Domestic manufacturers give chips more weight, refuse to await doom

By Zhang Dan Source:Global Times Published: 2020/4/21 18:56:35

A booth of Foxconn at an exhibition hall in Wuhan, capital of Central China's Hubei Province. File photo: VCG

Apple supplier Foxconn Technology Group has in recent days established a new semiconductor packaging and testing factory in Qingdao, East China's Shandong Province, in a bid to develop its semiconductor supply chain and widen its operation range to survive in the upcoming information era.

The world's largest electronics contract manufacturer made the decision to build the factory under cooperation with the Qingdao local government on April 15. The new facility will package and test application-specific integrated circuits specifically used in 5G communications and artificial intelligence (AI) hardware products.

The project is a core part of the chip design, manufacturing and application industries' supply chain, and will lead the opening up of upstream and downstream industrial chains, said Foxconn's chairman Liu Young-way, according to media reports.

Co-financed by the Rongkong Group, the plant is expected to begin operations next year and reach its target output by 2025, local media Qingdao Daily reported.

Foxconn did not reveal further details on target output or specific chips that will be made at the plant to the Global Times.

It is not the first time for Foxconn to eye semiconductor.

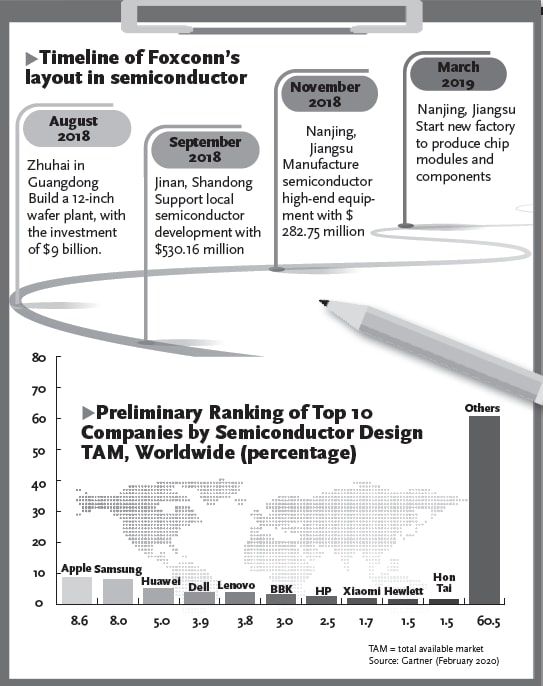

In August 2018, the Taiwan-based company reached an agreement with the Zhuhai government in South China's Guangdong Province to build a 12-inch wafer plant, with total investment reaching $9 billion, according to media reports.

In the following month, Foxconn paid 3.75 billion yuan ($530.16 million) to support five integrated circuit design companies and a chip company in Jinan, Shandong.

Two further semiconductor projects under Foxconn subsidiaries were settled in Nanjing, East China's Jiangsu Province in November 2018 and March 2019.

In the long term, Foxconn will refuse to manufacture low-end products on the industrial chain or manufacture for others, Ma Jihua, a Beijing-based tech industry analyst, told the Global Times.

"In the past, companies were divided upstream and downstream. But since 5G arrived, many companies are now expanding horizontally as they know they could soon be easily replaced or lose their voice," Ma said, noting that industrial chains are being reconstructed as we move into the 5G era.

GT Graphics

Seeking independence

Due to the impact of the coronavirus on semiconductor supply and demand, worldwide semiconductor revenues are forecast to decline 0.9 percent to $415.4 billion in 2020, according to leading research and advisory company Gartner. That forecast is down from the previous quarter's prediction of 12.5 percent growth.

"The wild spread of COVID-19 across the world and the resulting strong actions by governments to contain the spread will have a far more severe impact on demand than initially predicted," said Richard Gordon, research practice vice president at Gartner.

The pandemic has worsened already struggling semiconductor revenues. In 2019, worldwide semiconductor revenues totaled $419.1 billion, dropping 12 percent from 2018, Gartner said on Wednesday.

Andrew Norwood, research vice president at the company, noted that the 2019 trade war between the US and China once seemed the most imminent danger to the world economy, but with the current spread of the COVID-19 virus, trade wars seem minor issues in comparison.

"The pandemic will bring about difficulties related to raw materials for Chinese chipmakers. Plus, 5G smartphone consumption may also decline," Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times.

However, Xiang remained positive about the Chinese semiconductor market as the virus has begun to recede within China and the domestic semiconductor market has seen continuous growth due to large demand.

He took memory chips as an example, pointing out that even though made-in-China memory chips account for 5 percent of the global market share, Chinese chipmakers have continued making breakthroughs and progress step by step.

Wuhan-based Yangtze Memory Technologies Co has worked out the 128-layer 3D NAND flash memory chip, catching up with world-leading rivals Samsung and SK Hynix.

"The Chinese semiconductor market will decline this year for sure, but the drop will be the smallest among all markets," Xiang said.

Semiconductors are the core of technology. Working as data processors for various products, they have become an arena for the fiercest US-China competition.

Many of China's tech giants have stepped up researching, designing and manufacturing their own chips in order to cast off their dependence on overseas chipmakers.

Washington is preparing for new rules requiring foreign companies using US chipmaking equipment to obtain a license before supplying chips to Chinese telecoms giant Huawei - that would directly affect the Taiwan Semiconductor Manufacturing Company (TSMC), Reuters reported.

"In fact, Huawei has diverted part of its chip orders to Semiconductor Manufacturing International Corp… If TSMC loses Huawei, a major client, that would be terrible for the company," Xiang noted.

The move is in preparation for more US restrictions on Huawei, he added, and neither Huawei nor TSMC will await their doom.

Ma echoed Xiang, saying the coronavirus has hit US industrial chains and the country's talent structure hard. "The US was trying to contain China's advanced technology development, but now it needs to build itself up first."

Newspaper headline: Opportunities for China’s semiconductor industry

Posted in: INDUSTRIES,ECONOMY,BIZ FOCUS