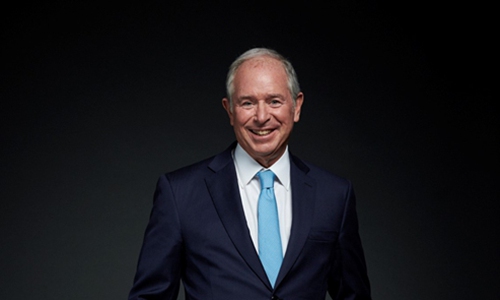

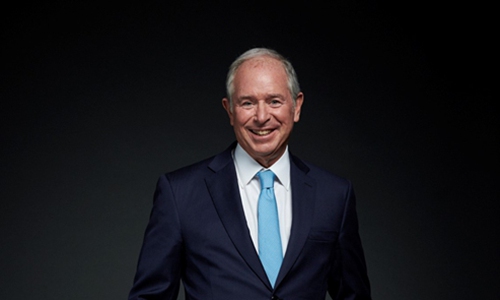

Stephen A. Schwarzman Photo: Courtesy of CITIC Press Group

Editor's Note:

With the coronavirus pandemic stoking unprecedented volatility across varying asset classes globally, a galaxy of investors has lately felt at sea with future directions. Hard-won life lessons of Wall Street influencer Stephen A. Schwarzman (Schwarzman) therefore instantly seem to be a beacon of hope.

In a written interview with the Global Times (GT), the chairman, CEO, and co-founder of Blackstone, the world's top alternative asset management firm, said he expected the enormous amount of volatility to calm "as governments around the world continue to act to mitigate the economic impacts from the various containment efforts."

Schwarzman also shared his thoughts on the US coronavirus response, the whereabouts of the world economy, and US-China trade talks, as the Chinese version of his memoir:

What It Takes: Lessons in the Pursuit of Excellence recently hit the shelves.

The US private equity guru who headed the now defunct White House business advisory council, in his judgement, reckoned that now is different from 2008, as the US banking system is on a much stronger footing. He estimated that by 2021, economic growth rates will be eventually similar to before the pandemic. As a profound understander of China, the household-name financier trows that the world's two largest economies can avoid the pull of the Thucydides's Trap.

The Chinese version of Schwarzman's memoir: What It Takes: Lessons in the Pursuit of Excellence Photo: Courtesy of CITIC Press Group

GT: You wrote in your new book that your mantra to investing is don't lose money. How could one not lose money throughout a lifetime of investing?

Schwarzman: People often smile whenever they hear my number one rule for investing, but it's just that simple: Don't lose money. At Blackstone we have established an investment process that helps us accomplish that basic concept. Our investment decisions are all about disciplined, dispassionate, and robust risk assessment.

This discipline is even more critical in today's environment with high levels of volatility and uncertainty. We must continue to focus on our process and the potential downsides of any decision we make on behalf of our investors.

GT: What are the most important things that have set you up for success at Blackstone?

Schwarzman: One is hiring "10s." I speak a lot in the book about the importance of hiring the right people - ideally people who rank "10 out of 10" on a scale. These people sense problems, design solutions, and take a business in new directions. They also attract other 10s, which makes your business successful. Even when your firm is small, finding the right people is the most important thing you can do.

GT: What's the impact of the recent US stock market rout on Blackstone?

Schwarzman: First and foremost, we are deeply saddened by the human impact of COVID-19. Our primary focus has and will continue to be on the safety of Blackstone's people and the employees of our portfolio companies. We're hopeful that the measures to control the spread will have a meaningful impact and things can soon begin returning to normal.

Blackstone is in exceptionally strong shape. The firm has no net debt, significant capital reserves, fund structures that prohibit short term redemptions by our investors, and over $150 billion of dry powder to deploy in high-quality companies during the current market dislocation. This structure is what helped us weather past crises (such as the 2008 global financialcrisis) and still deliver outstanding performance for our investors around the world. Our confidence in this approach remains stronger than ever.

In the midst of the crisis, we are actively working with our portfolio company leadership teams to help them manage through this difficult time.

GT: Has the oil price war precipitated the global stock market rout?

Schwarzman: The simultaneous supply and demand shocks have certainly impacted the oil and gas industry and have contributed to some of the broader market volatility.

GT: What are the culprits of the latest market crash across the globe? How much further would US stocks fall? Is the Chinese mainland market the safest and most invest-worthy stock market globally?

Schwarzman: We are seeing an enormous amount of volatility in the markets, driven mostly by the uncertainty of the situation. I would expect this to calm as governments around the world continue to act to mitigate the economic impacts from the various containment efforts. I am more focused on the long-term economic health rather than shorter term public market volatility.

