A bigger cut

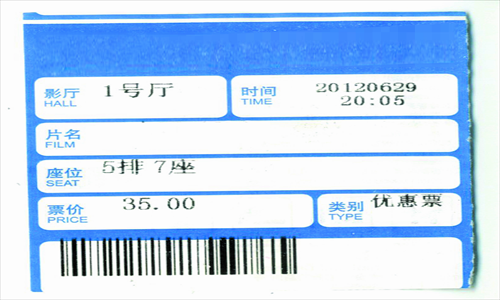

Photo:CFP

Huayi Brothers and Stellar, two film production companies in China, reached an agreement Sunday with cinema chains on flexible division of box office revenue for their films, offering a possible conclusion to the recent spat between China's leading film producers and cinema chains over the division of box office revenue.

Huayi's Back to 1942 and Stellar's The Last Supper, two big-budget films, will be shown starting Thursday as scheduled, marking the start of the new-year peak season for the cinema business, which will last for about two months.

Huayi agreed to divide revenue based on box office revenue and Stellar agreed to revenue division based on the screening period.

The latest progress in the dispute came with the collapse of an alliance of the country's five largest producers, namely China Film Group Corp, Huayi Brothers, Bona, Stellar and Enlight. On November 13, they had called for a rise in their share of the box office from 43 percent to 45 percent.

The request was turned down on November 19 by large cinema chains including Wanda and Beijing New Film Association, and they threatened not to show the producers' films unless they backed down.

China Film, Bona and Enlight still hope to get a larger share, but analysts believe the flexible revenue division agreed by Huayi and Stellar offers a new negotiation model for China's film industry, and that it can help solve the three producers' dispute with the cinema chains.

Problems remain in the sector, but a new subsidy policy announced by the State Administration of Radio, Film and Television (SARFT) may help to ease the tension.

Tough all round

In their joint notice, the five production companies said they were facing "rising filmmaking costs, caused by use of advanced filmmaking technologies and climbing labor costs."

However, the cinema chains and individual cinemas, collectively called film exhibitors, said that they too face rising costs. They have invested in advanced 3D projection technologies, and labor costs and rent prices are also rising. They said many cinemas have suffered from losses in the last two years.

The whole film industry is dependent on box office revenue, which saw a slowdown in growth in 2012, and this is one of the factors behind the dispute, Yang Shuting, an analyst with entertainment industry consultancy EntGroup, told the Global Times Friday.

The commercial model of the domestic film industry is not mature, with almost all income coming from box office revenue, said Chen Shaofeng, deputy director of the Institute of Cultural Industries at Peking University. In the US, box office takings account for less than one-third of a film's total revenue, Chen noted, with the rest coming from DVD sales and merchandising.

An increase in the number of Hollywood blockbusters being shown in China has also squeezed the market for domestic film companies. Few Chinese films have met their expected box office targets this year, so they have pinned their hopes on the upcoming golden season, Lu Shaoke, a film critic, told the Global Times.

According to a deal signed in February between China and the US, China agreed to lift its limit on the number of Hollywood movies to be screened per year in China from 20 to 34, starting from this year.

According to data from the SARFT, the industry regulator, the total box office revenue in China during the first three quarters rose 27 percent year-on-year to 12.18 billion yuan ($1.96 billion), slower than the 28.9 percent growth rate in 2011 and 63.9 percent in 2010.

Chinese films were also in a weaker position, accounting for only 40 percent of box office revenue in the first nine months of 2012, down from 53.6 percent in 2011.

According to EntGroup, there has only been one Chinese film among the top 10 this year in terms of box office revenue, and four among the top 20.

Dividing the spoils

In terms of the box office revenue for domestic films, 3.3 percent is taken up by sales tax; 5 percent is paid to the SARFT; film producers get 38 to 45 percent; distributors get 4 to 6 percent; and cinemas get up to 50 percent, Yang said.

When China began the revenue share division system in 1995, just 35 percent went to producers.

Producer Zhang Weiping, who recently parted ways with famous director Zhang Yimou, succeeded in raising the share for producers three times since 2002, eventually getting a share of 43 percent after tax in 2009, with exhibitors getting the remaining 57 percent.

The division of revenue will be more in favor of producers in future, said Yang, as the essence of the film industry is content.

The SARFT was not available for comment, but it said in 2009 that production companies should get no less than 43 percent of the box office revenue. It also said in 2011 that cinemas should get up to 50 percent of the revenue.

Film exhibitors get a higher share than producers at the moment, because of the nation's push to build more new cinemas, Yang said.

According to data from EntGroup, China now has 3,293 cinemas nationwide, with 11,835 screens, and the cinema market in big cities has reached saturation point, she said.

Such disputes are likely to get worse, as the large number of screens in big cities will hit revenues for exhibitors, Chen from Peking University told the Global Times.

Problem solving

The SARFT released a notice on November 22, stating that production companies using high technology such as 3D or IMAX can get subsidies ranging from 1 million yuan to 10 million yuan, based on the films' box office revenue.

Cinemas will also get a bonus from the SARFT if their annual box office revenue from showing domestically made films grows from the year before or accounts for at least 45 percent of their total revenue. The two notices apply to all domestic films shown since January 1, 2012.

However, analysts said more fundamental solutions are still needed to avoid a renewal of the dispute between the producers and cinemas.

Chen said that most Chinese film producers are losing money and suggested tax cuts for film producers to avoid a decline in the sector.

Yang from EntGroup also suggested that cinemas could cut merchandising prices, as that would boost sales.