SOURCE / INDUSTRIES

Retail sales seen resuming growth

Full-year economic expansion for China beyond doubt: analyst

A citizen selects vegetables at a supermarket in Changchun City, northeast China's Jilin Province, July 8, 2020. Photo: Xinhua

China's retail sales are likely to return to growth in July for the first time in 2020, underpinning a consensus that the economy is headed for an annual expansion despite a deep global recession, market observers said ahead of a slew of economic data for July due for release Friday.

They downplayed concerns over slowing credit expansion and believed the economy is well on course to continue its comeback from the coronavirus shock.

There is a chance that retail sales resumed growing in July, Tang Jianwei, chief macro analyst at the Financial Research Center of the Bank of Communications, told the Global Times Wednesday.

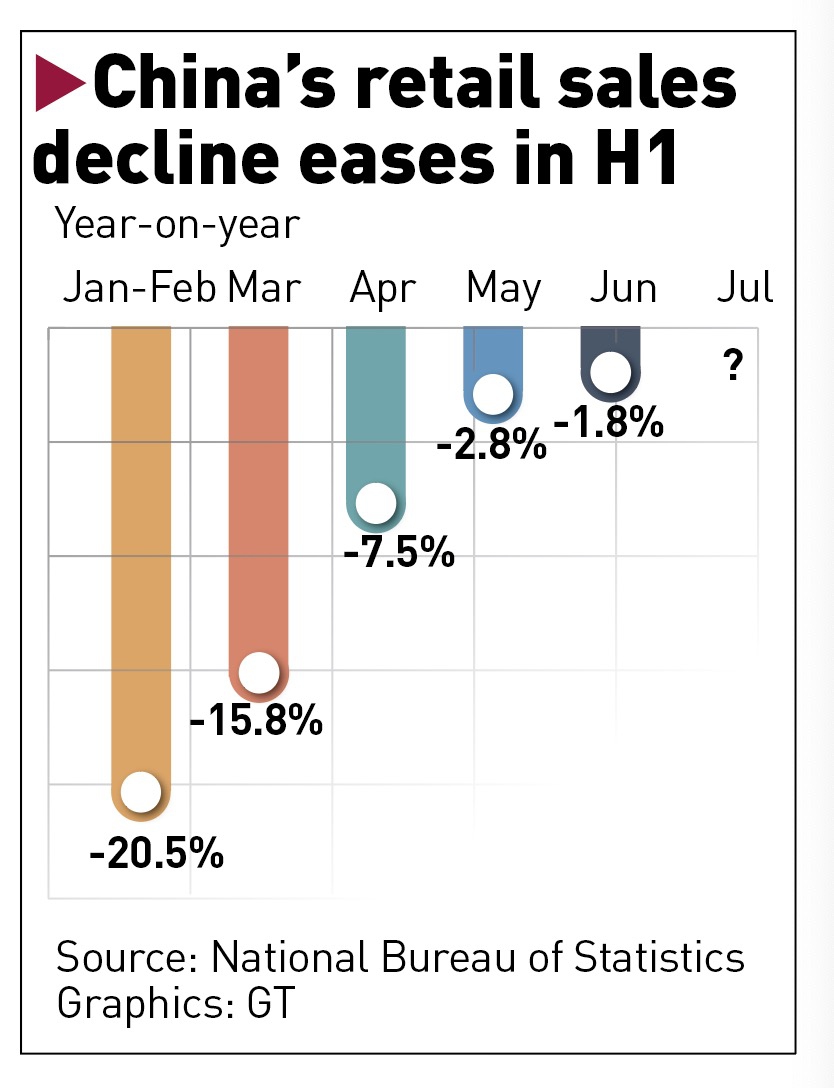

Retail sales plunged 20.5 percent year-on-year in January and February, as a nationwide lockdown put the economy into deep freeze.

With containment efforts tamping down the domestic spread of the deadly disease, retail sales improved, with the June reading tallying a 1.8-percent decline, according to data from the National Bureau of Statistics (NBS).

A raft of economic indicators for last month including retail sales, industrial production, fixed-asset investment, property development and sales are scheduled to be announced Friday. They will add to an array of data that's already been unveiled — the purchasing managers' indexes, import and export, and credit growth — all of which point to an upward trend in economy growth at large.

"With the second wave under control, the government will relax virus control restrictions, which will lead to a boost in consumption, especially services," Goldman Sachs economists wrote in a research note sent to the Global Times Wednesday.

Exports are facing better underlying global demand, although a slowdown in the expansion of medical equipment exports is likely. The Goldman analysts expect monetary policymaking to remain supportive, albeit less dovish than it was before June.

"Such an environment will be favorable to fixed-asset investment activities," the economists said, noting that risks to their 2020 growth forecasts appear largely balanced.

China's credit expansion slowed more than expected in July, snapping a robust rebound over the past months and flagging fears of monetary tightening.

New yuan-denominated loans came at 992.7 billion yuan ($142.87 billion) in July, down 63.1 billion yuan from a year earlier, the People's Bank of China, the central bank, said Tuesday. Household loans, mostly mortgages, hit 757.8 billion yuan, making up the lion's share of new credit extension in July.

Concerns over weaker-than-expected bank lending dragged down Chinese mainland shares, which took a stunning dive in the final hour of trading Tuesday before taking another battering Wednesday. The benchmark Shanghai Composite Index ended down 0.63 percent.

In Tang's words, the slowdown in July credit growth doesn't signal a monetary tightening, but does mean that the monetary policy was not as expansionary as it was in the first quarter.

This suggests that the monetary policy response to the COVID-19 outbreak will be tweaked toward a focus on funneling targeted support into small and micro-sized businesses and the rural sector, Tang said, noting that policymakers clearly won't resort to a flood of stimulus or a massive easing.

In a research report sent to the Global Times on Wednesday, Wang Tao, UBS' chief China economist, said that "new credit flows should stay resilient in the second half but may have already peaked in the second quarter."

The bank maintained its call for a targeted reserve requirement ratio cut equivalent to an overall reduction of 25 basis points (bps), and a cut of at most 5-10bps in the medium-term lending facility rate to help lower average funding costs in the remainder of the year, "although the likelihood of such cuts has declined a bit," according to the UBS report.

Still, with growth in both new yuan loans and social financing roughly holding above 13 percent year-on-year, well above last year's levels, the economy's post-pandemic recovery can be ensured, Tang estimated, painting three scenarios under which the Chinese economy will post a positive growth in 2020.

"That the economy returns to positive growth for the whole of 2020 is beyond doubt," he said. The only difference would be a 3-plus percent growth in the best-case scenario or a median forecast of around 2.4 percent growth, or a worst-case scenario of merely 1.5 percent growth.