HOME >> BUSINESS

JD.com Inc narrows loss, stresses cooperation with Yonghui Superstores

By Global Times – Reuters Source:Global Times Published: 2015-8-10 0:38:02

Deal part of e-commerce giant’s strategy to create a new business model

People shop in a Yonghui supermarket in Shanghai. Photo: CFP

JD.com Inc, China's second-largest e-commerce site by sales, has released its financial report for the second quarter of 2015 and announced investment into an off-line supermarket.

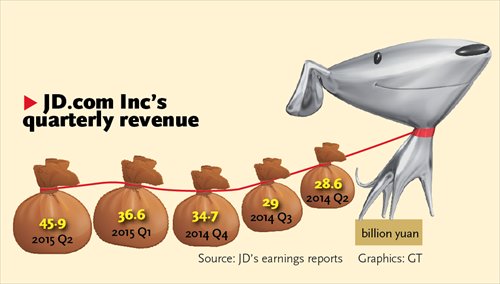

Over the weekend, JD reported a 61 percent year-on-year rise in quarterly revenue, topping expectations, powered by a jump in the number of shoppers and goods bought on its platform.

Second-quarter revenue of 45.9 billion yuan ($7.4 billion) exceeded an average estimate of 44.45 billion yuan from Reuters.

But the company's growth rate is expected to slow in the third quarter. JD said it sees third-quarter revenue of 43.2 billion to 44.7 billion yuan, which would be up 49 percent to 54 percent from the previous year.

JD, a distant rival to Alibaba Group Holding Ltd, is investing heavily in off-line operations to complement its Internet platform.

The company is taking activities such as warehousing and deliveries into its own hands.

This business model, similar in style to that of US-based Amazon.com Inc, has taken a toll.

JD made a net loss of 510.4 million yuan, shrinking only slightly from the year-earlier 583 million yuan despite the leap in revenue.

The catalyst for that jump was the 118 million annual active customer accounts on JD in the 12 months ended June 30, up 72 percent from the same period a year earlier.

Those customers drove an 82 percent jump in the total value of products sold on the company's platforms in the quarter, to a total of 114.5 billion yuan.

JD also said it will buy 10 percent of Chinese supermarket operator Yonghui Superstores Co Ltd for 4.31 billion yuan, with the right to nominate two directors to the board.

Cooperating with Yonghui is part of JD's online-to-offline (O2O) plan, which is of key strategic significance compared with other O2O projects, JD's CFO Huang Xuande said on a post-earnings conference call, according to media reports.

Yonghui is one of China's top providers of fresh products but apparently its 350 stores cannot cover the national market, Huang said.

As a result, there is ample potential for the two sides' cooperation, Huang said, noting that Yonghui has suppliers and inventories while JD has a wide logistics network.

JD has sought to create a new business model by combining suppliers with online platforms to provide customers with a more convenient and timely service, Liu Xuwei, an industry analyst with market research firm Analysys International, told the Global Times on Sunday.

JD has hired thousands of part-time delivery staff to operate a wider delivery network, which will lower the logistics cost and make the delivery process more efficient, Liu said.

As of Friday, there were more than 50,000 part-time delivery staff registered on JD's logistics platform, with increasing orders, Liu Qiangdong, founder and CEO of JD, said on the conference call.

These part-time staff mainly carry orders for daily necessities from nearby stores to customers' doors, which is a cooperation project called "JD to your front door" between JD and off-line supermarkets.

Although fresh food usually cannot provide high profit margins, customers buy it with high frequency, Liu said, noting winning customers on fresh food purchases will lead a large amount of visits to JD's platform, which is crucial to e-commerce companies.

JD also attracted many visitors from social media platforms such as Tencent's WeChat and QQ.

More than 20 percent of JD's new customers gained in the second quarter came from the two platforms, Huang said.

Posted in: Companies