China's investment sharply down in Australia amid rising bilateral tensions

By Chu Daye Source: Global Times Published: 2020/9/14 21:03:40

Beijing-Canberra tensions continue to escalate

A face mask-clad woman passes a mural in the Melbourne suburb of Prahran, Australia on Thursday. Melbourne is experiencing long harsh lockdown rules as it battles a second wave of COVID-19. Photo: AFP

Australia successfully shut its door to Chinese investment, which has fallen to a fraction of its peak two years ago, Chinese analysts said on Monday in response to a study released on Sunday.

They predict Chinese investment in Australia will further drop amid rising political and trade tensions between Beijing and Canberra, impeding Australia's economic recovery from the COVID-19 pandemic.

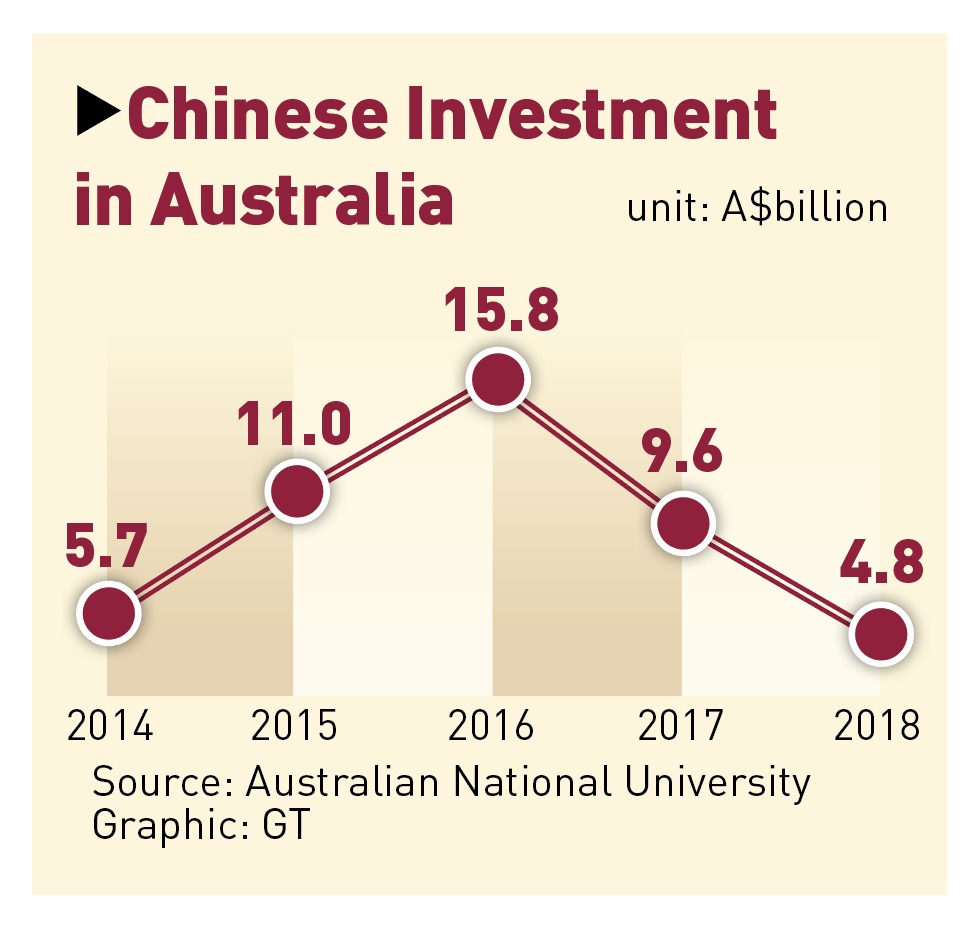

According to the report by the Australian National University, Chinese inbound investment has declined sharply from A$4.8 billion ($3.49 billion) in 2018 to A$2.5 billion in 2019. At the peak in 2016, Chinese investment was A$15.8 billion.

ANU's Peter Drysdale, who led the research, said Australia was experiencing a precipitating fall in investment since 2017.

Graphic: GT

The findings were in line with a June report by KPMG and the University of Sydney showing that Chinese investment in Australia in US dollar terms fell 62.2 percent during 2018-19 to $2.4 billion.

In 2017, Australia introduced a controversial foreign security law aimed at checking "foreign influence" in the country.

Chinese analysts said the US is increasingly requiring its allied countries that take a ride on its economic prosperity to show their loyalty, and Australia has been an active player. Its move to curb Chinese investment has been one of its major acts to please the US.

Yu Lei, a chief research fellow at the Research Center for Pacific Island Countries at Liaocheng University, predicted Chinese investment to Australia will contract further, given that the Scott Morrison government's anti-China policy won't shift this year.

"Leading political figures in Australia are politicizing and demonizing Chinese investment in Australia, making investment subject to geopolitical struggles," Yu told the Global Times.

Graphic: GT

Most recently, the Australian government killed an investment deal between Chinese dairy firm Mengniu and Australian brand Lion. The move was also believed to be under the influence of US business operating in the country.

"US companies have invested heavily in Australia and they don't want their vested interests and profits to be threatened by Chinese entrants," Yu said, noting that cumulative investment by US companies in Australia is about A$1 trillion while that of the Chinese never exceeded A$60 billion.

Yu said the mining sector is an example. "Many mines are owned by US investors, they don't want Chinese competition."

Mining has been one of the key areas absorbing Chinese investment, according to the ANU report. The sector attracted A$10.42 billion during the five years between 2014-18, trailing behind only real estate, which absorbed A$11.32 billion.

Liu Qing, director of the department for Asia-Pacific security and cooperation at the China Institute of International Studies, said that the plunge in Chinese investment foreshadows declining trade, although the latter was still at a record high level, protected by various long-term commercial contracts.

"What we will see is that along with rising political risks in Australia, Chinese companies and consumers will vote with their feet. Driven by risk aversion and consumer sentiment, they will punish ungracious suppliers," Liu told the Global Times on Monday.

The ANU report comes amid rising trade tensions between the two nations, with China placing tariffs and restrictions on Australian products, including beef, barley and wine.

Australia's move to close its doors on Chinese investment will bode ill for its beleaguered economy amid the COVID-19 pandemic. Australia's GDP fell 7 percent in the second quarter and the situation won't get better with China warning its tourists and students about the danger of going to the country.

Song Wei, associate research fellow at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times on Monday that Australia could still be a favorable investment destination if the Australian government could discard its protectionism and geopolitical mindset.

Newspaper headline: Investors shun Australia

Posted in: INDUSTRIES,ECONOMY