Chinese firms upbeat over mobile processor prospects

Huawei’s huge investment paying off, Xiaomi joins fray

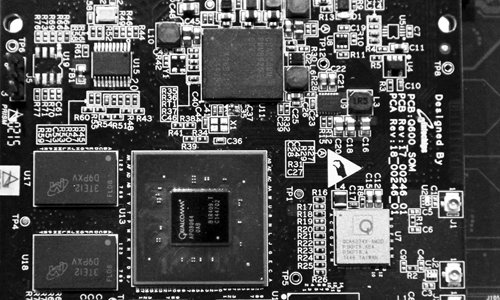

A Qualcomm Snapdragon 600 processor File photo: CFP

The world's smartphone landscape is expanding at a rapid pace and so is the technology powering such gizmos.

Nowadays, a mobile processor is even capable of dethroning processors found in PCs. Still, such expansion in a market dominated by US chip giant Qualcomm is filled with competition, which has been made even more evident recently with the emergence of economical chips produced by Chinese firms.

A mobile processor, also known as a system-on-a-chip (SoC) is at the heart of every smartphone. It is designed to support the running of applications, including graphics processing, memory management and multimedia decoding.

Mobile processors from Huawei Technologies Co are becoming increasingly popular with the public. In November 2015, Ai Wei, a senior vice president at Huawei, said at a press conference held in Beijing that the company shipped about 50 million in-house Kirin SoCs, which were adopted by more than 50 percent of 4G plus-enabled smartphones in China.

Widely used in Huawei's major phone models, including the popular high-end Mate 8 phone, the latest HiSilicon Kirin 950, which debuted in November 2015, is believed to boast a sharper performance than some comparable middle-range phones produced by Qualcomm and Samsung.

Even when compared to Qualcomm's premium quad-core Snapdragon 820, Kirin 950, a 16nm octa-core chipset based on ARM big.LITTLE technology, can theoretically outperform them if the user has large multi-tasking requirements.

On Wednesday, the company launched the all-new Kirin 960 SoC, which is expected to run on the next generation of Huawei flagship smartphone Mate 9.

As of June this year, shipments of Kirin SoCs exceeded 80 million, Ai was quoted by media reports as saying.

"The rise of Kirin SoCs can become a significant and distinctive edge held by Huawei smartphones in competing with Apple and Samsung," Wang Yanhui, secretary-general of the Mobile China Alliance, told the Global Times on Monday.

The Shenzhen-based company, which built its fortune on telecommunications equipment manufacturing, led China's smartphone market with more than 17 percent of market share in the second quarter of the current year, data from International Data Corp (IDC) showed.

IDC's senior market analyst Tay Xiaohan attributed Huawei's success in part to product differentiation.

This may explain why its arch-rival Xiaomi Inc is also planning to develop its independent chipset. The news has widely circulated online that the Beijing low-budget phone maker has completed its SoC. Pictures leaked by some Web users showed Xiaomi's in-house processor called "pinecone," running on its new smartphone model, which appears to be a Mi 5C, domestic tech news portal it.sohu.com reported on Sunday.

The company refused to comment on the matter when contacted by the Global Times.

Xiaomi is expecting to reduce its reliance on Qualcomm so as to lower its smartphone costs, said Wang, noting that "the purchase of Qualcomm processors usually accounts for most of the phone costs."

However, the analyst does not seem all that optimistic about Xiaomi's in-house chipset business.

Unlike Huawei, which has already devoted years of efforts to reaching current levels in the industry, Xiaomi and many other Chinese handsets are still going to rely on Qualcomm in the coming two years, said Wang.

"The costs of independent processors are very high. If there are sales of less than 200 million units, the chip is not a profitable business," he noted.

The money Huawei pours into R&D each year is equivalent to about of 400 A-share listed firms, according to media reports.