China targets chaotic market of mask fabric

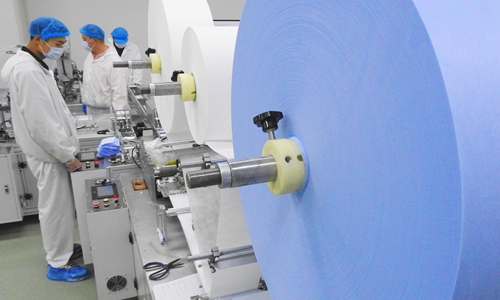

Workers at a factory in Lianyungang, East China's Jiangsu Province, are busy making face masks for overseas markets where the coronavirus has been spreading quickly. The company has received orders from the US and Belgium. Photo: cnsphotos

Chinese regulators are ratcheting up a crackdown on price gouging and other illegal activities in the chaotic market for melt-blown fabric, a key material in medical masks, warning profiteers to expect heavy punishment if they continue to exploit the global pandemic.

The move came after the price of melt-blown fabric prices multiplied up to 40 times higher amid the desperate global demand for masks.

It will help ensure the quality and stability of medical supplies - a critical issue for China not just economically but also politically as some foreign elements continue to smear China's pandemic aid efforts, analysts said.

The price of melt-blown fabric rose nearly 40 times to about 700,000 yuan ($98,980) a ton in half a year, with some likening its production to a "money printing machine."

Surging prices

As the virus spreads fast across the world, demand for melt-blown fabric has surged in China, the largest face mask filter raw material provider in the world.

"It's extremely hard for us to find channels for purchasing melt-blown fabric," Chen Lianjie, an executive at Zhejiang Kanglidi Medical Articles Company, told the Global Times on Sunday.

Chen said the company faces a daily shortage of three-quarters of the raw material. "A local government agency offered some help, but we have to rely on ourselves to buy the majority of the material - either through small workshops or Sinopec," he said.

Two out of 200 samples from small workshops met standards for medical use, Chen said. Meanwhile the price of the Sinopec material has climbed as high as 700,000 yuan, fueled by middlemen.

A manager at a domestic melt-blown fabric import and export company told the Global Times that Sinopec melt-down fabric prices soared as it became known for being of the highest quality. No stock was left within a week, he said.

China's state-owned enterprises (SOEs) are ramping up efforts to expand production of melt-down fabric, with centrally-administered SOEs' supply reaching 42.5 tons a day by late March, the Xinhua News Agency reported.

Some face mask manufacturers without medical equipment qualifications also scrambled for the raw material, Li Lin, general manager of Anhui Fumei Medical Company, told the Global Times.

Workers produce medical masks at Liaoning Shengjingtang Biotechnology Co., Ltd in Shenyang, capital of northeast China's Liaoning Province, April 14, 2020. The company has been actively manufacturing medical masks that will be exported overseas. (Xinhua/Yang Qing)

They in turn manufactured for Chinese import and export companies who have legally required documentation needed to export from China, he said."A face mask production machine generally costs 300,000 yuan, but some small workshops that aim to make a quick buck may bid up to 1.6 million yuan for a machine, which impacts large face mask enterprises' production expansion," Li said.

Li said his company has overseas orders for about 200 million face masks for export to countries including the US, Germany and Italy, requiring another 500 tons of the material.

An insider at the China Nonwovens & Industrial Textiles Association who requested anonymity told the Global Times Sunday that the mask market was distorted by the pandemic, with supply rapidly ballooning to several hundred million a day from a pre-crisis level of 20 million.

"When you have so much demand at one end and skyrocketing materials at another, and so many new producers rushing into the sector, pressing hard for earlier delivery, it is just inevitable that chaos arises from all this. Supervision and regulation is needed here," the insider said.

Severe crackdown

On Wednesday authorities in Yangzhong, a city in East China's Jiangsu Province, with a recently acquired reputation for manufacturing melt-blown fabric, banned 867 companies from making it.

An owner of a Yangzhong melt-blown fabric manufacturer who only gave the surname Yao, told the Global Times on Sunday that his factory stopped for three days, with all transport blocked for their product.

It's understandable that the government ordered a halt, the owner said.

"Almost everyone is manufacturing melt-blown fabric in Yangzhong, with some household workshops in rural areas jumping on the bandwagon, resulting in undesired quality and hygiene conditions."

The Ministry of Public Security said over the weekend that authorities have cracked down on 42 suspected profiteers involved in 20 cases, with amounts totaling 34.45 million yuan.

The crackdown has effectively contained the wild rise in prices of melt-blown fabric, the ministry said.

Offenders had hoarded and resold melt-blown fabric for exorbitant profit through raising prices or arranging fictitious transactions.

The State Administration for Market Regulation has cracked down on speculative producers since March.

It has asked eight provinces and municipalities including East China's Zhejiang and Jiangsu provinces to launch special inspections of the melt-blown material to stabilize prices and prioritize handling complaints about the price of the fabric, while stressing investigation of lawbreakers.

A worker produces a medical mask at Liaoning Shengjingtang Biotechnology Co., Ltd in Shenyang, capital of northeast China's Liaoning Province, April 14, 2020. The company has been actively manufacturing medical masks that will be exported overseas. (Xinhua/Yang Qing)

Zhejiang and South China's Guangdong Province also held meetings with producers to warn them not to speculate and profit from medical supplies critical in the fight against COVID-19.Chinese experts said maintaining an orderly market for the production and sale of medical supplies used for combating COVID-19 was imperative for China, which has risen to become the world's foremost provider of such supplies.

In March, electric car maker BYD, backed by Warren Buffet, declared itself the world's No.1 maker of masks with a daily capacity of 5 million.

Sinopec, which has a dozen production lines for melt-blown fabric, said last week it would be the world's largest producer by May when it achieves annual output of 10,000 tons.

Sinopec announced April 6 that it didn't consign any company or individual to sell its melt-blown fabrics and asked those involved to stop their illegal behavior.

Sinopec would hold those parties accountable for damaging its trademark and disrupting market order, the company said.

Global cooperation

Ensuring the quality of goods was mostly the buyer's responsibility, Indian businessman Arjun Bahri Dhawan, who is purchasing medical supplies from China, told the Global Times.

Some Western media have raised quality concerns over face masks imported from China.

AFP reported in March that the Netherlands recalled 600,000 face masks manufactured in China, claiming they did not meet minimum quality standards.

Chen Hongyan, an industry expert, told the Global Times that some countries sent middlemen to pick up face masks, who, in order to make a profit, tended to purchase cheaper masks intended for civil use.

"These countries themselves are responsible for the incident, as they should go through official channels like government agencies or associations, rather than middlemen," Chen said.

More foreign companies have also shifted into production of the vital fabric. German firm Innovatec has said it plans to manufacture an extra 2,000 tons of melt-blown fabric by the middle of June, with a further 1,000 tons planned by the end of the year, according to a Reuters report.

Bai Yu, president of the Medical Appliances Branch of the China Medical Pharmaceutical Material Association, told the Global Times that Germany, as the country with the most advanced equipment, could easily transform itself into a major melt-blown fabric manufacturer.

But there is a time gap of two to three months before Germany could do so.