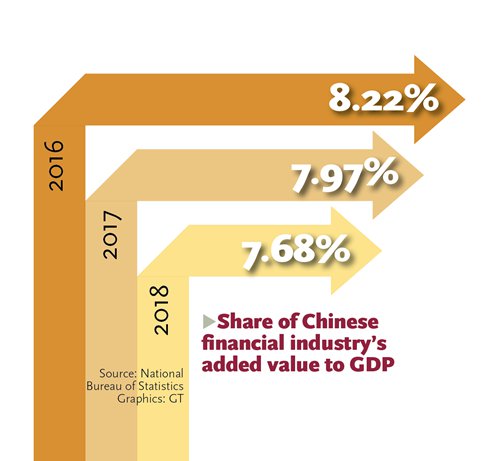

Share of Chinese financial industry's added value to GDP

China's GDP grew 6.3 percent year-on-year in the first half of 2019, slowing from 6.4 percent in the first quarter but falling within the annual target set by Chinese policymakers and surpassing those of other global economies.

Given persistent downward pressure from the China-US trade war and ongoing deleveraging efforts, Chinese officials and observers said the "stable, high-quality, sustainable and with great potential" growth shows the resilience of the Chinese economy, which is underpinned by an ever-expanding consumer market and a bounce back in investment.

In the second quarter of 2019, China's GDP grew 6.2 percent compared with the same period last year, 0.2 percentage points lower than the first quarter, according to data released by the National Bureau of Statistics on Monday.

The growth was the lowest in 27 years, but also within the 6-6.5 percent 2019 growth target range set by the Chinese government.

Chinese residents' disposable income went up 8.8 percent in the first six months of 2019.

China's first-half economy "performed within reasonable range" and has "sustained the momentum of progress in overall stability" despite headwinds from home and abroad, bureau spokesperson Mao Shengyong said at a State Council press conference on Monday.

Mao stressed the growth rate was "hard-won" as Beijing did not resort to a "flood-like" stimulus package to cope with the global slowdown and domestic structural problems.

Rather, policymakers cut taxes, reduced administrative fees and promoted gradual reforms to inject fresh vigor.

"The slowdown is very mild, not a cliff fall, and China's GDP growth is still relatively high compared with many other economies," Xu Hongcai, deputy director of the economic policy commission at the China Association of Policy Science in Beijing, told the Global Times on Monday. By contrast, the US GDP was estimated to grow 1.5 percent in the second quarter, according to a report by the Federal Reserve Bank of Atlanta.

China's GDP grew 6.4 percent in the first quarter, the fastest among major economies in the world, according to Mao.

Given persistent downward pressure from the China-US trade war and ongoing deleveraging efforts, Chinese officials and observers said the "stable, high-quality, sustainable and with great potential" growth shows the resilience of the Chinese economy, which is underpinned by an ever-expanding consumer market and a bounce back in investment.

In the second quarter of 2019, China's GDP grew 6.2 percent compared with the same period last year, 0.2 percentage points lower than the first quarter, according to data released by the National Bureau of Statistics on Monday.

The growth was the lowest in 27 years, but also within the 6-6.5 percent 2019 growth target range set by the Chinese government.

Chinese residents' disposable income went up 8.8 percent in the first six months of 2019.

China's first-half economy "performed within reasonable range" and has "sustained the momentum of progress in overall stability" despite headwinds from home and abroad, bureau spokesperson Mao Shengyong said at a State Council press conference on Monday.

Mao stressed the growth rate was "hard-won" as Beijing did not resort to a "flood-like" stimulus package to cope with the global slowdown and domestic structural problems.

Rather, policymakers cut taxes, reduced administrative fees and promoted gradual reforms to inject fresh vigor.

"The slowdown is very mild, not a cliff fall, and China's GDP growth is still relatively high compared with many other economies," Xu Hongcai, deputy director of the economic policy commission at the China Association of Policy Science in Beijing, told the Global Times on Monday. By contrast, the US GDP was estimated to grow 1.5 percent in the second quarter, according to a report by the Federal Reserve Bank of Atlanta.

China's GDP grew 6.4 percent in the first quarter, the fastest among major economies in the world, according to Mao.

China's GDP 2014-2018 and the growth target for 2019

Growth rate

In response to some Western media reports which cited China's 27-year-low growth rate as evidence for pessimism about its economy, Xu stressed that against the backdrop of China's economic upgrade and transformation, a stunning growth rate no longer speaks to China's economic potential.

"The essence of China's economy lies in its quality and how optimizing the structure has been powering its sustainable growth," Xu said.

The freshly released first-half data provides a clue on the improvement of China's economic quality, Xu believed.

For example, in the first six months of the year, high-tech manufacturing's added value grew 9 percent year-on-year, surpassing the average 6 percent growth of major industrial enterprises.

Chinese analysts also pointed out that if economic growth gets too fast during the ongoing economic transition, it would have side effects such as an industrial glut.

While the first-half narrative suggests a dwindling role for foreign trade in the Chinese economy as the bruising trade war bites, highlights include expanding consumption and stabilizing investment - partly the fruits of stimulus measures - and "mirror how indigenous demand put a floor for the domestic economy," Xu said.

In the first six months of 2019, China's retail sales rose 8.4 percent year-on-year to 19.52 trillion yuan, which is also 0.1 percentage points faster than the first quarter, bureau data showed.

Final consumption growth contributed 60.1 percent to China's economic growth, Mao said.

To shore up the economy since the beginning of 2019, Chinese policymakers have unveiled a bunch of counter-cyclical adjustment policies, including special bond issues and about 2 trillion yuan in tax and fee cuts.

Those measures have relieved the burden on private firms and enabled them to invest strategically in the future, Chinese analysts say.

The manager of a small packaging company in Shenzhen, South China's Guangdong Province told the Global Times that he expects to see a tax reduction up to 1 million yuan this year thanks to the cuts.

"I'm using the saved money to purchase high-end equipment to upgrade the production line," said the manager, who asked not to be fully named.

Manufacturing also rebounded in the first half, marked by 6 percent growth in industrial output. China's fixed-asset investment soared 5.8 percent year-on-year, 0.2 percentage points higher than the January-May period.

Second half outlook

Heading into the second half of 2019, China's consumption power will continue to stabilize its economic growth, Chinese analysts said.

And the effect of stimulus measures will be shown more clearly in the second half to improve GDP growth as long as the external trade environment stabilizes or improves, they argued.

Cheng Shi, chief economist of ICBC International, said in a note sent to the Global Times Monday that the genuine benefits of the tax cut will be released in the second half and about 51 percent of the dividends from the tax cut will be translated into consumer welfare, which in turn could drag down the consumer price index by 0.61 percentage points.

"The 6.3 percent growth rate in the first half has laid a good foundation for China to achieve its full-year growth target," Mao said. "China's stable economic fundamentals will not change in the second half. There is also plenty of leeway for policy maneuvers and a soaring consumer market."

The analysts predicted that China would roll out more policies in the second half to fend off economic slides, including further lowering the reserve requirement ratio and interest rate cuts.

"Chinese policymakers need to prepare for a worse trade situation, which may further weigh on the Chinese economy," Xu said. The biggest test for China at "rush hours" in the coming months, Xu said, would be how to stimulate domestic market demand, maintain a relatively loose credit environment but at the same time prevent systematic financial risks.