‘Dual circulation’ policy to quash America’s bullying

By Li Hong Source: Global Times Published: 2020/8/16 16:14:26

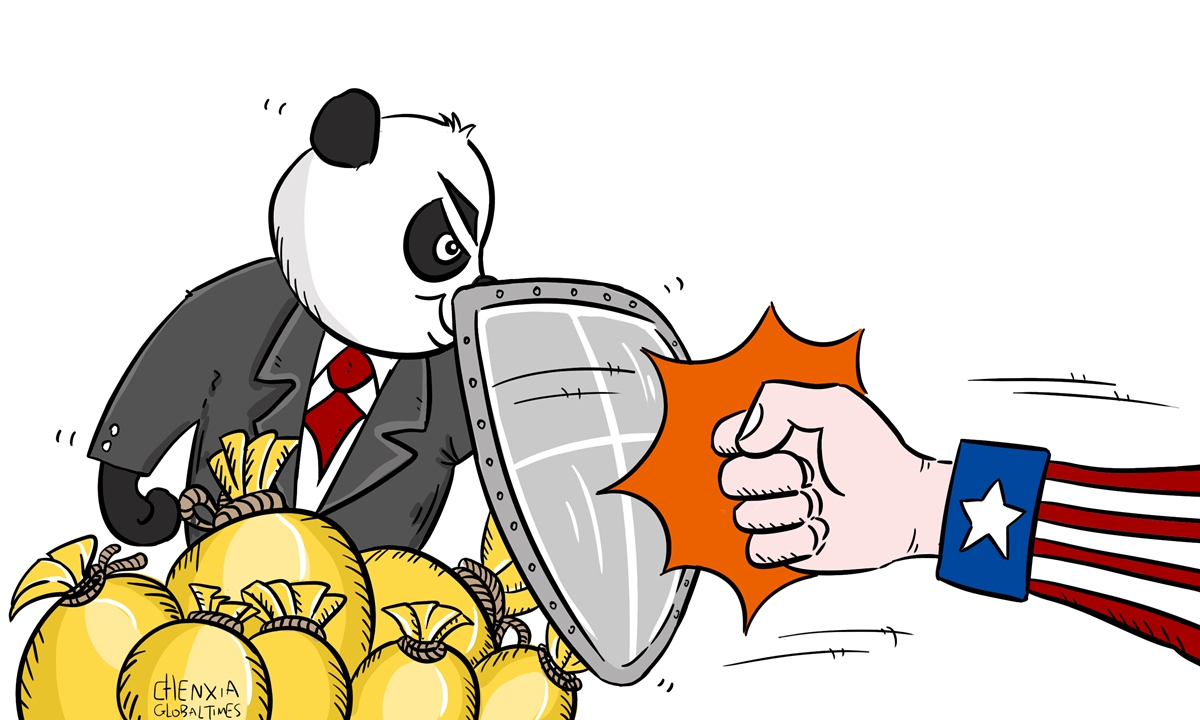

Illustration: Chen Xia/GT

China's economic rebalancing, pivoting to "inner circulation" by rapidly developing its domestic market competency in the global arena, will be a mild adjustment of policy in the coming years. The calibration aims to fight US bullying and hegemony.Trying to deflect the Trump administration's trade protectionism and technology blockade, the new Chinese policy aims to set up a global economic and technological innovation center, rivaling that of the US.

China will stick to "dual circulation" as always. Focusing more on "inner circulation" does not mean China will give up on "outer circulation". Economic reform or liberalization and opening-up policies - the two bedrocks of the country's prosperity over the past 40 years - will only be strengthened by Beijing.

However, to offset the US-led decoupling bid, China may be forced to turn its back on North America (the US and Canada) and Australia by keeping a greater distance from the three unfriendly countries, while focusing more on forming closer economic partnerships with the economies of Europe, Asia, Africa and other regions.

As an example, economic ties with the two traditional trade blocs, ASEAN and the EU, are to be resolutely accelerated. Additionally, the iconic Belt and Road Initiative will be vigorously enforced and funded.

At a recent top-level policy-making meeting in Beijing, China's leaders called for efforts to "fully bring out the advantages of China's large market and the potential of China's domestic demand, to establish a new development pattern, featuring domestic and international dual circulations that complement each other".

In the eyes of most pundits, this constitutes a re-orientation of policies for the country's future development.

With the outside world roiled in a protracted deep recession and outside demand ebbing to historic lows, it is natural for the policymakers to shift the gear toward driving domestic economic growth. That China's second-quarter GDP expanded 3.2 percent, from a 6.8 percent slump in the first quarter, is a testament to China's domestic market prowess. To control a sudden outbreak of COVID-19, the country was ordered to lock down in most of the first three months of the year and business activity came to a standstill.

The lockdown has helped China contain the contagion and set the basis for an economic restart. Chinese economists predict that second half-year GDP growth will reach more than 4 percent. However, this growth won't be satisfying.

Obviously, policymakers want a higher and healthier growth rate in the coming five to 10 years. The new "inner circulation" mantra is born.

How to pursue the new policy? First, the government will maintain its elevated investment in infrastructure, including reservoirs, rural amenities, urban subways and inter-city transit systems, high-speed expressways and railroads, 5G base stations and new and clean energy sources.

Secondly, Beijing is expected to confirm new policy guidelines to raise income levels of workers in all industrial and service sectors, to empower Chinese consumers to buy more. Constantly enlarging and enriching the middle class is the fundamental basis for operating "inner circulation".

Thirdly, China will be steadfast in strengthening its modern technology levels and never give up manufacturing the world's most advanced industrial products for its vast consumers. For instance, the Chinese people are avid lovers and consumers of the world's most advanced mobile devices, electric cars and AI-powered robots. A huge market, as large and energetic as China, will generate sufficient funds for non-stop technology research and innovation.

Beijing should always provide firm support to Chinese firms working for technology advancements, with favorable policies attracting the best talent and capital to the sector.

The recent successful listing of the country's largest semiconductor foundry, the Shanghai-headquartered SMIC, in the A share market is strong evidence of such government support. Additionally, Beijing could continue to facilitate the return of New York Nasdaq-listed ADR (American Depositary Receipts) companies back to China's own stock markets.

A vibrant Chinese stock market studded with listings of world-grade technology enterprises will surely add to the market's width, depth and liquidity, which also benefits the "inner circulation" of China's financial market investors.

The Trump administration has recently ratcheted up its attacks on Chinese technology giants including Huawei, Bytedance and Tencent, to blunt China's technological rise. Perhaps the "dual circulation" policy may prove to be a useful weapon in quashing the US government's bullying.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn

Posted in: EXPERT ASSESSMENT