Australian agricultural sector likely to lose Chinese market

By Chi Jingyi and Li Xuanmin Source: Global Times Published: 2020/7/27 22:33:40

Residents in Hainan buy Australian beef on Monday. Photo: CNSphoto

Graphics: GT

There have been calls in China to boycott Australian products in response to Australia's ongoing anti-China campaign. If the boycott intensifies further, Chinese importers may consider alternative sources, for example, Australia's neighbor New Zealand, said analysts, industry practitioners and enterprises.

Australia, which had exports of meat to China worth $1.36 billion in the first six months of 2020, lost its market share to global competitors, including Brazil, the US and neighboring New Zealand, which exported $1.14 billion of meat to China, showed statistics from the General Administration of Customs.

Since China suspended in May four Australian beef producers from exporting to China, some Chinese importers are making plans.

An importer of Australia beef and mutton based in Shanghai, which has imported nearly 300 tons of meat in 2019, told the Global Times on Sunday that it has started looking for exporters outside Australia from the end of last year as the soured bilateral relationship makes importers feel unsafe.

The importer said it has contacted exporters from Brazil and New Zealand and the signing of import contracts is under discussion, though it is impeded by the coronavirus.

"If the tension between China and Australia continues to escalate, Australia will lose a large share of its China market, as the country has started to diversify where it sources agricultural products from," Hu Qimu, a senior fellow at the Sinosteel Economic Research Institute, told the Global Times on Monday.

Hu noted that China has increased agricultural imports from the US under the two countries' phase one trade deal, which has squeezed some of Australia's market share.

China slapped a heavy antidumping tariff in May on Australian exporters of barley for five years.

As one of Australia's biggest barley importers, China accounted for nearly 50 percent of its exports.

Some Chinese consumers' boycott against Australian agricultural products is poised to benefit New Zealand, whose geographic and weather conditions are similar to that of Australia and therefore have a certain level of overlaps with its neighbor in terms of main export products, Wang Jiazheng, chief representative of the Guangdong Economic and Trade Representative Office in New Zealand (GETRONZ), told the Global Times on Monday.

An agricultural analyst surnamed Ma also said that products of the two neighbors are highly substitutable due to similar geographical location and climate.

"New Zealand cannot take all of Australia's share in China as global competitors are eyeing the Chinese market, but it will definitely take some share," Ma told the Global Times on Sunday.

China imported $2.27 billion worth of dairy products, eggs and honey from New Zealand in the first half of the year, while imports of the same products from Australia totaled $259.2 million, according to Chinese customs.

New Zealand has two things that Australia does not: mountains and rain, making its strengths lie in livestock, forestry and orchards, Long Hao, director of the New Zealand-listed AFC Group Holding whose business includes agricultural trade, told the Global Times on Sunday.

"AFC Group's total exports of dairy, honey, wine and facial masks for the first five months of 2020 increased by almost 25 percent year-on-year, with the largest increase in facial masks, despite an overall decline due to the coronavirus," Long said.

Addressing the China Business Summit on July 20 in Auckland, New Zealand Prime Minister Jacinda Ardern said that "China is New Zealand's largest trading partner and one of our most important relationships."

China has noted relevant reports and appreciate the remarks which show that the New Zealand government attaches importance to developing relations with China. Sound and steady development of bilateral relations serves the fundamental interests of both countries and peoples, said Wang Wenbin, spokesperson of the Foreign Ministry on July 21.

The chief representative of GETRONZ also said that New Zealand has been building close political and economic relations with China, so it is vital that the two economies maintain such ties amid fraying China-Australia relations.

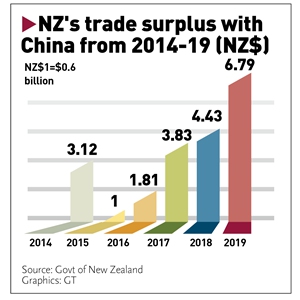

Trade between China and New Zealand reached $18.29 billion in 2019, up 8.5 percent from a year earlier, according to Chinese customs.

According to data sent by Wang Jiazheng, China accounts for one third of New Zealand's dairy product exports in pre-coronavirus period. In 2019, a total of 23 percent New Zealand's exports went to China, while China also represents 16 percent of New Zealand's imports.

China is now New Zealand's largest trading partner, and the second-largest and fastest growing tourism market, largest source of international students, and a significant source of foreign investment, according to a statement by the New Zealand Ministry Foreign Affairs and Trade in November 2019.

Under the situation of closer ties between China and New Zealand and with an upgraded free trade agreement as well as tension between China and Australia, New Zealand's agricultural exports to China will increase by a large margin, Wang Jiazheng said.

Posted in: ECONOMY