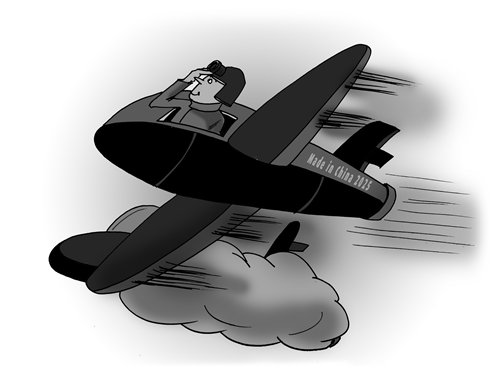

Illustration: Luo Xuan/GT

Starting at the end of last year, the difficulty of achieving the "Made in China 2025" initiative increased, with pressure from the US trade provocation and the domestic transformation and upgrading upgraded. To get to 2025, eight years lie ahead. In that time, China's manufacturing sector faces a protracted war that's similar to the Anti-Japanese War (1937-45) it fought.

To prepare for this battle, major enemies hindering the Made in China 2025 target should be identified by China's manufacturing industry.

We should clearly realize that China is still a laggard when it comes to core technology at the top of the manufacturing global value chain, especially in frontier industries such as commercial aircraft, semiconductors, biological machines, specialty chemicals and system software.

Technology barriers from abroad should also be noted. As developed European countries and the US are becoming more dissatisfied with China's scientific and technological rise, they're accusing China of obtaining advanced technology from them through subsidies, forced technology transfers, mergers and acquisitions and cyber theft to rapidly expand its independent research and development capabilities through assimilation, absorption and innovation of those technologies.

Despite economic cooperation with China, these countries have not only severely restricted China's access to high-tech fields, they have also periodically used economic sanctions to hinder the implementation of China's innovation-driven strategy. Finding ways to clear away these blocks represents an unavoidable task for Chinese manufacturing to thrive.

There's also sluggishness when it comes to policy implementation in China itself. In regions with different levels of economic development, there are differences in terms of institutional competitiveness in various aspects such as investment, financing and policies for the development of manufacturing.

The more developed areas in China are making more progress, while in some less-developed places, the business environment has not been fundamentally improved for a long time. These regions' conservative and backward ways of thinking are the real "enemy" holding back the development of manufacturing in these regions for a long time.

In recent years, China's manufacturing has gradually shed the "low-end" label. As more Chinese brands modernize their image, some sections of the public are becoming overly optimistic.

On the one hand, we should affirm China's industrial achievements of the past two decades. But on the other hand, when positioning China's manufacturing industry on the global value chain, objectivity is crucial.

The key to achieving the goals of Made in China 2025 lies in utilizing the four major advantages of China's manufacturing industry.

First, the Chinese government is one of the most active in the world in supporting the manufacturing industry and giving it genuine priority when it comes to policies. This indicates the promising future of the country.

From the central government down to local governments, most officials bring a sense of urgency to industrial development and innovation. They are committed to simplifying examination and approval procedures, improving work efficiency and optimizing the business environment.

Second, the technological advantage of the entire industry chain is a major reason why China's manufacturing industry will be favored for a long time. In the past 40 years, China has built up a complete industrial system. No country can compare with China in terms of the scope and integrity of the industrial chain.

From low-end production and middle-range assembly to the advanced level; from branding, procurement, marketing and services to innovation; from resource integration to technology conversion and further to information supply and demand, China has absolute competitiveness.

Third, China's manufacturing industry has a talent advantage, which means a bright future. China is unlike European countries and the US, where most of the best students have devoted themselves to finance, business management and the law in the past 20 years.

Since China expanded university enrollment in the late 1990s, about 5 million outstanding graduates in science and engineering have emerged each year, creating a reserve of 80 million to 100 million people with industry-related skills.

Fourth, the size of China's market itself is an important guarantee for the future of the manufacturing industry's global leadership. As consumption has become the primary force for economic growth, China is likely to surpass the US as the world's largest consumer market this year.

In addition, the Belt and Road initiative has attempted to shape a new pattern of international connectivity, to form a more unified market dominated by China. All these factors are positive forces for China's role in global manufacturing development.

The author is the executive dean with the Chongyang Institute for Financial Studies at Renmin University of China. bizopinion@globaltimes.com.cn