Alibaba posts strong Q2 revenue growth

By GT staff reporters Source: Global Times Published: 2020/11/5 20:23:40

Ant IPO woes could smack of trouble for the tech giant

Alibaba

Graphics: GT

Chinese e-commerce giant Alibaba, which launched the nation's annual Singles' Day shopping carnival, on Thursday posted very strong revenue for the past quarter, as the COVID-19 outbreak turns out to have amplified the online spending power of the nation's internet savvy consumers.

Still, the Chinese dominant e-commerce platform is shown to be shrouded in unease, as its fin-tech offshoot Ant Group's planned IPOs in the Chinese mainland and Hong Kong were put on hold, amid tightening regulatory moves.

With the shock suspension of Ant's IPOs, initially planned for Thursday, spelling out a clearly tougher supervisory stance on online micro-lending - a pivotal part of Ant's fin-tech strength - concerns have emerged over the regulatory impact on the entire Alibaba ecosystem.

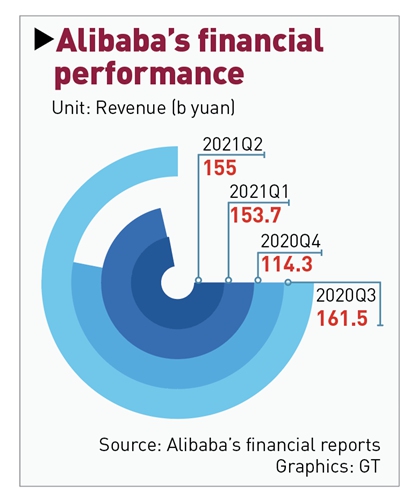

In its fiscal second quarter ended on September 30, Alibaba's revenue jumped 30 percent to 155 billion yuan ($23.44 billion), slightly above market expection. The company has 881 million monthly active users in the second quarter, according to its fiscal disclosure.

The double-digit growth was partly fueled by a boom in online shopping amid the COVID-19 epidemic curbs, analysts said. They stressed that the jump in revenue mirrored a robust consumption rebound in China since the second quarter, as the country steadily rebooted its economy and factories restarted humming.

China's economy recorded a 4.9-percent expansion in the third quarter, official data showed, and is widely estimated to become the only major economy with a growth trajectory for the full year.

Prior to the listing postponement that was made public on Tuesday ahead of the US market opening, Alibaba's shares in the US had soared over 50 percent since May, outperforming a 20-plus percent gain for its US-rival Amazon.

The stunner that shaved more than 8 percent off Alibaba's shares on Tuesday, however, signals more trouble down the road.

The business restructuring of Ant Group, on the heels of a tightened financial environment, could cast shadows over Alibaba's financial performance in its third and fourth fiscal quarters, and weaken the competitiveness of the tech giant's ecosystem, some analysts pointed out.

Alibaba holds a 33-percent stake in Ant.

"We, together with Alibaba, are building the digital infrastructure for commerce and services," according to Ant's stock prospectus. "We have created an ecosystem around our platform that consists of consumers, merchants, financial institutions, third-party service providers, strategic alliance partners and other businesses."

Such collaboration might be redefined because Ant, the operator of Alipay, a super payment app underpinning the Alibaba offshoot's fin-tech prowess, is set to be subject to the same kind of stringent regulation as its traditional banking counterparts.

A toughening US regulatory environment for cross-sector operations especially by Big Techs could serve as a template for efforts to avoid excessive fin-tech innovations from burdening the regulatory framework. It could also prevent technology giants from taking advantage of their data and user base to gain an unfair edge, said an industry observer who requested anonymity.

This is especially true for Ant, whose media functionality facilitates its penetration into the market. Ads for two of its major consumer finance products - Huabei and Jiebei - were almost everywhere before the IPO suspension, the industry observer told the Global Times, noting that such marketing practices involving loan services are strictly regulated in many markets.

Tighter scrutiny that tends to put fin-tech services and traditional financial offerings on an equal footing will be inevitable, the observer said.

Draft rules for online micro-lending released on Monday are therefore described as a "tightening the ring" for Ant, putting a dent on its market valuation and the purchasing power of many of China's online shoppers who have relied on either Huabei or Jiebei for payments.

"Alibaba's business growth rate will slow down significantly. But the extent to which it slows also hinges on how it carries out the new regulations," Fang Xingdong, director of the Consortium of Internet and Society at the Communication University of Zhejiang, told the Global Times on Thursday .

Fang predicted that the connectivity between Alibaba's online business and Ant Group's financial service could dwindle in the coming months. Usually, consumers directly use Alibaba's financial services, such as Ant Credit Pay, after placing orders on its shopping platforms.

During an urgent company meeting after the dual listing suspension, Ant Group executive chairman Eric Jing Xiandong lamented that "the past few days were the darkest and most difficult in the history of Ant Group and Alibaba," according to media reports.

Analysts noted that in extreme cases, the two businesses could be separated, which in turn would discourage some shoppers, especially young, cash-strapped shoppers.

Fang also questioned whether Ant Group's collection of personal information has gone beyond the scope of users' authorization.

He stressed the importance of technology in sustaining Ant Group as well as Alibaba's future growth. "It is of vital importance for the titan to return to the normal model of a tech firm. Finance could be an extension of its business, but should not become a main business because it could pose an evolving risk to China's financial system," Fang noted.

While that won't reshape the landscape of China's e-commerce platform, some analysts noted that it will speed up the growth of Alibaba's competitors, such as JD.com and Pingduoduo.

Pingduoduo, with its super-affordable offerings, has become a particularly worrying rival to Alibaba. The social e-commerce platform has been a rising star among US-listed Chinese online retailers. Pingduoduo's shares rallied 22.54 percent this week as of Wednesday on top of a surge of 191.54 percent for the year.

The gross merchandise value of Pinduoduo, which is scheduled to announce its quarterly earnings on November 12, one day after the Singles' Day shopping spree, was forecast to jump 69 percent year-on-year to 421 billion yuan in the third quarter, according to Goldman Sachs.

The number of Pinduoduo's monthly active users is slated to top 700 million for the first time during the third quarter, further closing in on Alibaba.