Citizens chase ‘bull run’ in Chinese stock market

By Shen Weiduo Source: Global Times Published: 2020/7/15 20:23:40

Regulators cautiously quell industry enthusiasm amid worry over bubble

Investors monitor stocks at a trading center in Chengdu, Southwest China's Sichuan Province. Photo: VCG

After lining up for two hours to register for an online stock account last week, Wang Liu, a Beijing-based white-collar worker, was more than thrilled to buy her first ever share. She chose to invest in a duty-free company whose share price has almost doubled since mid-June this year.

"Just overnight, everyone around me was talking about the booming market, saying that it's a now or never opportunity as China's A-share market has finally welcomed its bull run," Wang told the Global Times on Monday.

Wang is not alone in newly investing in the country's A-share market. An employee at one of the country's major securities companies told the Global Times on Monday that the firm has been "too busy to handle tons of application requests since the beginning of July - almost 80 percent more than normal times."

"Some old investors who have already canceled their accounts or new investors who are troubled by delays in opening online accounts are also coming to our counters and urging us to speed up the process," said the employee, who chose to remain anonymous.

According to a report from STCN.com, about 400 stocks have set historic highs since the beginning of July, and on Monday alone, at least 239 shares hit record highs.

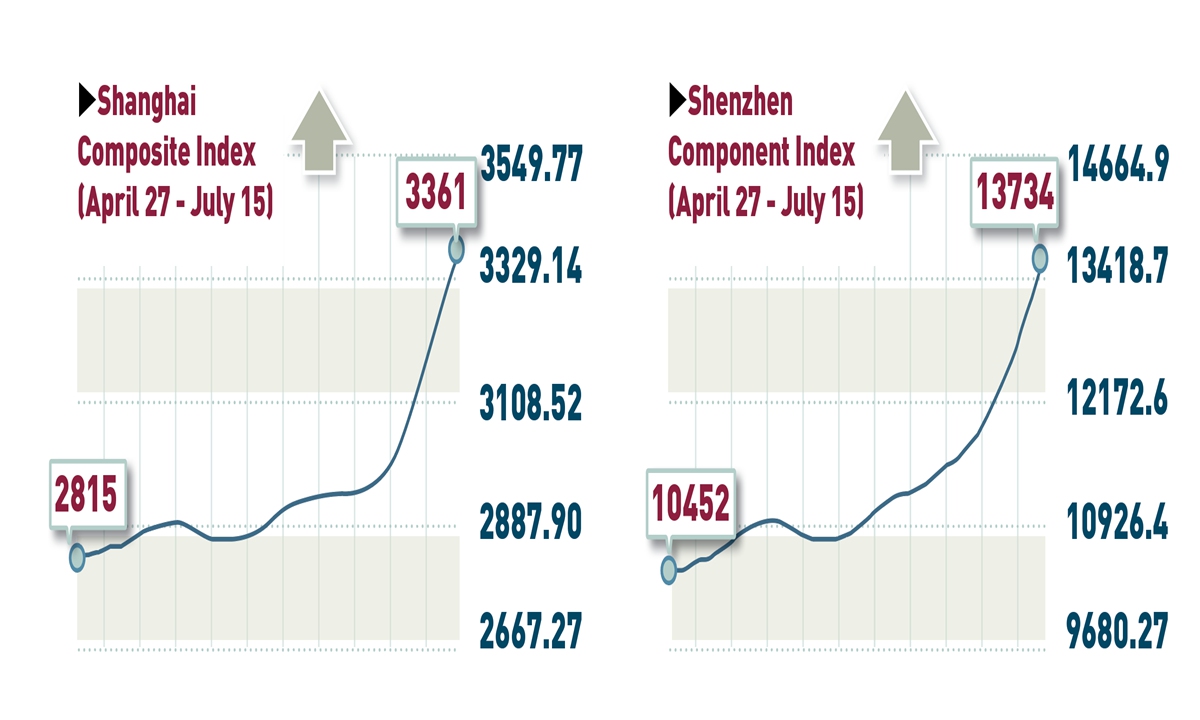

Turnovers in the benchmark Shanghai Composite Index and Shenzhen Component Index continued to climb and reached a total of 1.57 trillion ($224 billion) yuan on Wednesday, the eighth consecutive trading day to exceed 1.5 trillion yuan and eighth consecutive to exceed 1 trillion yuan.

As shares have experienced fluctuations this week, Wang said she's pulled back some money and is waiting to see what will happen to prevent risks.

Having said that, Wang is optimistic about the long-term growth of the stock market.

Slow bull run

China's record-breaking stock market surge is once again turning heads. All gains this year have been made in the past two weeks, when China's central bank cut its rediscount loan rate for the first time in a decade and the China Securities Finance Corp lowered margin requirements for brokers, said Hong Hao, managing director and head of research at BOCOM International.

The market read these moves as signs of PBC easing and the first relaxation of the regulator's grip on margin trades since the 2015 bubble, Hong said.

Moreover, analysts noted that the country's quick economic recovery, efficiency in handling the pandemic, and strong fundamentals also paved the ground for the market boom.

"This stock market rally is based on two factors: China's ability to control COVID-19 in a relatively short time, and the subsequent upticks in domestic consumption, government support policies to back up industrial growth and infrastructure investment," a veteran industry analyst and close follower of the country's stock market surnamed Li told the Global Times.

"We believe the upward trend remains intact. We can show that China's real yield is leading the performances of the Shanghai Composite Index and the Chinese economy by about half a year. And the real yield is recovering from a level similar to that seen during the 2008 financial crisis. As such, the Shanghai Composite Index, as well as the Chinese economy, should continue its rising trend," said Hong.

It will be "slow bull" run lasting for many months, said Li, predicting that it will take four to six months to reach the 3,800 points.

Bubble caution

Despite the public's stock market mania, the country's regulators have been taking a cautious attitude to prevent the market from becoming "too hot," said analysts.

Chinese regulators have been cautious in the face of the market boom, and have avoided adding flames to an already hot market, Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, told the Global Times on Tuesday, noting that this rational attitude will prevent the market from becoming "irrational."

The China Banking and Insurance Regulatory Commission (CBIRC) said over the weekend that some violations had reemerged on the Chinese mainland's capital markets. A CBIRC spokesperson noted that high-risk shadow banks, some in new forms, have been revived in China. Some capital has also flowed into the real estate and stock markets in an illegal manner, the spokesperson said.

They also stressed that the CBIRC will guide capital to flow from the virtual to the real economy. It will also forbid banks and insurance firms from participating in over-the-counter financing, and it will clamp down on illegal leverage and speculation to curb asset bubbles. Some analysts interpreted these moves as government gestures to cool down the equity market.

Guan Tao, chief global economist at BOC International (China) Co, told the Global Times that after years of adjustment, the valuation of China's stock market is relatively low, especially compared with the European and US markets. Thus it is normal that it is attracting investors from both home and abroad.

But these opportunities are coming with more challenges than ever, Guan said, noting that with global "over liquidity," the inflows could also rapidly overdraw China's stock market valuation advantage and cause prices to become artificially high, leading to asset bubbles.

As huge hurdles still remain in China's real economy, it is necessary to be cautious of too much money flowing into the stock market rather than supporting the development and recovery of the real economy, Dong said. "Unlike the US, which is abusing its international currency advantage and transferring financial risks to the world, China has to take a responsible attitude, for the good of both itself and the world."

RELATED ARTICLES:

Posted in: ECONOMY