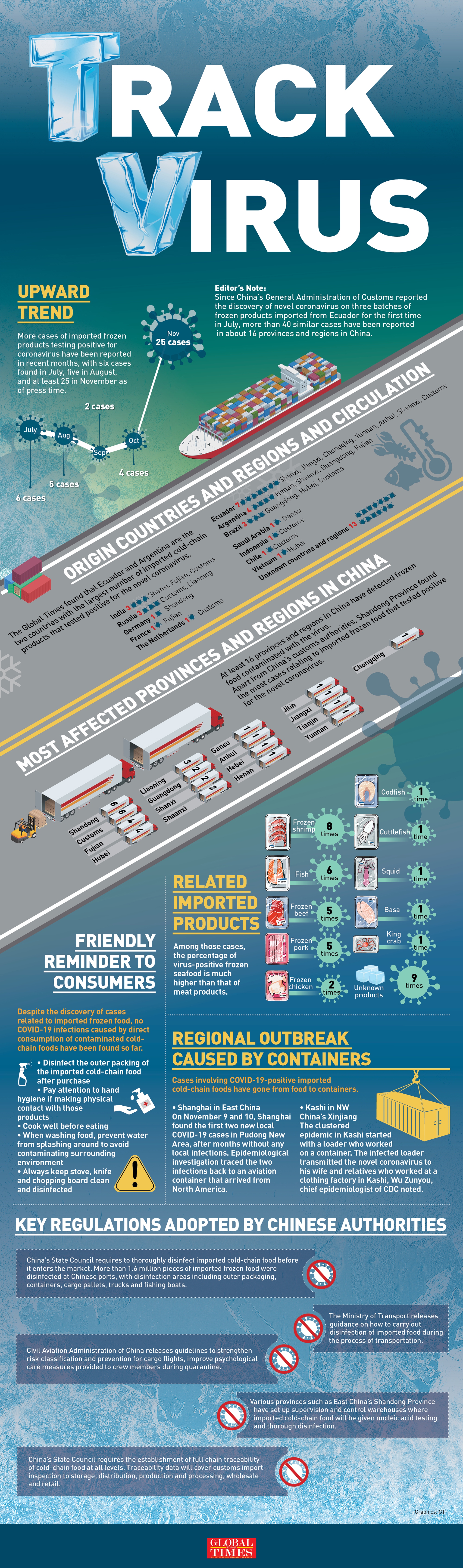

Almost a year ago, COVID-19 cases that were first reported from Central China’s Wuhan brought the entire country together to beat the deadly virus, underscoring the country's unparalleled resilience as the world still continues to struggle to rein in the pandemic. However, even for a country that claimed a strategic victory in the battle, the risk of a virus resurgence remains real and in different forms. With new cases linked to imported cold-chain foods and cargoes reported in many major hubs across the country, the spotlight is focused on how to prevent the new risk from cold-chain food imports and virus-carrying cargoes, particularly with cold winter temperatures, while ensuring the country's massive trade is not disrupted. To investigate that risk and China's response, Global Times reporters visited logistics centers, warehouses, ports and wholesale and retail markets in cities including Tianjin, Wuhan, Shanghai and Beijing, and talked with local officials on how to deal with the challenges posed by both imported cold-chain products and international freight and why China's efforts to minimize the risks of infection from cold-chain and cargo transportation are necessary.

After employees from international delivery firms UPS and FedEx tested positive for COVID-19 at Shanghai Pudong International Airport, one of the busiest airports in the world, cargo operations are continuing as normal, but freight operators and staff members have stepped up preventive measures, especially as two confirmed patients were both exposed to a contaminated container from North America. The latest outbreak in Shanghai flashed a warning sign for the country that has successfully reined in the epidemic over the past year, but which remains vigilant over new risks of the virus resurging from overseas via cold-chain and other cargoes. But in stark contrast to the massive mobilization and response when cases emerged almost a year ago, the country has been clearly steadfast and calm in face of the new risks - a show of confidence from the hard-fought victory so far.

While all employees on the ground at the Pudong airport were geared up with white and blue protective suits, those who need to enter the area must provide a negative nucleic acid test result and follow strict entry protocols.

