HOME >> BUSINESS

Vanke ‘open to talks with Baoneng’ on takeover

By Wang Cong Source:Global Times Published: 2015-12-23 21:28:02

Comment a sign of compromise from Wang Shi: analysts

Photo: CFP

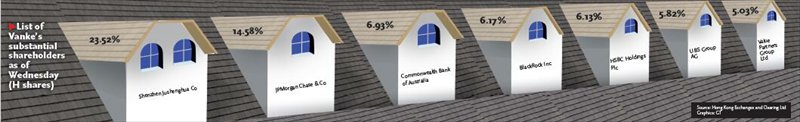

List of Vanke's substantial shareholders as of Wednesday (H shares)

China Vanke Co, the nation's largest residential real estate developer by sales revenue, said Wednesday that it's willing to keep the door open for talks with Baoneng Group and asked its biggest shareholder to "carefully review" the risks of changing Vanke's culture and operating style.

In a statement, Vanke said it welcomes all investors to buy its shares, but it does not welcome any move by Baoneng to acquire or control Vanke because the two corporate cultures and operating styles are "incompatible," according to domestic news portal sina.com.

The statement came after Vanke Chairman Wang Shi said during a speech at a Credit Suisse event on Wednesday morning that Vanke will not pursue a strategy known as a "poison pill" to fend off a possible takeover.

Market participants previously speculated that Vanke might use a poison pill strategy to thwart a potential takeover by Baoneng.

A poison pill strategy is a move by a company to block a hostile takeover by issuing more shares at a lower price to dilute the bidder's interest in the company and increase the cost of a potential takeover substantially.

Analysts said that Wang made the comment because he is faced with limited options and growing public pressure.

"It's just not possible to use a 'poison pill,'" said Xu Guangfu, a senior analyst at Shanghai Yinji Asset Management Co.

Such a move would require a vote by major shareholders, and given the current structure, it won't pass, Xu told the Global Times Wednesday.

Moreover, there is a "relatively negative view" among the public about Wang's outspokenness on the issue, said Song Ding, a market analyst at the China Development Institute. He said issuing additional stocks would result in a share price drop, which investors won't like.

As Baoneng began to build its stake, Wang questioned its credibility and financial capacity. He even reportedly called Baoneng executives "barbarians" and said they "lack credibility."

However, Wang took a much softer tone during Wednesday's speech, when he said that Baoneng, China Resources and Vanke are all part of the Shenzhen corporate "family" and should not engage in infighting, according to the 21st Century Business Herald newspaper.

Wang could not be reached for comment on Wednesday, and a media relation representative from Vanke didn't offer relevant information to the Global Times by press time.

But Wang's Wednesday comments stood in stark contrast to those he made earlier, and they show he's willing to compromise, Song said.

Vanke suspended the trading of its shares on the Hong Kong and Shenzhen stock exchanges Friday, the company said in statements to the exchanges, citing a material asset restructuring that could involve new shares and asset purchases.

Speculation then emerged that the company would issue additional shares to block Baoneng, a privately owned property developer and financial services group, from making an unsolicited takeover.

Currently, Baoneng is holding a 23.52 percent stake in Vanke.

Xu, the analyst, said it is likely that the two companies will reach an agreement soon because of the scale of capital involved.

However, details are uncertain because some major players haven't expressed a position on the issue yet, including Baoneng Chairman Yao Zhenhua, Song added.

Adding to the intrigue surrounding Vanke are moves by another two major shareholders to increase their stakes in the real estate giant.

Anbang Insurance Group, a leading Chinese insurance and financial firm, has increased its stake in Vanke to 7.01 percent from 4.5 percent in the last three weeks, while Value Partners Group has raised its stake to 5.03 percent, according to the Hong Kong Exchanges and Clearing Ltd.

Song said moves by Anbang and Value Partners could complicate things but the overall direction is "pretty much set" and that Baoneng would proceed with its plan to take over Vanke.

Posted in: Companies