on November 18 that it would go into production in China in 2020.

BMW is also not falling behind. Its iX3 electric SUV is scheduled to go into production in China in 2020, according to the company's report.

An anonymous source from Hyundai Motor said the company is boosting technical development to cater to the Chinese market, which is the most promising one to the company.

"We will continue to focus on the research and development and innovation of NEV technology, and give full play to our technical advantages in the field of hydrogen energy vehicles to better serve Chinese consumers," he said.

The slowdown in China's auto market is only a short-term pain, and the strong demand fundamentals of Chinese consumers suggest the future is still ahead, according to a report by a consulting firm McKinsey & Company in October.

Newspaper headline: Cruising into the market

Posted in: INDUSTRIES