Apple should practice caution as it nears $2 trillion

By Ma Jihua Source: Global Times Published: 2020/8/13 20:01:53

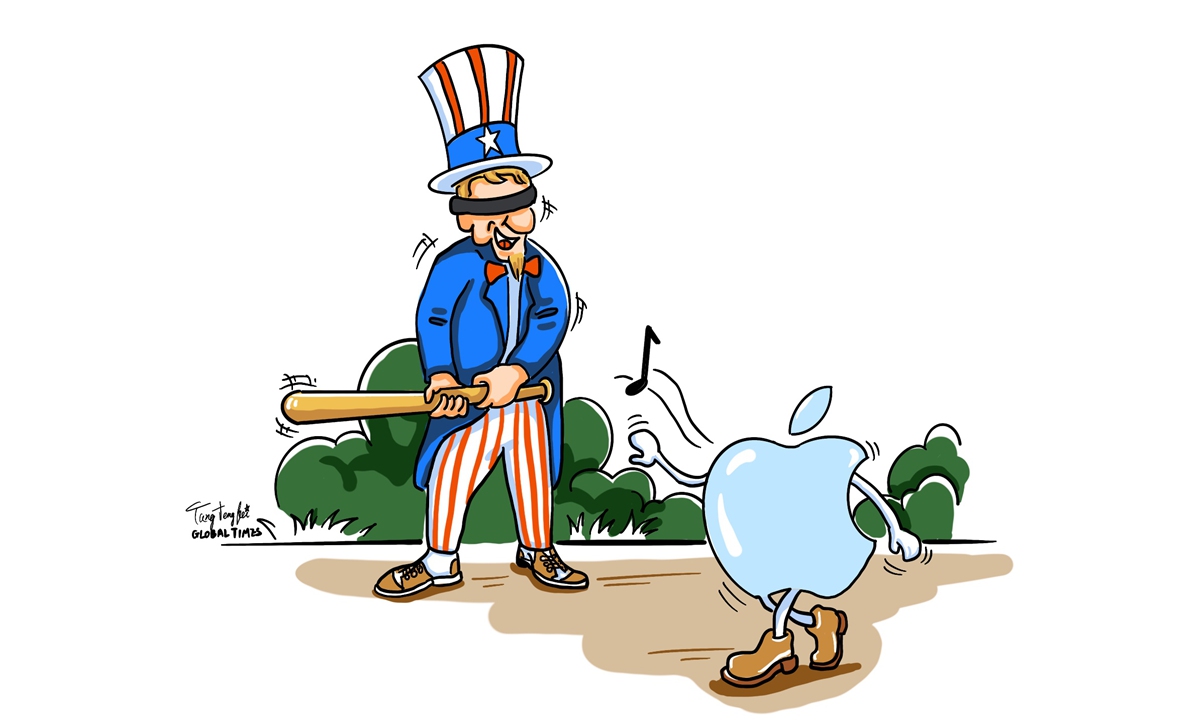

Illustration: Tang Tengfei/GT

Apple Inc is on track to become the first company to attain a $2 trillion market capitalization. Apple's current worth is around $1.93 trillion, less than 5 percent away from the new high. Analysts retained a bullish view of its buoyant shares even as its smartphone shipments continued to fall behind Huawei Technologies Co in the second quarter.However, Apple's spot at the top might be short-lived as its $44 billion China market is threatened by the Trump administration's WeChat ban. Once its surging stock price turns sour, many negative factors currently neglected by investors may erupt all at once.

Russia's Federal Antimonopoly Service has reportedly found that the iPhone-maker abused its dominant position in the mobile app marketplace and will order Apple to resolve multiple regulatory breaches.

Apple has been fined $506 million by a federal jury in Texas for "willfully" infringing a total of five patents on cellular standards, and the firm could be fined up to $26 billion as the EU investigates Apple's voice assistant Siri, according to media reports.

Chinese tech giant Huawei shipped more phones than Apple again in the second quarter, according to research firm Canalys. While Huawei shipped 55.8 million devices globally in the quarter amid a US crackdown, Apple shipped 45.1 million iPhone units across the world during the same period.

At the top, Apple currently seems untouchable, but if Washington actually orders it to remove WeChat from the App Store in September it may see its share price start to fall, and these negative factors may accelerate that drop.

In an optimistic scenario, Apple is only ordered to remove WeChat from the US App Store. Its iPhone shipments are in that case estimated to suffer a slight reduction. But if Apple is ordered to remove WeChat from the global App Store, annual iPhone shipments are expected to drop about 30 percent.

WeChat has become a necessary app for Chinese people. Cooperation between Apple and WeChat's parent company Tencent Holdings Ltd covers everything from online games to payments. While Apple is increasingly emphasizing its software services revenues, a divorce from Tencent would lead to profound aftershocks in its global business.

In recent online surveys in China, overwhelming majorities of respondents said they would choose WeChat over Apple devices if a choice became necessary. According to Bloomberg calculations based on IDC data, sales of Apple's iPhones in China amount to roughly $44 billion. If the US tech giant is hijacked by the Trump administration's political moves, its image among Chinese users will suffer a heavy blow.

When Trump threatened a WeChat ban last week, the share price of Apple concept stocks in the Chinese market fell immediately. Apple should be cautioned that if the same thing happens to its share price when Washington turns its threat into action, investors may start to notice all the negative factors they had previously neglected, drastically intensifying the company's downward trend.

The author is a veteran smartphone industry analyst. bizopinion@globaltimes.com.cn

Posted in: EXPERT ASSESSMENT