Chinese market too important for Canadian businesses to ignore: experts

Market too important for businesses to ignore despite external pressure

Customers wait in queue to enter a newly opened Canada Goose store in Shanghai on Tuesday. Photo: Xie Jun/GT

Canada Goose, Hatley, Factors Group - what do those names have in common? They are all Canadian companies that increased investment in China recently.

Those companies' moves show a warming-up trend in bilateral economic relations between China and Canada, as Canadian enterprises value business opportunities in the Chinese market and won't stop their investment plans because of external pressure, experts said.

Canada Goose, for example, made a choice to continue exploring the Chinese mainland market despite business setbacks arising from the two countries' cooling relations. In November, the Canadian jacket maker opened a new store in a Shanghai luxury shopping mall, its fifth store in China.

The new store got a positive response from local customers. At around noon on Tuesday, customers had to wait in queue for half an hour to enter the shop. The waiting time could be over one hour during weekends, one shop assistant told the Global Times at the entrance of the store.

"Some customers have traveled from other regions like Suzhou and Anhui, just to shop at the store," the shopping assistant said, adding that some designs had already sold out.

One customer, wearing a dark green Canada Goose jacket, told the Global Times that she passed by the store and dropped in to see if she could get something for her relatives.

A year ago, Canada Goose was caught in the crossfire following Huawei Chief Financial Officer Meng Wanzhou's arrest in Vancouver. The company experienced a steep share price drop for nearly one week, but it didn't halt steps to penetrate the Chinese market.

Canada Goose had planned to arrange a group interview with one of the company's senior executives but later cancelled it. The company didn't reveal its financial data in China when contacted by the Global Times.

A number of Canadian companies have made similar moves to increase their presence in China. Canadian coffee chain Tim Hortons opened a store in Shanghai in February, its first store in the country. Children's clothing maker Hatley and healthy food producer Factors Group signed deals during the recent China International Import Expo to bring more products to China, according to canadainternational.gc.ca.

A senior executive from the Canada-based telecom giant Ice Wireless, which is working with Huawei, said the company could deploy Huawei's 5G "in the hinterland in short order," according to a report of the Post Millennial.

Those are signs that testify to the warming trade and investment relations between China and Canada, which had been affected by a bilateral chill over the Huawei issue, Zhou Rong, a senior research fellow at the Chongyang Institute for Financial Studies at the Renmin University of China, said on Tuesday.

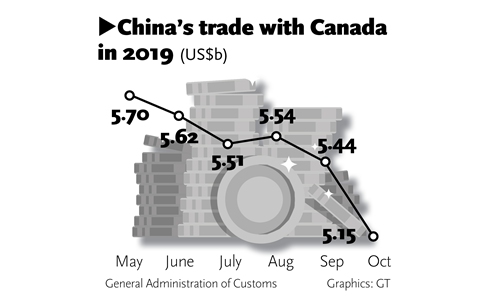

China's trade with Canada rose by 3.4 percent on a yearly basis to $54.4 billion in the first 10 months, customs data showed.

"The Chinese market is just too important for Canadian businesses to ignore. Being a country with vast land but relatively a small population, Canada needs a market to consume its products. Where else can Canada find such a market as China that has a large number of customers capable of spending?" Zhou said.

Their need to cling to the Chinese markets would turn more urgent as Canada's economy slows down in recent months, said Zhou.

But Zhou said it might take time for the Canadian government to further mend political relations with China. "But one thing is for sure, Canadian companies will increase investment in the Chinese market regardless of political friction," he said.