SOURCE / AVIATION

Neighboring countries could learn from China’s aviation industry amid epidemic

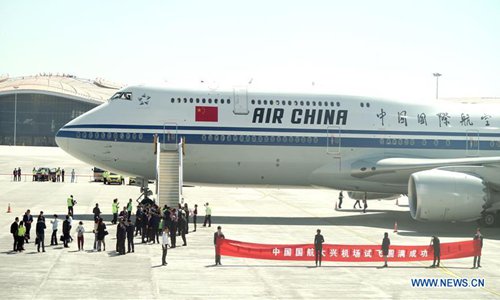

Photo: Xinhua

The Chinese aviation industry has embarked on a recovery following a slump as the coronavirus has been brought under control now. The COVID-19 outbreak coincided with the Spring Festival travel rush, striking a heavy blow to China's air traffic during the busi-est and most profitable period of the year.Experience gained in China could give offer some references to other countries now fac-ing similar hardships.

During the 15 days from January 10-24, airlines transported more than 28 million pas-sengers, up 7 percent from the same period last year and meeting growth speed expecta-tions.

But things changed from January 23, the day Wuhan cordoned itself off to curb the spread of the virus. Passenger volumes began to decline slightly, then tumbled by 15 percent year-on-year the following day.

By comparing daily aircraft movements during the COVID-19 epidemic to historical data published by the Civil Aviation Administration of China (CAAC), it can be seen that civil aviation in China hit an ebb since 2001 and now maintains a level similar to 2007-08. It means that the air travel needs to increase by 3.39 times if China's civil aviation is to come back to its peak.

However, with the country's effective execution of anti-epidemic measures, the nation-wide outbreak seems to be brought under control.

Since February 20, the number of confirmed coronavirus cases has steadily fallen, and operating flights have started to pick up after a massive contraction.

With the outbreak of COVID-19 in South Korea, the country was raised to its highest alert level on February 23, exactly one month after China announced its lockdown of Wuhan, Central China's Hubei Province.

Data from VariFlight shows South Korea's flight operations have been notably affected since the country's COVID-19 outbreak, similar to what occurred in China since January 23.

Should South Korea follow China's path, it will experience a downward trend in air traffic for about 40 days. And without an event like China's Spring Festival travel rush, flight op-erations in South Korea may stay in the doldrums.

To deal with the epidemic, the regulator is taking different paths to relieve airlines' pres-sure, and policies include airline exemption from civil aviation development funds, and the reduction of airport and air traffic control fees.

The CAAC also seems to support airlines in flexibly adjusting flight plans, international route structures and slot quotas in accordance with market demand, as well as simplified route approval procedures, time coordination procedures, and shortened time limits for the approval (reinstatement) of international routes.

The regulator will also support airlines in actively communicating and coordinating with relevant authorities in other countries and regions on special operational requirements during the epidemic, and any air traffic rights or slot issues encountered during the resto-ration of international routes.

It is clear that the CAAC holds a marketed-ordinated attitude.

Carriers are themselves trying to recover. It is clear that private carriers are showing more resilience to the impact of the virus, including those operated by SF Express, Xiamen Air-lines and Sichuan Airlines.

During the outbreak, cargo carrier SF Express never stopped its operations, and its latest fiscal report showed its January revenue stood at 11.628 billion yuan ($1.67 billion), up 14.4 percent from the same period last year.

Data from 2003 and 2008 showed that the economic revival is closely related to cargo flights, and only the freight picks up, and the broader economy will sunny up.