Blackstone has been an active investor in China for nearly two decades and will continue to look for compelling opportunities in the country. Our primary focus right now is the safety of our people and helping our portfolio companies manage through this challenging time.

GT: Would it be the case that some major investment banks or hedge funds might collapse amid the coronavirus outbreak, like what happened during the previous crisis when the world was battered by the Lehman shock?

Schwarzman: I have been through a lot of different market cycles in my career, and without a doubt this one is far reaching. However, it is important to remember that the economic impact of this crisis is the result of voluntary decisions to cease business activity - not a normal downturn. Another fundamental difference between now and 2008 is that the US banking system today is on a much stronger footing. While some companies and sectors will experience difficulty, the system is in a better condition. Governments around the world appear to be providing strong support and economic stimulus in the near term.

GT: What're the chances of the US economy falling into a recession in 2020?

Schwarzman: Never before have we voluntarily suspended economic activity at this scale, and the impacts will be extensive. The US government is taking important steps to avoid a more severe scenario.

GT: How effective are a slew of measures having been taken by the US government to calm the market and revive the economy? What might be other measures that should be considered?

Schwarzman: The US government's financial stimulus package does all the right things - it provides a direct infusion of money for the unemployed and individuals in society who need immediate support, gives significant funding for small businesses so they can keep people hired and on their healthcare plans, and supports larger corporations so they can bridge this period of shutdown.

The initial financial stimulus bill is probably not the full amount of support that the US economy will ultimately need, but as a start, it is really big.

GT: The coronavirus pandemic has swept across the world. How do you look at the pandemic's medium to long-term impact on world economy? Which industries do you think are invest-worthy after the disease grinds to a halt?

Schwarzman: If you look at the basic math, the near-term suspension of economic activity is likely to impact about a quarter of the US' annual GDP, and likely a similar amount elsewhere. The efforts of governments to help individuals and companies bridge this period will be critical. I have no concerns that we will not make it to the other side. We have seen China, Korea and Japan respond very well to the pandemic and I give these countries very high grades for their initial steps to bridge the economic gap.

The current situation will impact prices and create dislocation in a number of sectors. It is difficult at this point to predict exactly where that might be.

GT: What's your outlook for the Chinese economy? Would the nation post an economic contraction for the full year?

Schwarzman: Though China is several months ahead of the US in dealing with COVID-19, it is still too early to predict the exact near-term economic outlook. There is no question that this pandemic will have economic impacts that last beyond the initial period of controlling the virus. But I think by 2021, we will be through the vast majority of this, countries will be back at work with different levels of recovery, and we will eventually see economic growth rates similar to before the pandemic.

GT: You participated in China-US trade talks. Will the two countries reach a consensus in the trade arena in your opinion? Can China and the US avoid the pull of the Thucydides's Trap? What should a more constructive model of China-US economic cooperation be like?

Schwarzman: The initial US-China trade agreement was a significant first step. Progress toward additional phases will naturally be impacted as the US and China each manage the domestic challenges of coronavirus. But it remains in the long term mutual interest of both countries to resolve all trade tensions.

I believe the two countries can avoid the pull of the Thucydides's Trap. The phase one trade agreement demonstrated the ability to work together on major areas of disagreement. I believe both countries recognize it is in their mutual benefit to iron out tensions.

GT: The Chinese government made first investment in Blackstone back in 2007. How fruitful has the investment turned out in terms of yields? What's your input on the Chinese government's overseas investment strategy?

Schwarzman: We greatly value our partnership with (Chinese sovereign wealth fund) China Investment Corp and are grateful for their successful, long-term investment in our firm. We continue to value our partnership.

GT: You have deeply committed to Schwarzman College at Tsinghua University. What motivates you to invest in education? What do you think are the best education systems? What's your definition of Schwarzman scholars?

Schwarzman: I have long believed that education is the passport to a better life. A good education has the power to affect whomever it touches for the better. We all have a duty to not only preserve the knowledge that is handed to us but also develop it in a way that improves its relevance and impact for future generations.

Through my philanthropy, I have tried to make contributions across levels and types of education - I think each plays a critical role for individuals, communities and society. This includes everything from supporting primary schools in New York City that serve largely underprivileged students to Ivy League universities like Yale.

Schwarzman Scholars is a unique program that was designed to bring together future leaders and educate them on the economic, political and cultural factors contributing to China's increasing importance as a global power. The program's mission is to grow a network of young, global leaders who can use their knowledge and connections to improve connectivity between China and their respective countries, ultimately facilitating a more peaceful and prosperous world for all of us.