SOURCE / INDUSTRIES

Huawei Q1 sales revenue sees sharply lower growth due to coronavirus assault, US crackdown

Huawei's Q1 revenue shows lower growth due to coronavirus assault, crackdown by US

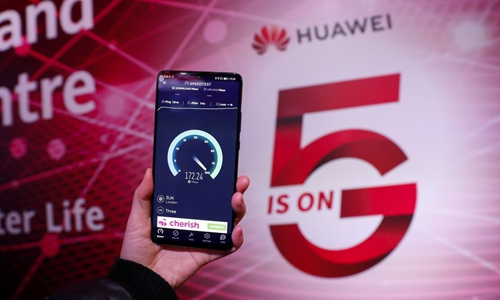

A staff member tests the speed with a Huawei 5G mobile phone at Huawei 5G Innovation and Experience Center in London, Britain, on Jan. 28, 2020. (Xinhua/Han Yan)

Huawei Technologies' first-quarter sales revenue rose only 1.4 percent to 182.2 billion yuan ($25.76 billion) - a sharply slower growth rate compared with the first-quarter sales growth of 39 percent in 2019, due to the coronavirus assault and the Trump administration's crackdown on the company.

Disrupted supply and logistics chains caused by the pandemic may continue to batter the Chinese telecom giant and 2020 would be the company's most difficult year, as Washington has not shown any signs of relaxing its Huawei ban, analysts warned.

The company's growth rate has slowed, but it also achieved a resilient performance in the face of both the US Entity List and the ongoing coronavirus pandemic, Huawei Vice President Victor Zhang said in a statement on Tuesday.

There will be supply chain difficulties for Huawei for sure, and different products will be affected on different levels, Fu Liang, a Beijing-based telecom industry expert, told the Global Times on Tuesday.

The world's largest maker of telecom equipment and second-largest smartphone vendor said its first-quarter net profit margin narrowed to 7.3 percent from 8 percent a year earlier.

Huawei's businesses are operating normally and the overall first-quarter performance was "in line with expectations," the company said in a statement on its website, vowing to work with its partners to overcome difficulties and resume production in an orderly manner amid the coronavirus pandemic.

Huawei itself has foreseen a hard year ahead.

"2020 will be the toughest year for Huawei, as we will be on the US Entity List for the whole year, and industry players have also estimated that Huawei has used up its 'reserves' in preparation for a US ban," Huawei Rotating Chairman Eric Xu said in March, adding that the COVID-19 outbreak was another situation that the company hadn't anticipated, and it may bring about a global recession and declining demand.

The pandemic has become another obstacle for Huawei, which has been cracked down on by the Trump administration for a long time.

"For long, the US has been restricting Huawei and using it as an excuse to bargain with China over the trade deal," Fu noted, adding that the US restrictions are always changing.

The US government is reportedly tightening rules that would require foreign companies using US chipmaking equipment to obtain a license before providing chips to Huawei.

That would directly affect Taiwan Semiconductor Manufacturing Co (TSMC), which is supplying 7-nanometer chips to Huawei.

In fact, Huawei has diverted part of its chip orders to Shanghai-based Semiconductor Manufacturing International Corp, as a preparation of losing TSMC's supplies, Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times, adding that the US restrictions against Huawei will only work as a motivation for it to cast off its dependence on overseas chipmakers and develop its own technology.

In addition, a Huawei executive told the Global Times in March that the Chinese government would not sit idle and watch the company being put on the chopping board if the US government arbitrarily changes the rules of the market, underscoring that China will have no choice but to take countermeasures against US firms.

"Why couldn't China ban US-produced 5G chips, smartphones and other smart terminals containing 5G chips in the China market, based on the same cybersecurity reasons?" asked Xu.

Even if the US bans TSMC from supplying Huawei, Huawei still has many other choices for chip supplies — such as companies from South Korea, the island of Taiwan, and companies in the Chinese mainland like Samsung, MediaTek and Unisoc, Xu added.

Ni Guangnan, an academician with the Chinese Academy of Engineering in Beijing, warned that China also has bargaining chips. For instance, if China restricted the US' 5G chips, terminals and other equipment that uses American technology, there would be at least $70 billion in losses for Apple and Qualcomm - equal to the total revenue of Boeing Co in 2019.

Ni said that at that time the market share of Qualcomm may dive sharply and it thus cannot afford the huge R&D investment.

Chen Qingqing contributed to the story.