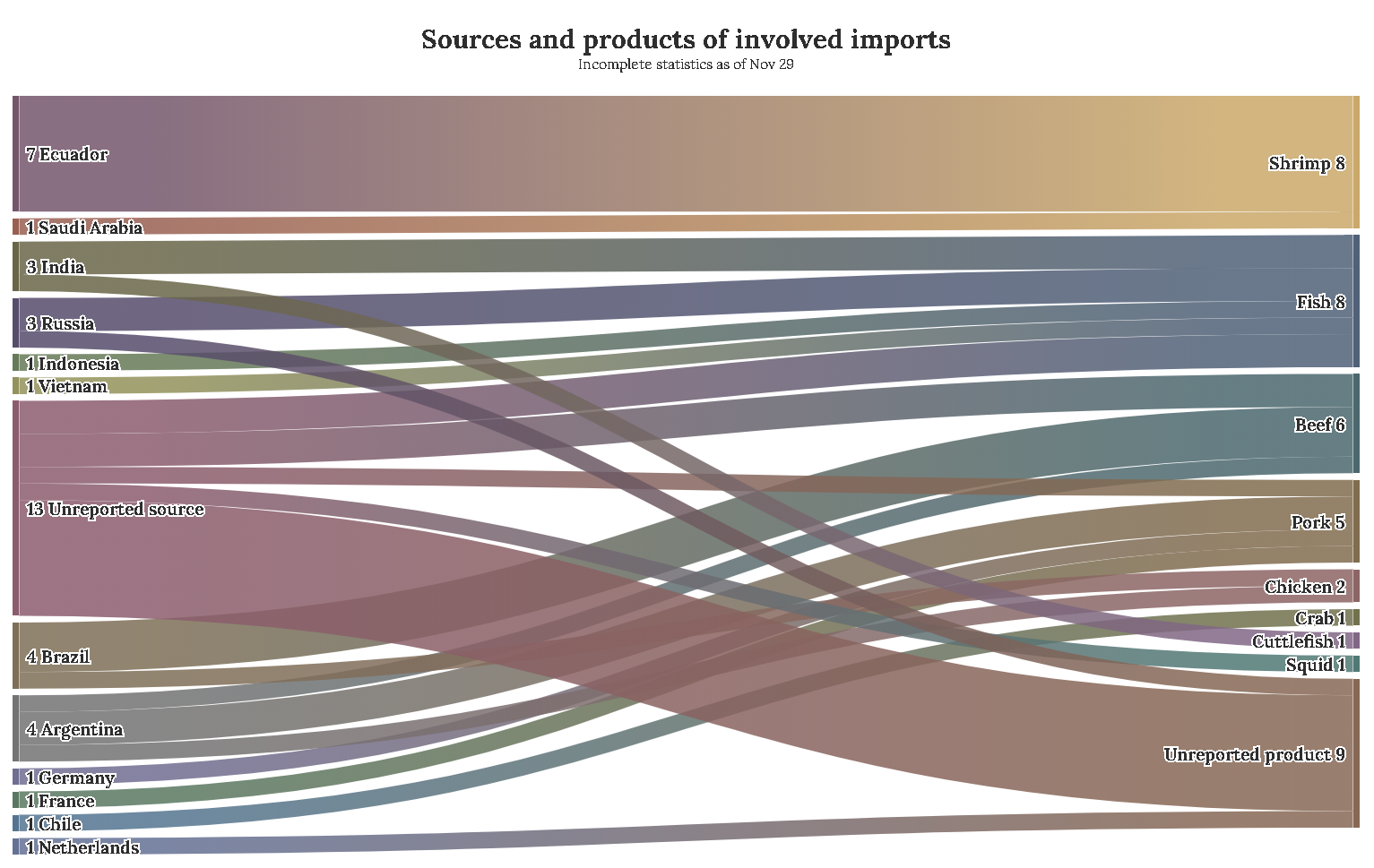

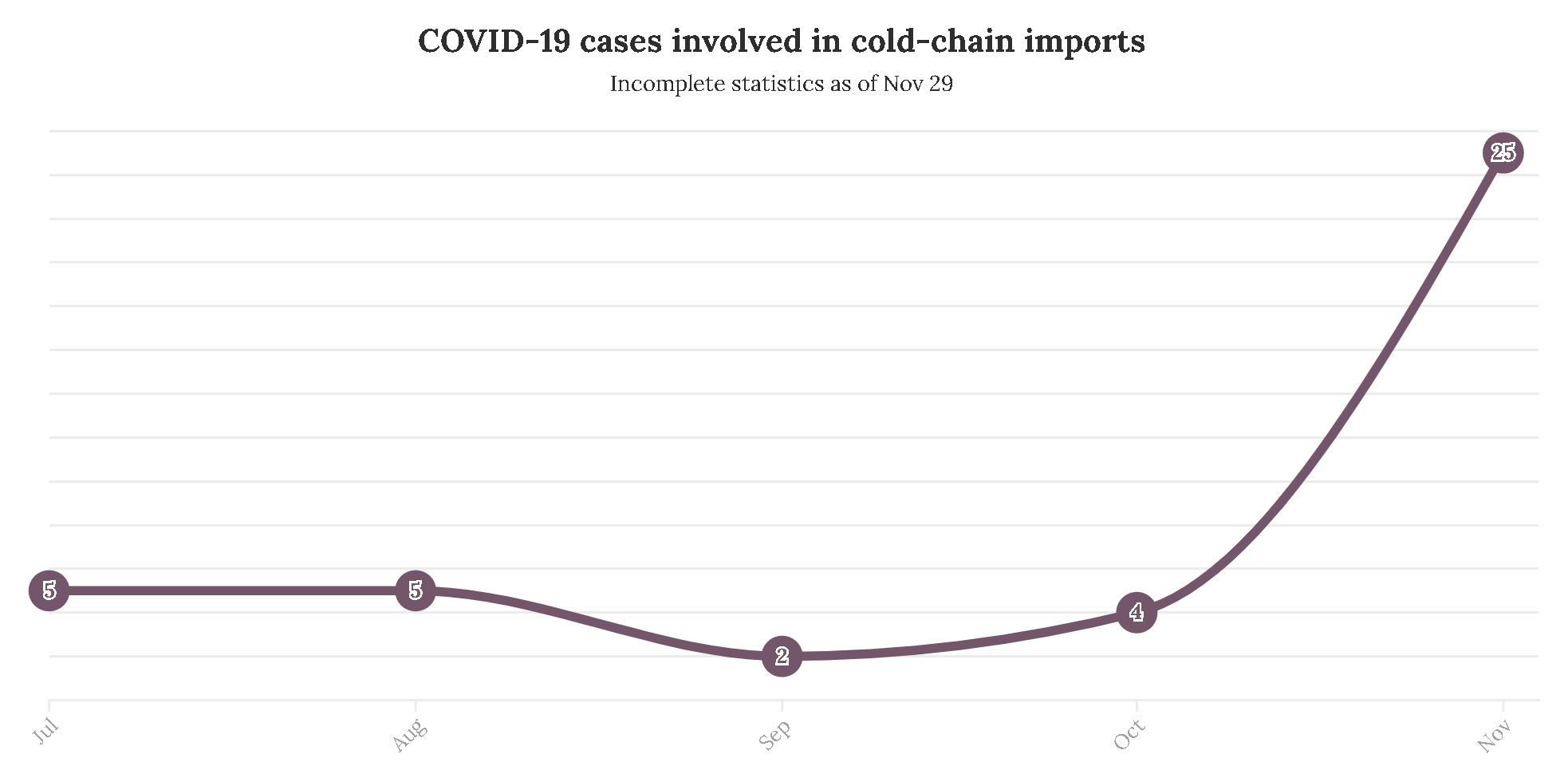

The latest sporadic outbreak at the airport occurred when China's top health authority found that the number of cases involving COVID-19-positive imported cold-chain foods has increased significantly, affecting more areas and products, such as seafood, meat and poultry. The infections have also extended from cold-chain food to containers.